Travel Insurance for Spain: Discover the Best Option

Travel insurance for Spain is a great ally when visiting this incredible country. We tell you which one to choose.

Spain is a magnet for travelers, remote workers, and digital nomads, offering countless reasons to visit. Its lively cities, including Madrid, Barcelona, Seville, and Valencia, buzz with culture and energy. Nature lovers will be equally captivated, with landscapes ranging from the rugged Cantabrian coast and serene Mediterranean beaches to picturesque mountain ranges and lush valleys. As one of the world’s top destinations, Spain truly has it all. To fully enjoy your time in this enchanting corner of the Iberian Peninsula, we strongly suggest securing travel insurance in Spain.

Choosing the right insurance is crucial for a worry-free experience. The problem is that with the wide range of travel insurance available, finding the best one can be a challenge. In this article, we will explore the main travel insurance options for Spain. With special emphasis on IATI Seguros for its value for money and the advantages it offers.

Why purchase travel insurance for Spain?

When looking for an answer to this question, there are a lot of explanations as to why it is necessary to take out travel insurance for Spain. For starters, the costs of private medicine in the country are very high, especially compared to public care, which is free for residents and covers most basic medical needs. The costs of private medicine vary according to the type of treatment and the region. For example, a simple medical consultation can cost from 50 to 200 euros ($52-$210), while a night in the hospital costs around 1,000 euros ($1,030). Can you imagine having to spend part of your budget on medical care excursions? I’m sure you wouldn’t want to go through that.

Travel insurance provides peace of mind by covering unexpected expenses and ensuring access to medical care, repatriation, and other emergencies. Additional perks often include tele-assistance for situations where you can’t reach a medical center, as well as coverage for activities like adventure sports or road trips. In a country like Spain, which beckons travelers to explore its stunning natural landscapes, you’ll likely find yourself trekking through the Picos de Europa or snorkeling in a hidden Costa Brava cove—making the added protection even more essential.

But, health does not solely define travel contingencies. Hence, the best travel insurance for Spain has to go beyond that and provide assistance in case of theft or loss of luggage and in many other situations. Imagine you have an accident and a family member needs to travel to Spain to accompany you. In that case, travel insurance is essential to avoid incurring such expenses.

What should a travel insurance for Spain cover?

Generally speaking, travel insurance for Spain should offer the same benefits as for any destination in the world. However, depending on the trip you have in mind, the type of coverage you are looking for will vary. For example, traveling with party plans in Ibiza is not the same as going on a pilgrimage on the Camino de Santiago. Nor is it the same to go on a summer vacation to the famous La Concha beach in San Sebastian as it is to drive through the white villages of Andalusia. Anyway, there are essential points that any good travel insurance for Spain has to cover. Curious about them? Let’s break it down for you:

- Medical coverage: You already know that medical care in Spain is expensive. Therefore, it is important that your insurance covers 100,000 euros ($105,000) or more for medical treatment and hospitalization.

- Repatriation and evacuation: In case you have to return to your home country due to an emergency.

- Loss or theft of luggage: Something very common during travels are accidents involving luggage. Surely you know someone who has gone through this ordeal. Therefore, it is important that your insurance includes coverage for protection of belongings. Ideally, it should offer a compensation of at least 1,000 euros ($1,030) to replace your belongings.

- Flight delay or cancellation: Financial compensation in case of travel incidents.

- Trip cancellation: Not all insurances offer it, and some providers add it as an optional complement. But, having this type of coverage is important in case you have to cancel your trip. That way, you will be able to recover the money you spent on buying flights and booking accommodation, excursions or car rental.

- 24/7 assistance in your language: Key for emergencies and queries. And, if it is in your language, even better.

- Civil liability: The insurance should cover you in case you accidentally incur in damages to third parties.

- Coverage against adventure sports: It is not a requirement, but if you are traveling with the idea of trekking, hiking, mountain biking, paragliding, diving or any other activity that involves a risk, your insurance should include this section. Many plans include it, while others offer it as a complement.

- No cash advance: This is another important point to consider, unless you want to take money out of your pocket to pay a medical bill in advance in case of surgery and subsequent hospitalization. Therefore, if you do not want to use your money to pay for medical care and then ask for a reimbursement, make sure that the service you contract includes this benefit.

- No excess: Your travel insurance should never require you to pay an excess. To steer clear of any unpleasant surprises, always take the time to read the fine print of the policy.

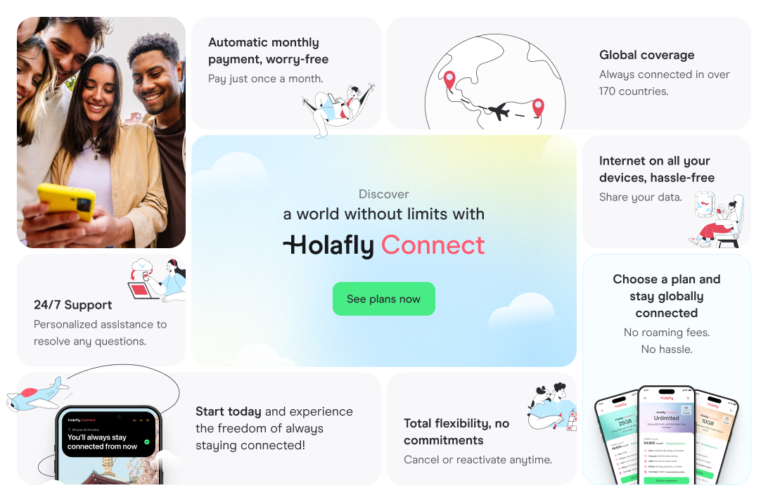

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Comparison of the best travel insurances for Spain

Do you know which are some of the most convenient travel insurances for Spain in terms of price-quality? As we told you at the beginning, IATI Seguros plans offer many advantages over others. But, there are many alternatives on the market, so we show you this table where we compare five great insurances, so you can choose the most suitable for your needs.

| Feature | IATI Insurance (Getaways) | AXA | Heymondo (Tranquility) | World Nomads (Standard) | Intermundial (Totaltravel Mini) |

| Price (7 days) | 7.81 euros | 11.41 euros | 38.66 euros | 90.21 dollars | 54.96 euros |

| Medical coverage | 50,000 euros | 3,000 euros | 600,000 euros | 5,000,000 dollars | 300,000 euros |

| Repatriation | 100% | 100% | 100% | 500,000 dollars | 100% |

| Lost or stolen luggage | 1,000 euros | 200 euros per item up to a maximum of 1,500 euros | 2,500 euros | 2,500 euros | 300 euros |

| Liability coverage | 30,000 euros | 60,000 euros | 60,000 euros | 1,000,000 dollars | 60,000 euros |

| Coverage for adventure sports | Included | Optional (+ 35.05 euros) | Basic | Yes | Optional (+ 4.55 euros) |

| 24/7 Support | Yes | Yes | Yes | Yes | |

| Trip cancellation | Optional (1,000 euros) | 900 euros | Optional (3,000 euros) | 5,000 dollars | Optional (from 1,000 up to 6,000 euros) |

What are the best travel insurances for Spain?

We already answered the question in the previous section. Now we look at each insurance and each plan with a magnifying glass, so that you have a broader picture of what each one offers.

1- IATI Insurance

IATI is a company with a high trajectory in travel insurance for all parts of the world. Its plans are tailored to all types of travelers. Including those who plan to do extreme sports, road trips, for those who travel with their pets and more. Therefore, do not doubt that you will find a suitable option for you.

Getaways insurance is the one we mention in the comparison chart, as we consider it to be one of the best options for traveling to Spain. Its coverage is very broad, both in terms of medical assistance and luggage problems. At the same time, it is ideal for lovers of adventure sports, mountains and adrenaline-pumping trips. It even offers coverage for theft of the rented bicycle itself. It is also suitable for road trips and campers, as it covers theft inside any vehicle and other aspects related to this type of trip.

And what if you travel with your four-legged friend? Well, IATI Getaways will also offer you coverage. It includes medical assistance for accidents, civil liability and more. Therefore, you can travel with peace of mind knowing that your pet is also protected

Now, this is not the only plan offered by IATI. You can also opt for one of these options:

- IATI Basic. This is an economical plan that covers the essentials, such as medical expenses up to 50,000 euros ($51,500), repatriation and basic protection for lost luggage. It is suitable for those looking for simple and affordable coverage.

- IATI Standard. Offers medical coverage up to 300,000 euros ($310,000), including repatriation, baggage loss and support in case of flight cancellations or delays. It is ideal for travelers seeking peace of mind during their stay in Spain.

- IATI Backpacker. Designed for adventurous travelers, this plan includes medical coverage up to 500,000 euros ($515,000) and coverage for adventure sports. It also offers protection for lost luggage, accidents in outdoor activities and full assistance in Spanish.

- IATI Star. This is the most complete plan, with medical coverage up to 1,000,000 euros ($1,030,000), plus coverage for extreme sports, repatriation and compensation for trip cancellations. This plan provides maximum security and is designed for those who seek comprehensive coverage, regardless of the type of trip.

2- World Nomads

Another of the best travel insurances for Spain is offered by World Nomads. Its two plans (Standard and Explorer) are designed for independent and adventurous travelers, with extensive medical and outdoor coverage.

The Standard plan, which is the one shown here, is ideal for travelers looking for comprehensive coverage without the need for extras. It includes medical assistance, accident protection, repatriation, lost or stolen luggage and flight cancellation. This plan also covers low-risk sports, such as hiking and mountain biking.

On the other hand, the Explorer Plan is more complete and is aimed at those looking to cover higher risk activities. Do you want to go scuba diving or skiing in the Pyrenees? Then this is the right plan for your adventurous spirit. In addition to high medical coverage it includes additional benefits. These include trip cancellation, reimbursement in case of loss of sports equipment and increased coverage in emergency situations.

Both World Nomads plans offer flexible coverage and the ability to extend insurance while abroad, which is an advantage for long-term travelers. In addition, World Nomads features multilingual support and a clear focus on the more adventurous travelers and digital nomads.

3- Intermundial

Intermundial’s travel insurance for Spain is valued for its medical assistance coverage. In addition, Intermundial offers 24/7 assistance in Spanish, which facilitates the process of assistance and management in case of emergencies.

In the table we present the Totaltravel Mini plan, but there are other options:

- Totaltravel. Offers extended medical coverage up to 500,000 euros ($515,000), as well as protection for unforeseen events such as theft, lost luggage and flight delays. It also includes civil liability and higher compensation for trip cancellation, being an intermediate option between basic and premium.

- Totaltravel Premium. This is Intermundial’s most complete and comprehensive plan, ideal for travelers seeking maximum protection. It includes up to 1,000,000 euros ($1,030,000) in medical coverage, coverage for adventure sports and high-risk activities, and the possibility of medical assistance at any time, as well as protection for trip cancellations.

- Go Schengen Plus. This plan is specially designed for travelers who need insurance for extended stays in Europe and meet Schengen visa requirements. It includes medical coverage, repatriation and baggage loss.

4- AXA

Axa is one of the world’s most recognized insurance companies, therefore, another good option for your trip. They offer two types of travel insurance for Spain tailored to non-residents: Schengen Low Cost and Schengen Europe Travel. The first one offers a medical coverage of 30,000 euros ($31,000) and repatriation. Ideal for those traveling to apply for the Schengen visa. While the second is a more comprehensive travel medical insurance for Spain, with medical assistance for up to 100,000 euros ($103,000).

5- Heymondo

Heymondo offers travel insurance for Spain that stands out for its flexibility and comprehensive coverage, adapted to different traveler profiles. Its plans include options for medical assistance in case of illness or accident, repatriation, lost luggage and trip cancellation.

In addition to its Tranquility plan, which is the most basic of all, there are other more complete options for travelers who need broader coverage. For example, Top Trip is a plan that offers coverage for up to 3,000,000 euros ($3,100,000). While the coverage of the Premium Trip plan reaches 10,000,000 euros ($10,300,000). The Premium Trip plan also includes extensive protection for adventure sports, making it ideal for more daring travelers.

Heymondo also stands out for its free app, which allows you to contact the medical team instantly and manage emergencies without advancing money in most cases. Assistance is available 24 hours a day and in Spanish.

What is the best travel insurance for Spain?

IATI is the travel insurance for Spain that we chose. There are several reasons why it beats the rest of the proposals. For starters, it offers full medical coverage with no deductibles. Its higher plans cover up to 1,000,000 euros ($1,030,000) in medical assistance, which is especially useful for Spain, where private medicine can be expensive. In addition, its policies eliminate the need for cash advances or deductibles during an emergency, fully protecting travelers without additional cost concerns.

Another reason for choosing IATI is its coverage for adventure sports and activities. Unlike other insurers, IATI offers coverage for adventure sports and outdoor activities in most of its plans. Otherwise, it gives you the option of adding it as a supplement. This is ideal if you plan to travel to Spain with the intention of exploring its landscapes and practicing hiking, trekking, canyoning, diving, surfing and much more.

As you know, IATI has a wide range of options for travelers of all types. This allows users to find a plan that fits their profile and budget, with specific options for long stays or trips focused on special activities.

Another of IATI’s great benefits is its Spanish-language customer service and 24-hour emergency assistance. Which allows for clear and quick communication in case of unforeseen events. This is especially useful for Spanish speakers who need to resolve problems quickly during their trip.

Finally, IATI also includes the possibility of adding a cancellation supplement to recover the money invested in the trip in case of unforeseen events that prevent you from traveling, as well as medical or funeral repatriation, which provides additional peace of mind in case of any eventuality.

Thanks to these features, IATI ranks as one of the most comprehensive, versatile, and hassle-free travel insurance options for visitors to Spain.

Frequently asked questions about travel insurance for Spain

Yes, if you are traveling to Spain from a country that requires a Schengen Visa, you will need to have travel insurance that offers a minimum coverage of 30,000 euros ($31,000) in medical expenses, including emergencies and repatriation. Even if you do not need a visa to enter Spain, it is advisable to have insurance to avoid expenses arising from medical emergencies, lost luggage or flight cancellations.

The average cost of travel insurance for Spain depends on several factors, such as the duration of the trip, the age of the traveler, the type of coverage and the level of protection chosen. For a short trip (about one to two weeks), the cost is usually between $30 and $70. For longer stays or for seniors, the cost can go up to between $80 and $150. It can even be more if extra coverage is added, such as trip cancellation protection, adventure activities, or COVID-19 coverage. In addition, many insurers offer packages with different levels of coverage. Allowing the price to be tailored to the needs of each traveler.

If you lose your luggage during your trip, most travel insurance policies offer coverage for lost, stolen or damaged luggage. This type of coverage allows you to recover the value of lost items up to the limit specified in the policy.

First, you must immediately notify the airline or carrier and request a lost or delayed baggage report. Then, you have to file an insurance claim, including all necessary documentation, loss report and receipts. The insurer will evaluate the case and, if the policy covers baggage loss, will reimburse up to the amount agreed in the coverage. Either for the value of the contents or a fixed amount per day in case of delay.

Language

Language

No results found

No results found