Travel insurance for India: Which one should you choose?

Do you know the best travel insurance options for India? Here we explain them in detail and compare them for you.

The best travel insurance for your trip to India are gathered here so you can choose what suits you best. We’ll show you why travel insurance matters and what the minimum coverage should include, depending on the kind of trip you plan.

We’ll also compare five insurance options and their key coverages, plus the cost of 7-day assistance in the Asian country. By the end, you’ll know which one we think is best for your journey to India. But don’t rush, read the full guide to see why we chose it. Let’s begin!

Why get travel insurance for India?

India offers magic, spirituality, and incredible places among beaches, temples, and mountains attracting more visitors daily. However, it’s a country where you must stay cautious in case of emergencies, and the best way to do that is by having insurance ready to assist you anytime.

You’ll find countless dishes you’ll want to try in India. This can cause stomach issues or allergic reactions that may need medical attention, and to avoid high costs, having insurance is essential.

You could also suffer injuries from falls, slips, or accidents, leading to high treatment expenses. If your health worsens, you won’t want to remain long in the country just for treatment.

Your insurance will ensure your medical repatriation. It’s also vital to protect your personal belongings which are essential for your trip. If you lose them, the insurance will help recover them or offer compensation so you can replace them during your stay.

If you’re doing outdoor activities, sports, or even short walks around tourist spots, insurance will cover any incident, including civil liability costs.

What should travel insurance for India include?

To choose the right insurance for your trip to India, you must know your itinerary, destinations, and possible risks. With that information, you’ll clearly understand what coverage you’ll truly need when purchasing your travel insurance.

Even so, these are the basic types of assistance your insurance should include:

- Medical assistance: This coverage must be reliable and strong, as you could face injuries, food poisoning, or viral infections needing hospital care. Without insurance, medical expenses can quickly rise.

- Medical repatriation: If illness or injury forces a hospital stay and interrupts your trip, your insurer must handle your return home and ongoing treatment.

- Luggage loss or theft: If your luggage gets stolen or lost, your insurer will cover costs to recover or replace your personal belongings. If it’s lost at the airport, the insurer will help track it.

- Loss or theft of documents: Your travel documents might get lost or stolen, which can complicate your trip since you need them to identify yourself in India. The insurance should offer financial help or direct support to replace them.

- Assistance for adventure sports: India offers many adventure activities. If you plan to go trekking, climbing, or hiking snowy peaks, ensure your policy covers such sports.

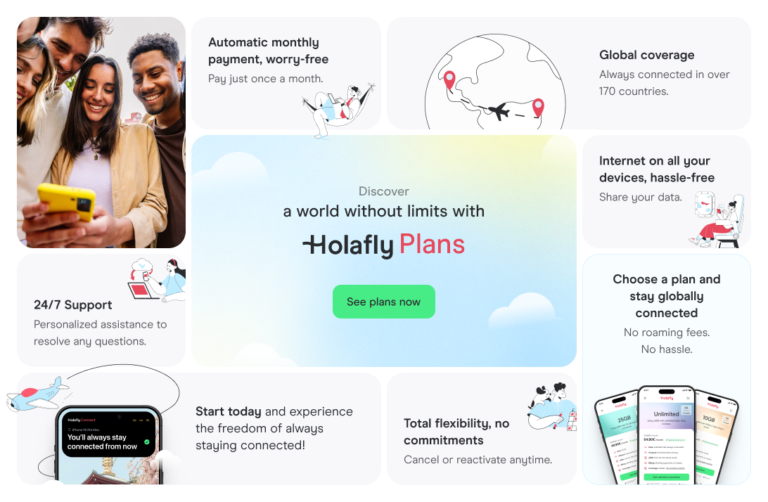

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 160 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Comparison of the best travel insurance for India

Now that you know the key details about your trip, let’s see what the five best travel insurance options for India offer. Below, you’ll find the coverage amount for each service and the price for 7-day assistance with a mid-range plan.

| Assistance | Tata AIG | ICICI Lombard | Heymondo | Bajaj Allianz | Niva Bupa |

| Price for 7 days | $35–45 (€32.30–41.50) | $4.40–13 (€4.05–12) | $30–65 (€27.70–60) | $28 (€25.85) | $10–15 (€9.25–13.90) |

| Medical expenses | $100,000 (€92,000) | $100,000 (€92,000) | $1,000,000 (€931,000) | $75,000 (€69,340) | $80,000 (€73,950) |

| Medical repatriation | Included | Included | Included | Included | Included |

| Dental emergency | $500 (€465) | $500 (€465) | $300 (€276) | $400 (€368) | $350 (€325) |

| Extreme sports | Must be added | Must be added | Included in premium plan | Included in premium plan | Must be added |

| Lost or stolen luggage | $1,000 (€920) | $1,000 (€920) | $3,000 (€2,790) | $3,000 (€2,790) | $800 (€740) |

| Trip cancellation refund | $2,000 (€1,840) | $2,000 (€1,840) | Optional | $2,000 (€1,840) | $1,500 (€1,380) |

| 24/7 emergency support | Yes | Yes | Yes | Yes | Yes |

The 5 best travel insurance options for India

Let’s now look at each of the five insurance providers in detail, their available plans, and their pros and cons. This comparison will help you choose the most suitable insurance for your trip to India.

1. Tata AIG

This insurance offers basic cover with optional add-ons so you can adjust it according to your travel needs. Tata AIG provides three plans with the following 7-day coverage prices:

- Silver: The most basic plan includes medical cover up to $50,000 (€46.20) and costs $35 (€32.30) for 7 days in India.

- Silver Plus: The mid-range plan includes medical cover up to $100,000 (€92.45) and costs $38 (€35) for 7 days.

- Gold: Includes $200,000 (€184,900) in medical cover and costs $45 (€41.50) for 7 days.

| Strengths | Weaknesses |

| Smooth, intuitive mobile app. | Doesn’t include adventure sports in any plan; must be added separately. |

| High coverage for dental emergencies. | Slow or unclear claim resolutions. |

| Affordable rates for different traveller profiles. | Customer service can be ineffective. |

2. ICICI Lombard

ICICI Lombard provides basic travel assistance with several extra benefits such as extended accommodation during illness or cruise cover.

It’s a slightly more complete option that allows you to add extra assistance based on your travel needs.

Here are the 7-day plan prices in India:

- Essential: Costs $4.45 (€4.10) for 7 days and includes medical cover up to $25,000 (€23.10).

- Optimum: Mid-range plan costs $9.80 (€9.05) and includes medical assistance up to $100,000 (€92,450).

- Adventure: Premium plan costs $13,62 (€12.60) for 7 days, with medical cover up to $250,000 (€231,100).

| Strengths | Weaknesses |

| Efficient service according to user reviews. | Occasional unjustified claim rejections. |

| Quick hospital assistance process. | Customer service can be difficult in complex cases. |

| Fast response to luggage loss cases. | Some unclear technical terms in claims. |

3. Heymondo

This insurer offers a wide range of cover options that you can easily enhance or adjust according to your preferences, especially in basic and mid-tier plans.

Here are the 7-day assistance prices in India:

- Essential Trip: Costs $30 (€27.70) and includes medical cover up to $150,000 (€138,70).

- Peaceful Trip: Costs $36 (€33.25) and covers medical assistance up to $1,000,000 (€924,50).

- Top Trip: Costs $55 (€50.85) with medical coverage up to $5,000,000 (€4,622,500).

- Premium Trip: Costs $65 (€60.10) for 7 days and includes up to $10,000,000 (€9,245,000) in medical cover.

| Strengths | Weaknesses |

| Fair prices compared with available coverage. | Basic plans may lack some protection. |

| Flexible options to add coverage to basic plans. | Doesn’t include adventure sports protection. |

| Experienced handling of medical cases. | Customer support can be slow. |

4. Bajaj Allianz

Bajaj Allianz is a trusted insurer within India. Even its basic plans include important types of coverage, providing a balanced cost-benefit ratio. Here’s the plan and 7-day cost:

- Premium Plan: Includes medical cover up to $500,000 (€462,250) and costs $28 (€25.85) for 7 days.

| Strengths | Weaknesses |

| Fast purchasing process. | Partial refunds without clear explanation. |

| Quick customer service response. | Sales agents may provide unclear information. |

| Balanced prices and assistance levels. | Too much documentation required to buy a plan. |

5. Niva Bupa

Niva Bupa offers a wide variety of insurance types with extended coverage options. It’s a recognised company in India and internationally, especially across Asia.

Here’s the plan and price for 7-day assistance in India:

- Travel Assure Lite Comprehensive: Offers balanced coverage and costs $10–15 (€9.25–13.90) for 7 days in India.

| Strengths | Weaknesses |

| Extensive network of partner hospitals. | Unjustified claim rejections. |

| User-friendly mobile app. | Some claims remain unresolved. |

| High responsiveness to customer needs. | Unexpected cost increases. |

Which is the best travel insurance for India?

Considering both cost and benefits, especially the assistance offered for your trip to India, we recommend Tata AIG. This insurer has solid experience and offers well-designed plans for all kinds of travellers.

It also provides a large hospital network, ensuring security and trust as health and traveller safety are their top priorities. Additionally, the plans are flexible, allowing you to adapt your cover according to your trip type and personal needs.

Its reputation is strong, and although it’s not the cheapest option, the price reflects the quality of the assistance provided.

Connectivity while travelling in India

Holafly offers monthly subscription plans so you can enjoy 25 GB or unlimited data in more than 170 countries, including India. These plans let you share data with your laptop or tablet easily.

If your trip to India is short, we recommend the Holafly India eSIM. It offers unlimited data with no roaming fees or SIM card changes, ideal for hassle-free connectivity.

Frequently Asked Questions

No, most travel insurers for India require adding adventure sports coverage separately. Some don’t include competition-related activities.

It’s not mandatory, but it’s always advisable to have support in case of medical or travel emergencies.

You’ll pay 100% of your medical costs, including ambulance, hospitalisation, medication, and treatment, which can be very expensive.

Most travel insurers cover travellers up to 74 years old, though this can vary depending on the company.

No, travel insurance doesn’t usually cover vaccines before your trip, so it’s best to pay for them yourself.

Language

Language

No results found

No results found