Travel Insurance for Chile: How to Make the Best Choice?

Do you want to know which is the best travel insurance for Chile? We tell you everything you need to know to travel with total peace of mind.

More than a few travelers come to Chile every year, attracted by the mysterious Easter Island, the impressive Atacama Desert or any other of its many places of interest. If you are also thinking of stopping by, this article is for you. We want to talk to you about one of the most important things you will need to think about when preparing for your adventure: travel insurance for Chile.

A good insurance policy will cover you not only for medical bills, but also for other unpleasant situations, such as flight delays or lost luggage. Although in other articles you can get an idea of which are the most popular insurance companies for international travel, today we will review the most suitable policies for destinations such as Valparaíso or Santiago.

Why purchase travel insurance for Chile?

Many travelers often view travel insurance as an unnecessary expense or something they can skip. Others select one at random “just in case.” However, choosing the right travel insurance is one of the most crucial decisions you’ll make when preparing for your trip.

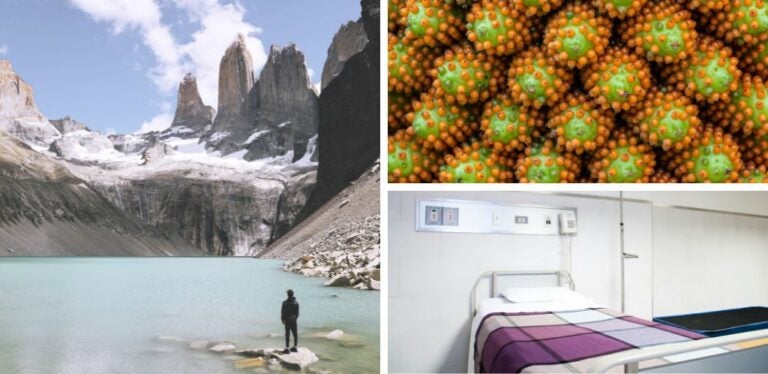

Although, unlike other countries, Chile does not require travel insurance to enter, it is more than advisable to take out one. Can you imagine having to face altitude sickness in the Atacama Desert or a fall while trekking in Patagonia? Hopefully not, but if that happens, you’ll want to be protected by an insurer used to dealing with these types of situations.

They will expedite the procedures and send you to reliable medical centers. In addition, they will cover care in private clinics — preferred by tourists for their quality and speed — which can be quite expensive. A day’s hospitalization can exceed 2,000,000 pesos ($2,200) and a medical consultation ranges from 30,000 to 80,000 Chilean pesos ($35-90). In the worst case scenario, if you need medical repatriation, you could face bills of around $10,000.

But a travel insurance for Chile will also cover you for other unforeseen events. When you are going to visit a country with such long distances, it is normal to take several internal flights. Problems with flights, such as delays or cancellations, are very common, especially if your itinerary includes remote destinations such as Easter Island. A reliable insurance plan can offer financial compensation to help you stay on budget during such disruptions. Additionally, it provides coverage in cases of theft or lost luggage, giving you peace of mind throughout your journey.

What should a travel insurance for Chile cover?

Now that you know that you should set aside some of your adventure planning time to find a good travel insurance for Chile, you might be a bit lost with the coverages you should require. Although, we anticipate that this depends a lot on the itinerary you are planning, the type of traveler you are and the activities you intend to do, these are the most important coverages you should look for in a policy:

1. Emergency medical care. Private medical care in Chile is known for its quality, but not for being inexpensive. Make sure your insurance covers at least 500,000 euros (about 450,000,000 Chilean pesos / $530,000) for medical expenses. This includes hospitalization, medical consultations, medicines and diagnostic tests. Also, verify that the policy covers tropical or high altitude illnesses. Relevant if you plan to visit the north of the country or regions with extreme weather.

2. Medical or death repatriation. Imagine having an accident in Torres del Paine or in the Atacama Desert. A medical transfer to your country of origin can cost more than 9,000 euros (approximately 8,100,000 Chilean pesos / $10,000). This coverage is key to guarantee your peace of mind in critical situations. You will be covered for repatriation for medical reasons or, in the worst case, death.

3. Loss or theft of luggage. The risk of losing your belongings or having them stolen is something to consider, especially in busy cities such as Santiago or Valparaíso. Good insurance should offer you financial compensation of between 1,000 and 3,000 euros (between 900,000 and 2,700,000 Chilean pesos / $1,100 – $3,300). This would be enough to replace essential belongings and continue your trip without complications.

4. Flight delays and cancellations. As we said, Chile’s extensive geography forces you to take internal flights to move from one point of interest to another. If a delay or cancellation affects your plans, the additional costs in transportation or accommodation can derail your budget. Make sure your insurance covers between 150 and 300 euros (between 135,000 and 270,000 Chilean pesos / $165 – $330) per day of delay.

5. Civil liability. This coverage protects you from legal claims and covers you in case you have to compensate for material or personal damages, with a usual range of between 30,000 and 50,000 euros (27,000,000-45,000,000 Chilean pesos / $32,000 – $54,000).

6. Adventure sports and outdoor activities. Chile is a paradise for adventure tourism. It is common for many travelers to sign up for activities such as trekking in Patagonia, skiing in the Andes or diving on Easter Island. If you are likely to do any of these, make sure that your policy includes coverage for accidents related to these activities. Most insurance companies do not include this clause in their basic insurance policies.

7. 24/7 assistance and mobile application. The time difference and the remote characteristics of some Chilean areas make it essential that you have access to assistance 24 hours a day. The best insurance companies offer assistance in Spanish and mobile applications to manage any incident quickly. Don’t forget to get your Holafly eSIM to stay connected and reach support whenever needed.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Comparison of the best travel insurance for Chile

After this review of the importance of having travel insurance for Chile and the essential coverages it should include, it’s time to decide which is the best option for you. The range of insurers on the market can be overwhelming: some stand out for their international prestige and others have managed to gain the trust of travelers for their innovative approach and competitive prices.

To make your choice easier, we have prepared a comparison table with the five best travel insurances for Chile in 2024. In it, you will be able to see more clearly the most relevant coverages, the prices for a seven-day stay and other details that will help you find the policy that best suits your needs and budget.

| Coverage | Chapka (CAP TRIP Basic) | HeyMondo (Easy Travel) | IATI (Backpacker) | AXA Assistance (Total) | Intermundial (Totaltravel mini) |

| Price (7 days) | 26.76 euros ($28.90) | 35.59 euros ($38.49) | 53.99 euros ($57.00) | 58.07 euros ($62.80) | 33.31 euros ($36.10) |

| Medical expenses | 250,000 euros ($269,946) | 600,000 euros ($648,837) | 500,000 euros ($540,697) | 150,000 euros ($162,209) | 300,000 euros ($325,083) |

| Repatriación | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Lost or stolen baggage | 800 euros ($865) | 1,500 euros ($1,622) | 1,500 euros ($1,622) | 1,500 euros ($1,622) | 1,500 euros ($1,622) |

| 24/7 Service | Yes | Yes | Yes | Yes | Yes |

| Trip cancellation | Optional | Optional | Optional | Optional | Optional |

| Coverage of adventure sports | Yes | Yes | Yes | Optional: Sports insurance (33,61 euros) | No |

| Liability | 40,000 euros ($43,191). Deductible 150 euros ($162) | 60,000 euros ($64,883) | 60,000 euros ($64,883) | 30,000 euros ($32,441) | 50,000 euros ($54,180) |

| Flight delay compensation | At the beginning of the trip only, up to 150 euros ($162) | 300 euros ($324) | 270 euros ($291) | 150 euros ($162) | 150 euros ($162) |

The 5 best travel insurances for Chile

As you can see in the table above, although all insurers offer similar things, the details make the difference. So that you can choose with all the information in hand and travel to Chile with total peace of mind, let’s take a closer look at what each company offers.

IATI Seguros: Personalized attention and complete coverage for Chile

With over 135 years of experience, IATI Seguros stands as one of the most established and trusted insurers. Its app, very easy to use, allows you to manage incidents, access medical consultations and receive immediate assistance. Very useful for those looking for security and speed in distant destinations such as Chile. In addition, its 24-hour service in Spanish guarantees constant support regardless of the time difference.

Among its policies, the IATI Star stands out, offering comprehensive medical coverage and protection against cancellations. The IATI Backpacker plan is perfect for those who plan to do adventure sports in destinations. Such as Torres del Paine or the Atacama Desert. All its insurances include 100% repatriation and emergency assistance.

Main coverages:

- Medical expenses: Up to 5,000,000 euros ($5,500,000 / 4,600,000,000 Chilean pesos).

- Repatriation: Full and unlimited assistance.

- Loss of luggage: Up to 2,500 euros ($2,700 / 2,300,000 Chilean pesos).

- Adventure sports: Covered in advanced plans.

- Cancellations: Protection included in some advanced plans.

Plans and prices:

- IATI Basic: 32.90 euros ($35 / 30,300 Chilean pesos) for 7 days.

- IATI Standard: 38,88 euros ($42 / 35.800 Chilean pesos) for 7 days.

- IATI Backpacker: 53.99 euros ($58 / 49,700 Chilean pesos) for 7 days.

- IATI Star: 70.87 euros ($77 / 65,300 Chilean pesos) for 7 days.

| Advantages | Limitations |

| Broad medical coverage in all plans | Cancellations not included in basic plans |

| 24/7 customer service in Spanish | High price in premium options |

| Fast incident management with your app | Risk sports not included in all policies |

Chapka Seguros: A versatile option for exploring Chile

Since its founding in 2002, Chapka Seguros has positioned itself as one of the preferred insurers for travelers seeking reliable protection at affordable prices. Its customer service, available in Spanish, offers prompt assistance and adequate coverage even in the most remote areas of Chile. With adventure sports coverage included in all plans, it is an especially popular choice among outdoor enthusiasts.

This insurer offers several policies to suit the needs of all types of travelers. Cap Trip Basic is perfect for those seeking essential protection during short trips. The Cap Trip Plus, however, offers more coverage and includes cancellations, ideal for longer trips or more complex itineraries. Its practical approach makes it an excellent alternative for those exploring Patagonia, the Atacama Desert or the wine routes of the Colchagua Valley.

Main coverages:

- Medical expenses: Up to 250,000 euros ($270,000 / 230,000,000 Chilean pesos).

- Repatriation: Full and unlimited assistance.

- Loss of luggage: Up to 800 euros ($865 / 740,000 Chilean pesos).

- Adventure sports: Included in all plans.

- Cancellations: Optional in some superior plans.

Plans and prices:

- Cap Trip Basic: 26.76 euros ($29 / 24,600 Chilean pesos) for 7 days.

- Cap Trip Plus: 35.59 euros ($39 dollars / 32,700 Chilean pesos) for 7 days.

| Advantages | Limitations |

| Sports coverage included at no extra cost | Limited medical expenses compared to other insurers |

| Customer service in Spanish | Cancellations not included in basic plans |

| Competitive rates | Limited customization in some plans |

InterMundial: Flexibility and customized protection for Chile

Founded in 1994, InterMundial is a Spanish insurer that has earned a reputation for offering adaptable plans and comprehensive coverage for all types of travelers. Its focus on customization allows users to select the coverages that best suit their needs, which is especially useful for diverse destinations such as Chile. In addition, its 24/7 customer service in Spanish ensures fast and efficient assistance in any situation.

Its plans include the Totaltravel Premium, ideal for those seeking maximum peace of mind, with comprehensive medical coverage and protection against cancellations. It also offers options such as the more economical Totaltravel Mini, for short trips. These policies are perfect for those who plan to explore both the remote landscapes of Patagonia and the modern cities of Santiago and Valparaíso.

Main coverages:

- Medical expenses: Up to 1,000,000 euros ($1,100,000 / 920,000,000 Chilean pesos).

- Repatriation: Unlimited in all plans.

- Luggage loss: up to 2,500 euros ($2,700 / 2,300,000 Chilean pesos).

- Cancellations: Optional, with compensation up to 2,500 euros.

- Liability: Up to 100,000 euros ($108,000 / 92,000,000 Chilean pesos).

Plans and prices:

- Totaltravel Mini: 33.31 euros ($36 / 30,600 Chilean pesos) for 7 days.

- Totaltravel: 41.74 euros ($46 / 38,300 Chilean pesos) for 7 days.

- Totaltravel Premium: 65.78 euros ($72 / 60,300 Chilean pesos) for 7 days.

| Advantages | Limitations |

| Extensive medical coverage in advanced plans | Adventure sports not included in basic plans |

| Assistance in Spanish 24/7 | Higher costs in advanced plans |

| Flexibility to add coverage | Lower baggage allowance on basic options |

AXA Assistance: Global coverage and premium services for Chile

Present in the market since 1958, AXA Assistance is an insurer recognized worldwide for the quality of its services and its global assistance network. Ideal for those seeking security and reliability, its policies include coverage for medical emergencies and protection in unforeseen situations. Customer service is available 24 hours a day.

Its plans include Total Insurance, with full coverage for international travel, and Total Plus Insurance, which extends protection for more complex activities. Its flexibility and the possibility of adding adventure sports make it a reliable option for those who visit places such as Torres del Paine National Park or engage in urban activities in Santiago.

Main coverages:

- Medical expenses: Up to 150,000 euros ($162,000 / 138,000,000 Chilean pesos).

- Repatriation: Unlimited.

- Loss of luggage: Up to 1,500 euros ($1,622 / 1,380,000 Chilean pesos).

- Adventure sports: Optional for an additional 33.61 euros.

- Liability: Up to 30,000 euros ($32,000 / 27,600,000 Chilean pesos).

Plans and prices:

- Mini Insurance: 37.65 euros ($41 / 34,500 Chilean pesos) for 7 days.

- Total Insurance: 58.07 euros ($63 / 53,200 Chilean pesos) for 7 days.

- Total Plus Insurance: 80.28 euros ($87 / 73,600 Chilean pesos) for 7 days.

| Advantages | Limitations |

| Extensive international assistance network | Adventure sports require additional cost |

| Excellent customer service in emergencies | Higher prices than other options |

| Customizable plans | Limited medical coverage on basic options |

HeyMondo: Technology and convenience for travelers to Chile

HeyMondo is a young insurance company that has made a name for itself by combining technology and personalized services for international travelers. Its intuitive and efficient app allows you to manage incidents, contact doctors and receive assistance quickly. In addition, it offers 24/7 support in Spanish.

It offers plans with quite interesting coverages to visit Chile. The Essential Trip, designed for those seeking basic protection, or the Premium Trip, with complete coverage and specific options for adventure sports.

Main coverages:

- Medical expenses: Up to 10,000,000 euros ($10,800,000 / 9,200,000,000 Chilean pesos) in the Premium plan.

- Repatriation: Unlimited in all plans.

- Baggage loss: Up to 3,500 euros ($3,778 / 3,200,000 Chilean pesos).

- Adventure sports: Included in advanced plans.

- Liability: Up to 60,000 euros ($65,000 / 54,000,000 Chilean pesos).

Plans and prices:

- Essential Trip: 30.55 euros ($33 / 28,000 Chilean pesos) for 7 days.

- Tranquility Trip: 35.59 euros ($39 / 32,700 Chilean pesos) for 7 days.

- Top Trip: 57.18 euros ($63 / 52,600 Chilean pesos) for 7 days.

- Premium Trip: 76.01 euros ($82 / 69,900 Chilean pesos) for 7 days.

| Advantages | Limitations |

| Efficient app to manage incidents | High costs in premium plans |

| Extensive medical coverage in premium plans | Limit on compensation for delays |

| 24-hour service in Spanish | Specific extreme sports may not be covered |

What is the best travel insurance for Chile?

Although the best travel insurance for Chile will be the one that best suits your requirements and your specific circumstances, after analyzing the main insurers and their coverage there is one that stands out above the rest: IATI. Its commitment to travelers and the flexibility of its plans make it one of the most recommended options for this destination. On its own website, IATI highlights the IATI Backpacker plan as the ideal choice for those visiting Chile, especially for those who plan to engage in adventure activities or explore remote areas.

IATI Backpacker offers comprehensive medical coverage of up to 500,000 euros (approximately 486,000,000 Chilean pesos / $540,000). This includes hospitalization, emergency care and treatments for diseases common in South America, such as dengue fever or yellow fever. In addition, it guarantees that you will not have to advance money for any medical services.

Another highlight of this insurance is its coverage for adventure sports, a must for those who plan to explore the Chilean wilderness. It also includes coverage for loss or theft of luggage up to 2,500 euros (2,430,000 Chilean pesos / $2,700), ideal for those traveling with specialized equipment or valuable belongings.

In addition to its coverage, IATI’s customer service, available 24/7 in Spanish, is another of its strengths. It will allow you to resolve any incident quickly and effectively, no matter where you are in Chile. For all these reasons, the IATI Backpacker not only meets the basic requirements, but offers additional security that will make you enjoy your trip with total peace of mind.

And so much for our review of the best travel insurance for Chile. Choose the one that best suits your circumstances and travel covered and protected. Do you need more information to organize your trip? Be sure to take a look at our travel guide for Chile.

Language

Language

No results found

No results found