Mapfre review: All you need to know about it

Is it worth it? Here you’ll find reviews of Mapfre travel insurance plus details about its products, policies, and prices.

Are you thinking about getting health insurance to travel safely to your next destination? Check our Mapfre travel insurance review of its policies.

We want to help you make the best travel decisions. Getting insurance that protects you from unexpected events is essential. So, discover what kind of travel products Mapfre offers, the services, benefits, and limitations, plus other travellers’ experiences.

What are Mapfre travel insurances and how do they work?

Mapfre is a Spanish multinational company founded in 1933, dedicated to insurance and reinsurance services. Its name stands for “Mutualidad de la Agrupación de Propietarios de Fincas Rústicas de España.” It first entered the Latin American market through Colombia and expanded across the region.

Today, Mapfre operates in 38 countries with around 5,000 offices and nearly 31,000 employees from 90 nationalities. This structure allows it to serve over 30 million clients worldwide.

Mapfre offers a wide range of travel insurance plans tailored to each traveller’s specific needs. Some key products include:

Temporary Travel Insurance

This insurance suits short trips, whether for leisure, business, or studies. It provides medical assistance, trip cancellation, and luggage protection during your travel period, among other benefits.

Student and Erasmus insurance

Designed for those studying abroad, this policy includes medical coverage, civil liability, and personal accident protection during the study period.

Trip Cancellation Insurance

Protects travellers’ investment in case of unexpected cancellations. It covers non-refundable expenses when cancellation happens for valid reasons, such as illness or urgent family issues.

Specialised insurances

These policies adapt to specific activities, such as:

- Golf insurance: Protects golf equipment and covers accidents related to playing the sport.

- Adventure insurance: Covers adventure activities, including rescue expenses if needed.

- Ski and snowboard insurance: Provides medical assistance and civil liability during winter sports.

What do Mapfre travel insurances cover?

Mapfre’s travel insurance coverage varies by plan, but generally includes:

- Medical assistance for illness or accident: Covers medical expenses during the trip, up to €500,000 ($545,000).

- Trip cancellation expenses: Compensation if the trip is cancelled for valid reasons, with limits between €1,000 ($1,090)and €1,500 ($1,635).

- Luggage loss: Financial compensation for lost, stolen, or damaged checked luggage, up to €1,000 ($1,090).

- Delays and overbooking: Compensation for transport delays or flight overbooking, including assistance and possible reimbursements.

- Repatriation and medical transport: Covers repatriation costs due to serious illness, accident, or death during the trip.

- Private civil liability: Protects against damage caused to third parties during the trip, covering indemnities and legal fees.

- Legal assistance: Offers advice in travel-related legal situations, such as disputes with service providers or foreign incidents.

- Sports and adventure activities: Covers sports such as golf, surfing, or skiing, as well as hiking or other risky activities under specific policies.

What’s not included in Safe Travel Assistance travel insurance?

Although Mapfre’s travel insurance provides wide coverage, there are exclusions that travellers must keep in mind:

- Pre-existing conditions: Medical costs linked to illnesses or conditions existing before buying the policy aren’t covered.

- Intentional acts or negligence: Incidents caused by deliberate actions, negligence, or illegal activities aren’t covered.

- War or natural disasters: Situations resulting from war, armed conflicts, terrorism, or natural disasters may be excluded depending on policy terms.

- Cosmetic or non-urgent treatments: Expenses related to cosmetic procedures, non-urgent treatments, or routine check-ups are generally excluded.

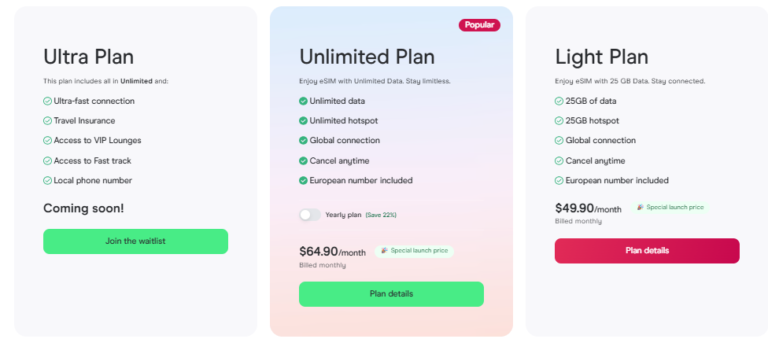

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 160 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Comparison of Mapfre travel insurance policies and coverage

Take a look at Mapfre’s different travel insurance types and their specific coverages below:

| Insurance type | Mandatory Coverage | Optional Coverage | Pros |

| Temporary Travel Insurance | Assistance for people (medical care, repatriation, extended stay, accommodation for companions, among others). – Baggage coverage (loss, theft, damage). – Delays (compensation for delays and overbooking). – Personal accidents (compensation for death or disability). | Cancellation (covers cancellation expenses). – Medical assistance outside the country of residence. – Baggage (extended compensation coverage). – Business (covers missed connections and travel due to lost passport). – Personal accidents (increased compensation). | Medical assistance up to €500,000 ($543,000). – Cancellation expenses up to €1,500 ($1,630). – Baggage loss up to €1,000 ($1,090). – Legal defence.- Accommodation expenses of €100 ($110) per day, up to 10 days. |

| Student and Erasmus Travel Insurance | Assistance for people (medical care, repatriation, extended stay, medicine delivery, etc.). – Baggage (loss, theft, damage). – Delays (compensation for delays and overbooking). – Civil liability. – Personal accidents (death or disability). | Medical assistance during travel. – Cancellation (travel cancellation expenses). – Personal accidents (increased compensation). – Civil liability (inclusion of the instructor). | Baggage loss covered up to €1,000 ($1,090) from the first day. – Medical and legal assistance. |

| Trip Cancellation Insurance | Cancellation expenses for family, health, work, official or extraordinary reasons (like home damage). – Coverage for transport incidents and stolen documents. | – No additional options, covers only specified cancellations. | Guaranteed cancellation. – Cancellation costs up to €1,500 ($1,630). – Baggage covered up to €1,000 ($1,090). |

Coverage comparison of Mapfre travel insurance plans.

Comparison of Mapfre specialised insurance policies and coverage

Mapfre’s specialised insurances also offer broad coverage for various activities such as golf, adventure, hiking and camping, safari and hunting, skiing and snowboarding.

| Insurance type | Mandatory Coverage | Optional Coverage | Pros |

| Golfers | Medical assistance for illness or accident. – Repatriation and extended stay. – Loss or damage to golf equipment. – Civil liability (accidents related to the sport). – Personal accidents (death or disability). | Loss or theft of golf equipment. – Trip cancellation due to injury or health problems. – Additional assistance for transporting sports equipment. – Golfer’s civil liability | Coverage up to €500,000 ($543,000) in medical expenses. – Golf equipment loss covered up to €2,000 ($2,170). – Civil liability for damage to third parties. |

| Adventure | Medical assistance and repatriation for adventure activities. – Personal accidents from adventure activities (death or disability). – Baggage and loss of specialised equipment (like climbing or rafting gear). | Emergency evacuation during extreme activities. – Insurance for mountain sports, scuba diving, mountain biking, among others. – Civil liability for high-risk activities. | Coverage for extreme and adventure sports and medical evacuation. – Specialised equipment covered up to €2,000 ($2,170). |

| Excursion and Camping | Medical assistance during excursions and camps (in case of accidents or illness). – Personal accidents (death or disability). – Baggage damage or loss. – Civil liability in camp activities. | Trip cancellation due to health problems. – Additional baggage for specific camp or excursion activities. – Extended coverage for adventure activities (hiking, rafting, etc.). | – Full outdoor coverage with medical and group civil liability protection. |

| Safari and Hunting | Medical assistance for injuries or accidents during safaris or hunting activities. – Personal accidents from hunting or safari (death or disability). – Baggage (loss, theft, damage to hunting equipment). | Loss or theft of hunting equipment or cameras. – Trip cancellation due to health problems. – Assistance in obtaining necessary permits or documents for the activities. | Coverage up to €500,000 ($543,000) in medical expenses. – Protection for hunting equipment. – Civil liability for accidents. |

| Ski and Snow | Medical assistance at ski or snowboard resorts. – Personal accidents from skiing or snowboarding (death or disability). – Baggage and equipment (loss, theft or damage to ski or snowboard gear). – Civil liability in snow activities. | Loss or theft of ski or snowboard equipment. – Trip cancellation due to injuries or health problems. – Assistance at high-altitude ski resorts. – Rescue or evacuation expenses on ski slopes. | Coverage up to €500,000 ($543,000) in medical expenses. – Equipment protection and rescue at ski resorts. |

Coverage comparison of Mapfre’s specialised insurances.

How to rate Mapfre’s customer service?

Mapfre travel insurance reviews on platforms such as Trustpilot show the company aims to provide quick responses. Most comments highlight its advisers’ personalised attention when resolving policy or purchase questions.

Problem-solving efficiency varies by case. Some users praise professional and fast incident handling, while others report difficulties with claims, mainly for trip cancellations.

Here are Mapfre’s main customer service channels for travel insurance:

- Phone: Free 24-hour travel assistance helplines are available.

- WhatsApp: For some services like medical authorisations, Mapfre offers WhatsApp support from 8 a.m. to 8 p.m., Monday to Friday.

- Email and online services: Queries and procedures through the customer area on Mapfre’s website allow independent management.

- Mobile app: The Mapfre app makes insurance management easier, giving access to services and assistance on mobile devices.

Mapfre travel insurance reviews and website experience

The platform lets users quote and purchase travel insurance in just a few steps. Travellers can choose the insurance type, enter personal details, and get an instant quote. Mapfre’s site provides detailed information about each policy’s coverage, exclusions, and conditions.

The purchase process is clear and guides the user through completion. Mapfre accepts secure payments by credit or debit card, ensuring flexibility and data protection.

Advantages and disadvantages of Mapfre travel insurance

Since Mapfre travel insurance reviews are mixed, here are key strengths and areas to improve. This overview helps you decide if the company matches your expectations and travel needs.

| To keep | To improve |

| Extensive international assistance network: Coverage in many countries guarantees global support. | Clarity on cancellation terms: Improve communication about specific exclusions. |

| Variety of customisable plans: Options adapted to every traveller and need. | Claims management: Speed up and simplify the process for faster resolutions. |

| 24/7 customer support: Constant availability for emergencies and queries. | Transparency on exclusions: Clearly explain uncovered situations to avoid confusion. |

| Easy online purchase: Quick, straightforward process through the website. | Post-sale communication: Strengthen follow-up and after-sales support. |

Mapfre travel insurance reviews and user experience

During our research on Google, Tripadvisor, and Trustpilot, we found mixed experiences about Mapfre travel insurance. We can conclude the company offers quality customer service, and its sales advisers show excellent product knowledge. This gives travellers confidence and sets positive expectations.

However, feedback about post-purchase services is limited. Most reviews mention slow problem handling, especially with refunds. Let’s look closer at Mapfre travel insurance reviews in key areas.

Medical care and expenses abroad

“I bought travel insurance here and had an accident in Asia. I needed medical transport, and the company handled everything well. They checked on me constantly, and I returned to Spain safely. I’ll definitely use them again.”

~ Denis Maldonado.

“Last September, my wife had a medical emergency in Havana, but Mapfre’s assistance insurance we’d bought gave no response at all.”

~ Jose Antonio.

“I had a small issue at the consulate with my travel insurance, but Mapfre’s team in Astillero solved it the same day.”

~ Yasmina Pardo.

Trip cancellation, refunds, and luggage protection

Regarding trip cancellations, refunds, and luggage delays or losses, customers often criticise Mapfre for not meeting policy promises:

“We bought Mapfre travel insurance with medical and cancellation coverage. We had to cancel our trip for reasons clearly covered, yet they refused any refund. We lost all trip costs and the policy money.”

Lu Lu.

“Mapfre is misleading. They claim trip cancellation coverage, but when you claim, they say it doesn’t cover weather issues. Total scam.”

Oscar M.

“My son travelled to Vancouver, and his luggage was delayed for three to four days. They didn’t pay the compensation (less than €200 ($218) for four days). They asked for endless paperwork. I feel Mapfre avoids paying claims.”

Carlos Jiménez.

Are you ready to make your own judgement and share your opinion on Mapfre travel insurance? This review includes everything you need to decide and plan your next trip confidently. In this review, you’ll find everything you need to make your decision and start planning your trip.

Getting travel insurance is essential, and staying connected when you arrive at a new destination matters too. It helps you open your Uber app, use Google Maps, and let your loved ones know you’ve landed safely.

Don’t worry about finding a SIM or public Wi-Fi. Discover Holafly’s monthly plans and make sure you’ve got monthly coverage and reliable internet access wherever you go.

Language

Language

No results found

No results found