Vivid card reviews: Advantages & disadvantages

What are the reviews of the Vivid Money card? Find them here, along with the services offered by this digital bank for travelers.

If you’re a traveller who wants to simplify financial management and only focus on your suitcase and passport at your next destination, then a digital wallet is for you. There are many ways to handle your money through virtual banking, but today at Holafly we’ll share Vivid Money card reviews, a fintech that’s currently very popular and well recommended.

Planning a trip is already tiring enough without worrying about exchange rates or finding ATMs with the lowest fees. In this post, we’ll take a detailed look at Vivid Money’s best and worst features to help you decide if this is the bank that’ll travel the world with you.

What is Vivid Money?

Vivid Money is a German financial technology company (fintech) founded in 2019. It partners with Solaris Bank, a licensed European bank, and uses Visa technology to provide modern savings and money management solutions.

Its main services include:

- Accounts with multiple individual IBANs (International Bank Account Numbers): Useful for managing different budgets or splitting expenses.

- Cashback on purchases: Earn up to 4% back on spending with popular brands.

- Access to investments and cryptocurrencies: Trade at competitive rates directly from the app.

- Instant currency conversion: Perfect for frequent travellers.

International availability

Vivid Money card reviews are positive regarding its usability anywhere Visa cards are accepted, as it’s backed by this global network across millions of physical and online retailers.

Main countries where Vivid Money operates

- European Union (EU) countries: The card is optimised for use in European countries such as Germany, Spain, France, Italy, the Netherlands, and Portugal. It also supports local currency payments outside the Eurozone.

- Other countries accepting Visa: Works in over 40 currencies, ideal for destinations outside Europe such as the United States, Canada, the United Kingdom, Japan, and countries across Latin America, Asia, and Oceania.

- International online payments: You can use it for shopping at international online stores, as long as they accept Visa.

Vivid Money card options for travellers

Vivid Money offers two main options designed for individuals seeking financial flexibility while travelling. Both provide debit cards, each with specific features and benefits:

Vivid Standard: Simplicity and zero fees

- No monthly fee: This account has no fixed charge if you keep a minimum balance of €1,000 ($1,090) or make at least €100 ($109) in monthly transactions. Otherwise, a fee of €3.90 ($4.26) per month applies.

- Individual IBAN accounts: You can create up to three sub-accounts (called pockets) with unique European IBANs. It’s convenient for organising spending, such as a dedicated travel fund.

- Basic cashback: Earn up to €20 ($21.80) monthly on selected purchases, saving a little on partner brands.

- Low-cost currency conversion: A 0.25% fee applies when converting money in over 40 currencies. For example, converting €2,000 ($2,180) to dollars would cost just €5 ($5.45).

- ATM withdrawals: Free up to €200 ($218) per month at any ATM worldwide. After that limit, a 3% fee or a minimum of €1 ($1.09) per transaction applies.

Vivid Prime: More benefits for frequent travellers

- Free trial: Enjoy one free month to explore all features. Afterwards, the monthly fee is €9.90 ($10.79).

- Up to 15 individual IBAN accounts: Perfect for managing detailed budgets, ideal for long or complex trips.

- Extended cashback: Earn up to €140 ($152.60) per month, with up to 4% cashback in selected categories like restaurants, transport, and popular brands such as Amazon or Carrefour.

- Fee-free withdrawals: Withdraw up to €1,000 ($1,090) per month at international ATMs.

- Metal card: A premium and durable design combining aesthetics with strength.

- Savings interest: Earn up to 4% interest on funds held in specific savings accounts.

Services included in both accounts

- International payments: Works in all countries that accept Visa, supporting over 40 currencies.

- Advanced security: Manage your card directly from the mobile app, allowing you to lock or unlock it in real time.

- Fully digital management: Through the app, you can track spending, check balances, and make instant transfers.

Vivid Money card features

Vivid Money cards are debit cards linked to a current account managed entirely through the mobile app.

- Personalised IBAN

Each account allows multiple sub-accounts (pockets) with individual IBANs, ideal for keeping budgets organised. You can assign a specific pocket for your travel expenses and maintain clear financial control.

- Flexible cashback

This benefit lets you earn cashback on purchases from popular brands and selected categories. You can receive up to €140 ($152.60) per month through cashback with the Prime plan.

- Interest on savings

You can earn up to 4% interest on money deposited in your pockets. With Vivid, you make money while saving.

- Metal card and multilingual support

The card, available for Prime subscribers, offers premium design and durability. Multilingual customer support ensures effective communication and fast issue resolution, making it easier and more comfortable for users worldwide.

Vivid Money card fees and commissions

One of the Vivid Money card reviews highlights its transparent and competitive fee structure, designed especially to reduce travel expenses.

1. Account fees

- Vivid Standard: Free for active users (minimum balance of €1,000 ($1,090) or €100 ($109) in monthly spending). Otherwise, a monthly fee of €3.90 ($4.26) applies.

- Vivid Prime: €9.90 ($10.79) per month, with one free trial month for new users.

2. Withdrawal fees

- Free ATM withdrawals up to €200 ($218) per month on the Standard plan and up to €1,000 ($1,090) on Prime.

- After reaching that limit, a 3% fee or a minimum of €1 ($1.09) per transaction applies.

3. Currency conversion

- Fixed cost of 0.25% for conversions in over 40 international currencies. For example, converting €1,000 ($1,090) to dollars costs under €3 ($3.27).

4. Investment fees

- Access to stocks, investment funds, and cryptocurrencies directly from the app.

- Fees range from 1% to zero for advanced Prime users.

Let’s say a traveller spends €1,500 ($1,635) in a month with an average cashback of 3%. They could get back up to €45 ($49.05) using the Prime plan. Also, with the €1,000 ($1,090) withdrawal limit free of fees, they’d save at least €30 ($32.70) compared with traditional cards. Sounds good, right?

Advantages and disadvantages of the Vivid Money card

Vivid Money card reviews suggest this is a modern solution for managing your money digitally. In this section, besides the benefits, we’ll also explain the limitations or aspects to consider so you get a complete picture of the service.

| Pros | Cons |

| Attractive cashback in the Prime plan, with returns of up to €140 ($152.60) per month. | Prime plan costs €9.90 ($10.79) monthly, which might not suit everyone. |

| Low 0.25% currency conversion fee, ideal for paying or withdrawing money abroad. | Limited cashback on the free plan (maximum €20 ($21.80) per month). |

| Worldwide use through the Visa network and support for over 40 currencies. | Limited free withdrawals (€200 ($218) on Standard, €1,000 ($1,090) on Prime) — exceeding them adds costs. |

| Multiple IBAN sub-accounts make it easy to organise expenses or budgets. | Available only to residents in specific European countries. |

| Fully digital management with advanced controls via the mobile app. | No physical branches, which could be inconvenient without internet access. |

| Enhanced security with features such as instant card lock from the app. |

Advantages and disadvantages based on Vivid Money card reviews

How to apply for the Vivid Money card

Requesting the Vivid Money card is a fully digital process. Follow these steps to get yours:

- Download the Vivid Money app

- Available for both iOS and Android devices.

- Search for “Vivid Money” in the App Store or Google Play Store.

- Register as a user

- Enter your email address and create a secure password.

- Fill in your personal details, such as full name, address, and country of residence.

- Identity verification

- Upload a photo of an official document, such as your passport or ID card.

- Record a short video or selfie to confirm your identity, a common step among European fintechs.

- Choose your account type

- Select between the free plan (Vivid Standard) or the Prime plan, which includes a one-month free trial.

- Link a payment method

- You can add another bank card or account to make your first deposit.

- Receive your card

- Once registration is complete, you’ll get an instant virtual card to start making online payments.

- If you want the physical card (metal for Prime), it’ll arrive by post within a few days.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

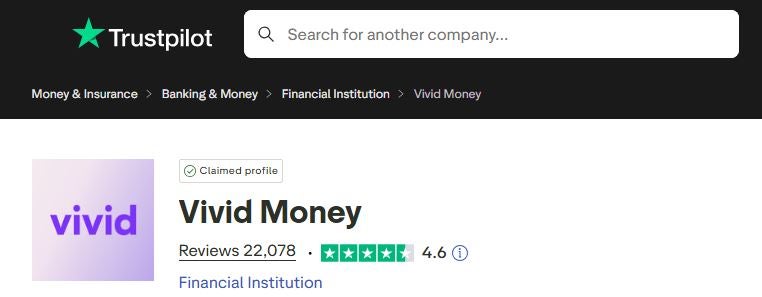

User experience and Vivid Money card reviews

We’ve already explained everything you should know about Vivid. Now, let’s hear from real users through their Vivid Money card reviews. At Holafly, we’ve gathered traveller experiences and customer feedback from Trustpilot covering several aspects of the service. Take a look:

Making payments in stores

Trustpilot

“Easy to use, intuitive app, and great cashback and savings interest. I use it daily and when I travel. Very satisfied.”

~ Luis.

Trustpilot

“It’s a company with great service. I used it last year abroad and had no issues.”

~ Rafael.

Trustpilot

“I’m happy because I can pay all over Europe with the same card and no fees.”

~ Juan.

Trustpilot

“Vivid is a good banking app. It works perfectly for transfers and payments abroad.”

~ José María.

Trustpilot

“I’ve travelled and used my money in any currency.”

~ Camila Alejandra.

Trustpilot

“It’s very easy to use and convenient for paying in any currency while travelling. Highly recommended.”

~ Ana María.

ATM withdrawals and online payments

Trustpilot

“Great card for travel and cash withdrawals. It’s easy to use and has no fees.”

~ Adela.

Trustpilot

“Fast and reliable management. Very comfortable to use. Totally recommend it! The online payment card is very secure.”

~ Juan José.

Customer service and support

Trustpilot

“I’ve used Vivid for a while, and it works well. You can create virtual cards and enjoy cashback.”

~ Diego Sol.

Trustpilot

“Customer service has really improved. A representative contacted me directly, in Spanish, and solved my issue quickly.”

~ Jacob Malka.

Trustpilot

“Whenever I’ve had an issue, they’ve responded quickly and in my own language.”

~ Rodrigo López.

Trustpilot

“It offers many features that traditional banks don’t, and fees are low even on the free plan.”

~ Pol.

Trustpilot

“Managing pockets is simple. I like moving money easily and seeing where I can invest my savings.”

~ Francisco.

Security

“It’s an intuitive, secure, and robust app. I feel safe making transfers and payments. A great choice!”

Teresa Rodríguez

TrustpilotAlternatives to the Vivid Money card

Of course, there are other similar options to Vivid Money that let you manage your money digitally while travelling. Check these recommendations below.

N26:

- German digital bank designed for frequent travellers.

- Free and premium accounts offering benefits like international transfers and travel insurance.

- Intuitive app available in multiple languages.

- Learn more in our article: N26 card reviews.

Wise (formerly TransferWise)

- Debit card linked to a multi-currency account.

- Currency exchange with interbank rates and no hidden fees.

- Low-cost international money transfers.

- Ideal for frequent travellers needing to make payments in various currencies or international transfers. Learn more in our post Wise card reviews.

Evo

- Smart card with no maintenance fees and free withdrawals worldwide.

- “Smart Account” plan with travel benefits like free currency exchange.

- Traditional bank offering modern digital features.

Manage your finances directly from your phone and make your trip seamless with the Holafly international travel eSIM! Enjoy unlimited data for as many days as you need. Or choose one of the monthly plans to stay connected at high speed in over 200 destinations — no SIM changes or roaming fees!

Language

Language

No results found

No results found