Taxes in Costa Rica: Which should I pay?

Discover the ins and outs of the Costa Rican tax system. Learn everything about taxes in Costa Rica — including deductions!

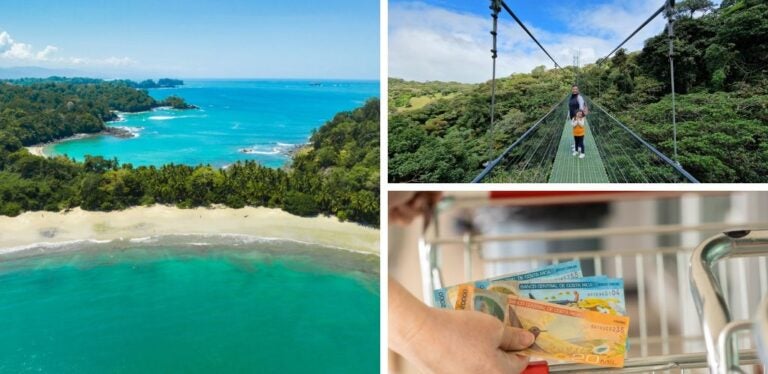

Are you thinking about changing your surroundings and considering the country of pura vida as your next residence? Before taking the final step, one thing you should consider is its tax system. It will directly affect your quality of life. Although it is far from being a tax haven, we can tell you that it can be a very attractive option for living or investing. Taxes in Costa Rica are moderate, the economy is stable, and there are many incentives that can significantly reduce your tax burden.

To make it easier for you to assess whether it’s worth packing your bags and setting up your new home in this nature-filled country with a lifestyle admired worldwide, today we want to help you understand its tax framework. We’ll review the taxes you’d need to pay as an individual and also if you decide to start a business in San José, Puerto Viejo, or any other part of the country. Let’s go!

Taxes for individuals in Costa Rica

Before diving in, it’s important to take a moment to understand how their tax system works. The tax system in the pura vida country combines both direct and indirect taxes. Its main goal is to fund essential public services like free education, the universal healthcare system, and basic infrastructure. It ranks (though in the lowest positions) in the list of countries with the lowest taxes, and its rates are moderate compared to other Latin American economies.

The Costa Rican tax system is directly linked to your residency status. If you spend more than 183 days a year in the country or have your main economic interests there, you will be considered a tax resident and must declare the income generated within Costa Rica. If, on the other hand, you’re not a tax resident, you’ll only be taxed on income coming from Costa Rican sources. With this cleared up, we can now take a look at the main taxes that might impact your finances if you decide to move to this Central American paradise.

1. Personal Income Tax (ISR)

If you decide to move to Costa Rica, the Income Tax will be the most significant tax on your declaration. It’s the most relevant tax for anyone living or generating income in Costa Rica. It applies to the gross income earned within the country and follows a progressive system. In other words, the higher your income, the higher the percentage you’ll pay. For tax residents, this means you’ll pay tax according to the tax brackets set by law. Non-residents, on the other hand, face a fixed rate for certain types of income.

Applicable rates for 2025:

- Up to €6,920 ($7,460) annually: Exempt.

- From €6,920 to 10,340 ($7,460 – 11,150): 10 %.

- From €10,340 to 17,270 ($11,150 – 18,550): 15 %.

- From €17,270 to 34,620 ($18,550 – 37,160): 20 %.

- Over €34,620 ($37,160): 25 %.

Let’s look at a practical example to better understand this. Suppose you generate annual income of €20,340 ($21,820):

- Up to €6,920 ($7,460): They are exempt, so no tax is paid.

- €6,920 to 10,340 ($7,460 – 11,150) (€3,420 ($3,670)): Taxed at 10 %, which is €340 ($370).

- From €10,340 to 17,270 ($11,150 – 18,550) (€6,910 ($7,420)): Taxed at 15%, which is €1,035 ($1,110).

- From €17,270 to 20,340 ($18,550 – 21,820) (€3,040 ($3,270)): Taxed at 20 %, which is €610 ($650).

Total income tax to pay: €1,985 ($2,130).

This tiered system ensures that each portion of your income is taxed proportionally, according to the brackets set by Costa Rica’s Ministry of Finance.

2. Value Added Tax (VAT)

This is the tax you’ll notice the most in your daily life. VAT, or Value Added Tax, is applied to the consumption of goods and services and is included in final prices. It was introduced as part of a 2019 reform. It replaced the old sales tax, with the aim of broadening its scope to services that were previously untaxed, such as digital services.

Current rates:

- 13 %: Standard rate for most goods and services.

- 4 %: Applied to private education services and products of social interest.

- 2 %: For medicines and medical equipment.

- Exempt: Basic products like fruits, vegetables, and other essential foods.

Let’s look at another example. Imagine you buy an electronic device for €465 ($500). With the 13 % VAT, the final price will be €525 ($565). On the other hand, if you buy a medicine worth €18,60 ($20), the VAT will be 2 %, and you’ll pay €19 ($20.40).

This tax is a key source of income for the government and helps finance essential public services. Additionally, it reflects a tax system designed to balance revenue collection with the basic needs of the population.

Compared to other countries, 13 % is a moderate rate. For example, in Argentina, this tax is set at 21 %. However, it is higher than in Panama, where the ITBMS (their equivalent of VAT) is set at 7 %.

3. Property tax

Are you planning to stay for a while to enjoy pura vida and want to buy a house? Then, you’ll need to consider the property tax. It is managed by local municipalities and is intended to fund services like waste collection, public lighting, and the maintenance of local infrastructure.

This tax is calculated on the registered value of the property, which is generally lower than the market price. The rate is 0.25 % of the cadastral value and is paid annually. Compared to other countries in the region, this tax is quite affordable and allows property owners to enjoy a reasonable tax burden while contributing to local development.

How much would you need to pay? Let’s say you buy a property in Guanacaste worth €139,500 ($150,000), but with a registered cadastral value of €111,600 ($120,000). The calculation would be:

- 0.25 % on €111,600 ($120,000): You would pay €280 ($300) annually as property tax.

This tax is independent of other property-related costs, such as the transfer tax when acquiring it or maintaining basic services. Some municipalities offer discounts for those who pay their taxes on time.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

4. Capital Gains Tax

If you plan to buy properties or any other type of asset in Costa Rica, you should also consider the capital gains tax. This tax applies to the profits made from selling an asset, such as houses, stocks, or other investment goods. The rate is fixed at 15 % on the generated profit.

The interesting thing about this tax is that it doesn’t apply in all cases. If you sell your primary residence, you’ll be exempt. This makes Costa Rica an attractive destination for those looking to live in the country and sell their property later without facing additional tax burdens.

Imagine you buy land in the Alajuela region for €46,500 ($50,000) and, after a few years, decide to sell it for €74,400 ($80,000). The net gain would be €27,900 ($30,000). In this case, the capital gains tax would be 15 % on that amount, which is €4,185 ($4,500). This fixed rate simplifies tax planning and gives investors better control over their returns.

This tax reflects the country’s effort to balance attracting foreign investment with maintaining a fair and sustainable tax base.

5. Other important Taxes for individuals in Costa Rica

These are the main taxes, but there are more. Some of the most relevant include:

- Property Transfer Tax: Applied when buying a property and equals 1.5 % of the transaction value. It is usually divided between the buyer and seller, although both parties can reach an agreement.

- Remittance Tax: If you transfer money from Costa Rica to another country, you’ll need to pay a fee that ranges between 5 % and 15 % (depending on the nature of the transfer). This is particularly relevant for expatriates who manage income or investments in multiple countries.

- Vehicle Tax: Planning to buy or import a car? You should keep in mind the Marchamo, an annual vehicle property tax. The rate depends on the value of the car and its age. Moreover, if you import a used car, the import tax can be quite high, sometimes even exceeding 50 % of the vehicle’s value.

- Inheritance and Donation Tax: Costa Rica taxes the transfer of goods through inheritance or donations. The rates vary based on the relationship between the parties and the value of the transferred goods.

Taxes for companies or businesses in Costa Rica

Now let’s look at the tax system for businesses in Costa Rica. If you’re thinking of starting a business or expanding your company to the pura vida country, it’s important to understand how it works. This could save you money and headaches. Overall, Costa Rica offers an attractive environment for investment. Although it’s not a country with low tax rates, it provides economic stability, access to international markets, and a growing network of trade agreements. Let’s take a look at the most notable taxes you would face:

1. Corporate Income Tax (ISR)

The corporate income tax in Costa Rica applies to legal entities based in the country and taxes income generated within the national territory. The system is progressive, aiming to benefit small and medium-sized businesses with reduced rates, as long as their gross annual income doesn’t exceed a certain threshold.

Applicable rates for 2025:

For companies with gross annual income up to €202,000 ($217,000):

- Net income up to €9,530 ($10,230): 0%

- From €9,530 to 14,290 ($10,230 – 15,340): 10%

- From €14,290 to 19,040 ($15,340 – 20,440): 15%

- Over €19,040 ($20,440): 20%

For companies with gross annual income up to €202,000 ($217,000):

- A fixed rate of 30 % applies to net income.

It’s important to note that these rates apply to net income, which means income after deducting costs and expenses allowed by law.

Corrected practical example

Let’s say your business had gross income of €169,000 ($182,000) in 2025 (below the threshold of €202,000 ($217,000)) and after deductions, the net income was €20,340 ($21,820). The calculation would be:

- The first €9,530 ($10,230) are exempt: €0 ($0)

- From €9,530 to 14,290 ($10,230 – 15,340) (€4,760 ($5,110)) taxed at 10 %: €713 ($765)

- From €14,290 to 19,040 ($15,340 – 20,440) (€4,750 ($5,100)) taxed at 15 %: €713 ($765)

- From €19,040 to 20,340 ($20,440 – 21,820) (€1,300 ($1,400)) taxed at 20%: €260 ($280)

Total to pay: €1,330 (approximately $1,570).

The maximum rate of 30 % in Costa Rica is similar to the rates in countries like Mexico or Brazil, but it’s higher than more tax-friendly destinations like Panama and Uruguay, where companies are taxed at 25 %.

2. Value Added Tax (VAT)

Companies act as intermediaries collecting this tax. While consumers bear the cost, businesses apply it to the goods and services they sell and then transfer it to the government. Different rates apply depending on the product or service:

- Standard rate: 13 % (applies to most general goods and services).

- Reduced rate: 4 % (private education services and products of social interest).

- Super-reduced rate: 2 % (medicines and essential medical equipment).

- Exempt: 0 % (basic products like fruits, vegetables, rice, and beans).

In Costa Rica, as in most countries with a VAT system, businesses can deduct the VAT paid on purchases or expenses related to their economic activity. What does this mean? It means that if a business pays VAT when acquiring goods or services necessary for its operations (e.g., raw materials, professional services, or equipment), they can subtract that amount from the VAT they’ve collected from customers.

3. Presumed Minimum Income Tax

In Costa Rica, businesses that do not generate significant income but remain active are subject to a minimum tax. It acts as a basic fee for registered companies that do not report significant profits or whose activity is minimal.

The standard rate is 3 % of declared gross income. However, for companies that remain registered but are not significantly operating, a fixed annual fee applies, which is around €95 ($110). This includes businesses that keep their status active in the commercial registry but do not conduct significant commercial operations.

4. Remittance Tax

If your company sends payments abroad, such as dividends to international partners or payments for services, these will be subject to this tax. The rate varies depending on the type of payment:

- Dividends: 15 %.

- Interest and technical services: Between 5 % and 15 %, depending on the nature of the payment and existing tax agreements.

Imagine your company sends €93,000 ($100,000) in dividends to an international partner. You would need to withhold 15 % (€13,950 ($15,000)) and transfer it to the Costa Rican government.

This tax is relevant for businesses with international partners or those working with external services, as it increases the total cost of remittances. However, some double taxation agreements may offer reductions in these rates.

5. Education and Culture Stamp Tax

This tax is mandatory for all active businesses in Costa Rica and is paid once a year. Its purpose is to fund cultural and educational initiatives in the country.

The rate varies depending on the size and nature of the business:

- Small businesses: Between €1.25 – 2.50 ($1.50 – 3).

- Medium-sized businesses: Around €5.60 ($8.50).

- Large businesses: Up to €11.20 ($17).

6. Other relevant taxes for businesses

In addition to the main taxes, there are other taxes that may affect your business:

- Property Tax: If your business owns property, you’ll need to pay property tax, calculated at 0.25 % of the cadastral value of the property.

- Property Transfer Tax: If your business acquires property, it will need to pay 1.5 % of the transaction value.

- Contributions to the Costa Rican Social Security Fund (CCSS): As an employer, you’ll need to contribute 26 % of your employees’ gross salary to finance pensions, healthcare, and workplace risks.

Highlighted tax benefits in Costa Rica

Although it’s not a tax haven, Costa Rica makes an effort to offer significant incentives to attract investment, boost economic activity, and facilitate foreign residency. These tax benefits can make your tax burden much more manageable. If you’re thinking about settling down or starting a business in this country, it’s worth exploring the available advantages to optimize your finances and make the most of the system.

Highlighted tax benefits in Costa Rica:

- Tax exemption for new residents under the Law to Attract Investors, Rentiers, and Pensioners: If you move as a rentier, pensioner, or investor, you can import personal belongings like vehicles, appliances, and tools for your professional activity without paying import taxes. You’ll also be exempt from paying tax on income generated abroad, such as pensions or investments, for the first 10 years of residency.

- Free Trade Zone Regime: If you decide to start a business or move your company to one of Costa Rica’s free trade zones (there are over 30 across the country), you’ll enjoy full or partial exemptions on income tax, import duties, and other taxes. This incentive is ideal for businesses in technology, manufacturing, or international services looking for a favourable environment to operate.

- Tax incentives for tourism: Businesses focused on sustainable tourism, such as hotels, ecotourism agencies, or adventure activities, can benefit from reductions in VAT and import duties on infrastructure and equipment for tourism activities.

- Discounts on municipal taxes for rural businesses: In less developed areas, small businesses can get discounts on property taxes and other local fees, encouraging economic activity in these regions.

- Tax reductions for sustainability projects: Businesses investing in renewable energy or environmentally friendly technologies can benefit from exemptions on VAT and advantages on income tax.

- Fiscal support for SMEs and startups: Small and medium-sized businesses registered in Costa Rica have access to reduced rates on income tax during the first years of operation. They also have access to training programs and financing on favourable terms.

As you can see, Costa Rica combines an accessible tax environment with advantages designed to attract both individuals and businesses. If you’re considering moving or investing in Costa Rica, it’s important to thoroughly study its tax obligations and responsibilities before making any decisions. Don’t hesitate to consult an expert who can assess your specific case and help tailor your tax strategy to optimize your finances. And don’t forget to get your Holafly eSIM to ask any questions once you arrive!

Frequently asked questions about taxes in Costa Rica

If you work as a self-employed individual in Costa Rica, the income tax you’ll pay depends on your annual income. The first €6,920 ($7,460) are exempt. From there, the rates vary from 10% to 25% depending on your gross income. Additionally, you can deduct certain expenses related to your professional activity to reduce your taxable base.

In Costa Rica, basic products such as rice, beans, and milk are exempt from VAT. Certain essential services, such as public education and certain medical services, are also exempt. Moreover, medicines and essential medical equipment have a reduced rate of 2%.

Yes, if they generate income within the country. Foreign companies operating in Costa Rica are subject to the same income tax rates as local companies. Additionally, if they transfer dividends or make payments abroad, they must withhold and pay the remittance tax, which ranges from 5% to 15% depending on the type of transaction.

Companies operating in free trade zones enjoy significant tax exemptions, such as full or partial exemptions from income tax and import duties. They also benefit from favourable conditions for importing equipment and raw materials needed for their operations.

Property tax is calculated based on the registered value of the property, which is usually lower than the market price. The rate is 0.25% of the cadastral value and is paid annually to the corresponding municipality.

If you don’t file your return on time, you could face financial penalties ranging from a percentage of the tax due to fixed amounts depending on the type of omission. Additionally, interest will accrue for each day of delay, which could significantly increase the final cost.

Language

Language

No results found

No results found