Travel Insurance for Morocco: What Options are there?

Do you know which are the best travel insurances for Morocco? We look at some options and help you choose the best insurance for your trip.

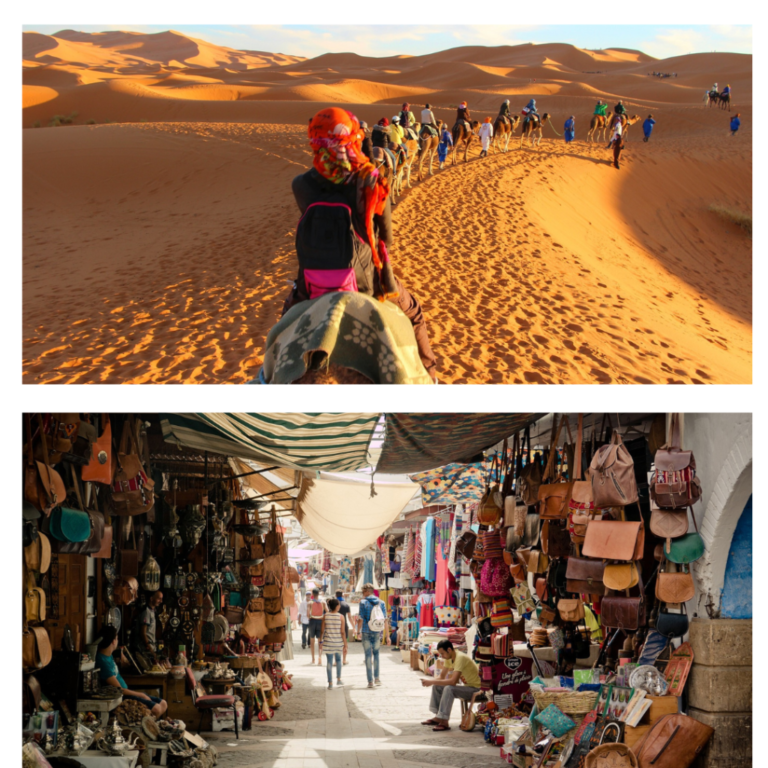

Traveling to Morocco could be the adventure of a lifetime! Strolling through the vibrant, maze-like souks or embarking on a heart-pounding desert adventure are experiences that awaken all your senses. Diving into its culture is something many dream of experiencing. But, as on any trip, no one is exempt from suffering health problems, such as indigestion after eating a typical Moroccan dish. That’s why having travel insurance for Morocco is key to making your trip unforgettable—in the best way possible!

Travel insurance for Morocco won’t only give you peace of mind, but will also save you significant costs in case of accidents or medical emergencies. The good news is that there are many possible alternatives, with IATI Seguros being the one we recommend the most.

However, as there are many alternatives, you may be wondering what’s the best insurance for travelling to Morocco. Don’t worry, because in this article we will look at the different options, including prices, features and benefits. Discover the ideal insurance for your adventure in this fascinating North African country.

Why take out travel insurance for Morocco?

While Morocco has a low health risk, health issues, accidents, or lost luggage can happen to anyone. In addition, private medical services in the country are expensive. For example, the price of a medical consultation can range from €51,61 ($50 US) to €103.22 ($100 US), while a hospital stay can exceed €1.032,22 ($1,000 US) per day. Without adequate travel insurance, facing these costs could ruin your budget and that long-planned trip.

Keep in mind that most private clinics in Morocco have agreements with insurers, so having travel insurance will save you more than just a headache! In addition, not only will you be covered for medical expenses, but the insurance can also offer protection against flight cancellations or lost luggage. Even if you plan to travel to Morocco with your family or a group of friends, you’ll find that there are joint policies to protect everyone.

What should a travel insurance for Morocco cover?

As you can imagine, travel insurance for Morocco can be quite different from, say, insurance for a trip to a U.S. city Food poisoning and sunstroke are common in this country, something that may not happen as often in other destinations. Either way, a good travel insurance plan for Morocco should include:

- Medical care: Emergency, hospitalisations, and medical consultations. A detail in this section is to have assistance in your language (or in English), as having to communicate in Moroccan can be quite complicated.

- Repatriation: In the event of severe illness or death, the insurance should cover the cost of transport back to the country of origin.

- Lost or stolen luggage: While Morocco is one of the safest countries in Africa, having financial protection against loss, theft, or damage to your belongings is essential.

- Flight cancellation cover: If your flight is delayed or cancelled, the insurance should offer compensation.

- Civil liability: Coverage in case of damage to third parties during your stay.

- 24/7 assistance: Ongoing emergency assistance whenever you need it.

- Accidents in outdoor activities: A must for travellers heading to Morocco for hiking in the Atlas Mountains, cycling routes, safaris, or water sports like surfing and kitesurfing.

Ultimately, having coverage for these areas won’t just give you peace of mind—it’ll let you fully enjoy your trip without worrying about unexpected hiccups. Another factor that will give you peace of mind during your time in Morocco is a good internet connection, don’t you think? In that case, in addition to insurance, make sure you have your Holafly eSIM and the best data plan.

Comparison of the best travel insurances for Morocco

Choosing travel insurance for Morocco can be tricky, as there are many options on the market, all of which are generally very good. That’s why we help you with this table comparing five travel insurances for Morocco. You’ll see their main features, so you can choose the most suitable one for the type of trip you have in mind.

Be sure to consider some key aspects when making your choice, such as whether you plan to do adventure sports, whether you are travelling alone or in company, and how much you’re willing to spend. Also note that these companies offer different types of coverage with varying amounts of benefits and that, in some cases, you‘ll have to pay a deductible. That’s why you should carefully analyse your options and always read the fine print to avoid any unpleasant surprises.

But what about Internet connection? Just as important as having travel insurance is being able to stay connected without limits in all the destinations you are going to visit. Luckily, with Holafly’s eSim you can always stay connected during your trip in Morocco .

That said, let’s look at the best travel insurance options for Morocco.

| Feature | IATI Insurances | Chapka | Allianz | AXA | Heymondo |

| Price (7 days) | €28.57 ($29.49 US) | €20.40 ($21,06 US) | €48,54 ($50.10 US) | €71,26 ($73.56 US) | €21,90 ($22.61 US) |

| Medical expenses | €500.000 ($516,107.72 US) | €250.000 ($258,053.86 US) | €10.000 ($10,322.15 US) | €1.000.000 ($1,031,640.41 US) | €500.000 ($516,107.72 US) |

| Repatriation | 100% | 100% | 100% | 100% | 100% |

| Lost or stolen luggage | €1.500 ($1,548.32 US) | €800 ($825.77 US) | €400 ($412.89 US) | €1.500 ($1,548.32 US) | €1.500 ($1,548.32 US) |

| 24/7 assistance | Yes | Yes | No | Yes | Yes |

| Flight delay support | €200 ($206,44 US) | €150 ($154,83 US) | €150 ($154,83 US) | €150 ($154,83 US) | €300 ($309,66 US) |

| Coverage for adventure sports | Yes | Depending on the plan | No | Yes | Basic |

| Trip cancellation | Optional:€3.500 ($3,612.75 US) | Optional: €2,000 ($2,064.30 US) | €1.500 ($1,548.32 US) | €3,000 ($3,096.65 US) | – |

| Civil liability | €60.000 ($61,932.93 US) | €40.000 ($41,288.62 US) Deductible:€15,000 ($15,483.23 US) | €10.000 ($10,322.15 US) Deductible: €90 ($92.90 US)/loss | €30.000 ($30,966.46 US) | €60.000 ($61,932.93 US) |

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

The 5 best travel insurances for Morocco

Based on the table above, we now provide a more detailed description of each of the travel insurances for Morocco, giving you a clearer picture of what each company offers, including pros and cons.

1. IATI Travel Insurance

IATI is one of the most popular insurances for travellers worldwide, especially recommended for Morocco because of its excellent medical cover of up to €500,000 ($516,107.72 US). Your IATI Backpacker plan is perfect for a cross-country trip, as you’ll be covered for more than 60 sports and adventure activities. If you have a restless spirit, with this type of insurance you can enjoy scuba diving or even trekking at altitudes of over 5,000 metres.

IATI’ s travel insurance for Morocco offers 24/7 assistance, lost luggage coverage and pays clinics directly, making it easy to receive medical treatment without having to pay money upfront. Additionally, its competitive price makes it an ideal option for those looking for the best value for money.

An additional advantage is that there are no deductibles, which means that you won’t have to bear any out-of-pocket costs. Finally, it offers personalised attention in several languages, ideal for international travellers.

Strengths: Comprehensive medical coverage, 24/7 care, repatriation, personalised care in several languages.

Weaknesses: It doesn’t offer unlimited coverage for medical expenses.

2. Allianz Global Assistance

Allianz offers coverage of up to €10,000 ($10,322.15 US) in medical expenses and stands out for its 24/7 customer service. It’s another reliable option for traveling to Morocco, as it includes additional services like repatriation and compensation for flight delays. Although it’s more expensive than other options, its wide range makes it an excellent choice for those seeking total security.

Strengths: Extensive medical coverage, efficient customer service.

Weaknesses: Its policies tend to be more expensive compared to other insurers, especially for short trip coverage. In addition, some users report that the refund process can be slower than expected, which can lead to frustration in urgent situations.

3. Chapka

Chapka is one of the best travel insurances for Morocco. To start, it offers 24/7 assistance in multiple languages. On the other hand, coverage for medical expenses, including hospitalisation and repatriation, is extensive, so you’ll be well protected during your trip. Another plus point is its coverage of sports and adventure activities, which are popular with tourists in Morocco, such as hiking in the desert or surfing on the Atlantic coast. Chapka also covers loss, theft, or damage to luggage, which is essential for a long trip or a trip full of transfers, as is often the case when exploring Morocco.

Strengths: It offers coverage for extreme sports and 24/7 assistance.

Points against: While Chapka offers adequate coverage, some insurances such as IATI tend to offer higher limits on medical expenses. In addition, it doesn’t have as many options for customising your coverage plan.

4. AXA Assistance

AXA is known for its global network, making it a solid choice for those travelling to Morocco. It offers comprehensive medical cover, including repatriation and medical evacuation in serious situations, along with protection against baggage loss and 24/7 assistance in emergencies. It also covers flight cancellations and delays, providing a smoother travel experience.

Advantages: Good customer service, decent medical coverage.

Disadvantages: Low compensation for lost luggage.

5- Heymondo

Heymondo is another good option for travellers looking for a hassle-free experience during their trip to Morocco. Like the others, it provides extensive medical coverage and includes protection for lost luggage, repatriation, and 24/7 emergency assistance.

Advantages: Its mobile app, which allows for stress-free management of any incident during the trip, such as requesting refunds or contacting support. Disadvantages: Some of the most comprehensive coverages are only available in the superior plans. May be more expensive for longer journeys compared to other options.

Which is the best travel insurance for Morocco?

In conclusion, because of its excellent value for money, we recommend IATI as the most suitable travel insurance option for Morocco. We picked it for its top-notch coverage—high medical expenses, repatriation, theft ,and lost luggage protection, plus 24/7 assistance! Moreover, its flexibility allows the traveller to choose between different plans according to his or her needs. That’s why you’re sure to find a plan that fits you perfectly!

Another reason we chose IATI is that you won’t have to pay upfront for medical assistance, unlike with other companies. This means that if you need medical assistance, you don’t have to pay and then ask for a refund, but the insurer takes care of everything.

Getting your travel insurance for Morocco with IATI is a breeze thanks to its intuitive menu. In just a few minutes, you can have your policy ready! Please note that you’ll be able to activate the Trip Cancellation Coverage add-on, which will cover you in case your trip to Morocco is cancelled due to any reason or circumstance.

Now, with your travel insurance already taken out, you’ll be able to enjoy a unique experience in this jewel of the African continent.

Travel insurances for Morocco: Frequently asked questions

Travel insurance is not compulsory to enter Morocco. However, it’s highly recommended, as medical and emergency costs in the country can be high, and insurance can protect you in case of accidents, illness or problems during your trip.

It’s advisable to look for insurance that offers at least €500,000 ($516107,72 US) of medical coverage to be well protected. Remember that you can extend your policy coverage and enjoy other benefits, such as compensation in case you have to cancel your trip due to unforeseen circumstances.

If you need medical assistance, you should contact your insurance company immediately via the 24/7 helpline. They’ll guide you on how to proceed and point you to the nearest affiliated hospitals or clinics where you can receive care without having to pay out of pocket.

Many travel insurances, such as the IATI plan, offer coverage for outdoor adventure activities. However, it’s important to check that your policy specifically includes sports or risky activities if you plan to do something more extreme, such as desert hiking or water sports.

Most current travel insurance, including those offered by IATI and other companies, cover COVID-19-related medical expenses, such as tests and treatment. They also usually include cover for repatriation or trip cancellation if you contract the illness before or during your stay.

Language

Language

No results found

No results found