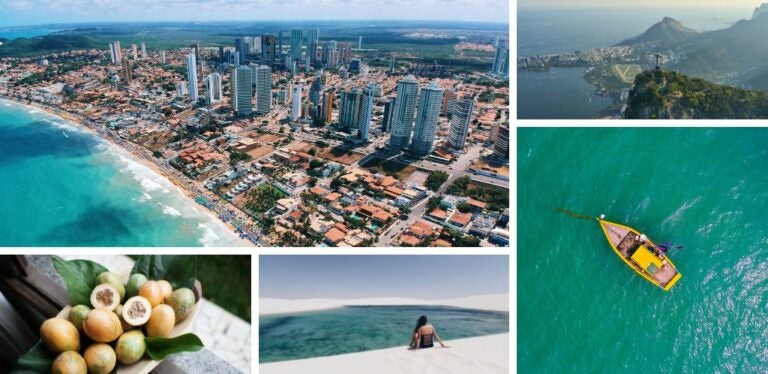

Travel Insurance for Brazil: Learn the best options

Are you visiting Rio de Janeiro or another Brazilian destination? Take out an insurance and minimise risk. Discover the best travel insurance for Brazil.

Are you planning to go to Brazil? Although it’s a fascinating and diverse destination, where you’ll find all kinds of services, it’s good to be well prepared for any possible incidents that may arise. While preparing for your trip, between organising itineraries and finding hotels, you should set aside some time to take out good travel insurance for Brazil.

This type of insurance won’t only cover you for medical emergencies, but also if you miss your flight, lose your luggage or accidentally break something important. As this is a complex issue, especially if you aren’t used to contracting this type of service, we want to help you. We’ve already talked about international travel insurance in the past, but in this article, we’ll take a look at the coverage and prices of the best insurance companies operating in this country. Join us and discover the policy that best suits your needs.

Why take out travel insurance for Brazil?

Most of the time, when planning a vacation, we leave the search for the right travel insurance until the last minute. That’s normal, it’s one of the least exciting things about the preparations. However, it’s essential to devote some time to it. If something unexpected does come up, hopefully not, you’ll want to be prepared and protected by a company that is an expert in dealing with any setbacks.

In the case of Brazil, in addition to the usual unforeseen events in other destinations, it’s a very diverse country where nature plays a major role in travellers’ itineraries. Although travel insurance isn’t mandatory for entry, it’s recommended that you take out travel insurance. It’ll be very helpful, for example, if you have a medical emergency. The Brazilian public health system (SUS) may not be up to the expectations of tourists, especially in remote regions or for those seeking fast and quality medical care.

A consultation in a private clinic can cost between $550 R and $1,600 R ($95-277 US). A hospital stay of around $27,000 R ($4,672 US). Also, be aware that outbreaks of dengue, yellow fever and Zika have been reported in recent months.

In addition to the medical aspects, travel insurance can also save you financial problems if you lose your luggage when you arrive at an airport such as Guarulhos or if your flight is delayed. This could lead to unexpected hotel and food expenses that, with travel insurance for Brazil, would be covered.

Are you convinced that travel insurance for Brazil is essential and not just an unnecessary expense? As you should know that you’ll be covered in many more aspects, we’re going to review the main coverages that you should demand from your policy.

What should a travel insurance for Brazil cover?

If you’ve never considered travel insurance before, you may feel lost among so many options and unfamiliar terms. Medical cover, cancellations, legal assistance… How do you know what’s really necessary? When choosing travel insurance for Brazil, you should consider whether your coverages are appropriate for the part of the country you are visiting and the activities you plan to do. These are the basic coverages that shouldn’t be missing in your policy:

1. Emergency medical care: In Brazil, private clinics offer better care than public hospitals, but their prices are high. Insurance should cover, at a minimum, between $1,600,000 R and $2,600,000 R ($320,000-530,000 US) in medical expenses. This includes hospitalisation, consultations and medication. Also, check that the insurance covers treatment for tropical diseases such as dengue or yellow fever, which are quite common in some parts of the country.

2. Medical or death repatriation: A medical transfer from Brazil can cost more than $110,000 R ($22,000 US). A little more if a medical aircraft is needed. By taking out this cover you’ll ensure that, in the event of a serious accident, you can receive treatment in your home country or that your family members don’t have to bear high expenses in extreme situations. All insurance options usually cover repatriation.

3. Coverage for adventure sports: Brazil is a paradise for adrenaline seekers. Zip-lining, white-water rafting, reef diving and jungle trekking are popular with travellers to this part of the world. However, many insurers don’t include these activities by default. Opt for a policy that specifies coverage in case of accidents while doing extreme sports or high-risk activities.

4. Lost or stolen luggage: Can you imagine losing your belongings in Rio de Janeiro or, even worse, arriving in Foz do Iguaçu ready for a jungle excursion only to realize you have nothing with you? Losing your suitcase can be a real headache. Especially if you need to replace your clothes, electronic devices and documentation. Good insurance will offer youfinancial compensation for the loss or theft of your belongings, as well as helping you to deal with all the paperwork quickly.

5. Flight delays and cancellations: If your flight is delayed or cancelled, additional expenses such as accommodation, transport and meals can blow your budget in no time. Insurance to cover these unforeseen events will protect you from unnecessary expenses and guarantee assistance in finding immediate solutions.

6. Destination legal assistance: Although not a common coverage in all insurance options, it can be crucial if you face legal problems during your trip. For example, if you have a traffic accident or a contractual dispute in Brazil, having coverage for legal fees and translations can save you headaches and money.

7. 24/7 care and management app: The time difference and the complexity of some situations make it essential to have access to assistance 24 hours a day. Many insurers offer apps that allow you to manage claims, contact a doctor or receive immediate help from anywhere. Remember to sign up for your Holafly eSIM to contact support at any time! Oh, if you don’t speak Brazilian, it’ll help if your insurer offers care in other languages.

Comparison of the best travel insurance plans for Brazil

Now that you know you need travel insurance for Brazil and have a good idea of what coverage you should expect to be protected against any incidents at your destination, let’s talk about who will provide you with the coverage you need. There’s a wide range of companies offering this type of service. Many have decades of experience and an impeccable reputation. Others are newer to the market but have earned the trust of discerning travellers. How to make the right choice?

To make it easier for you, we’ve prepared a comparison of the five best travel insurance opitons for Brazil in 2025. In it, you’ll find the main coverages of each policy clearly outlined. Along with the prices.

| Coverage | Chapka (CAP TRIP Basic) | HeyMondo (Ease of Mind Travel) | IATI (Star) | AXA Assistance (Total) | Intermundial (Totaltravel mini) |

|---|---|---|---|---|---|

| Price (7 days) | €26.76 ($28.90 US) | €35.59 ($38.49 US) | €53.99 – ($58.38 US) | €58.07 ($62.80 US) | €33.31 – ($36.10 US) |

| Medical expenses | €250,000 ($269,946 US) | €600,000 ($648,837 US) | €5,000,000 ($5,398.125 US) | €150,000 ($162,209 US) | €300,000 ($325,083 US) |

| Repatriation | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Lost or stolen luggage | €800 ($865 US) | €1,500 ($1,622 US) | €2,500 ($2,700 US) | €1,500 ($1,622 US) | €1,500 ($1,622 US) |

| 24/7 assistance | Yes | Yes | Yes | Yes | Yes |

| Trip cancellation | Optional | Optional | Optional | Optional | Optional |

| Coverage for adventure sports | Yes | Yes | Yes (Premium Adventure optional) | Optional: Sports insurance (€33.61) | No |

| Civil liability | €40,000 ($43,191 US) Deductible €150 ($162 US) | €60,000 ($64,883 US) | €60,000 ($64,883 US) | €30,000 ($32,441 US) | €50,000 ($54,180 US) |

| Compensation for flight delay | Only at the start of the trip, up to €150 ($162 US) | €300 ($324 US) | €324 ($291 US) | €150 ($162 US) | €150 ($162 US) |

The 5 top travel insurance options for Brazil

Likely, after the comparison table, you’ll be closer to your choice. However, it’s normal that in order to contract such a decisive service, which will allow you to travel with peace of mind in the knowledge that you’re covered, you need more information. Let’s look at a more detailed analysis of these insurers so that you can be convinced of your choice.

IATI Seguros: Experience and personalised service for Brazil

Founded in 1885, IATI Insurance is a leading insurer in Europe, renowned for its track record and commitment to travellers. It stands out for its focus on offering flexible and complete solutions, adapted to all types of travellers, from backpackers to families. Among its most valued services is its app, which allows for quick incident management, online medical consultations and access to useful information about nearby hospitals. Feedback from those who have used IATI to travel to Brazil is very positive. Its rapid response to emergencies and clarity in the management of reimbursements are appreciated. Its customer service, available 24/7 in different languages, is another of its key strengths.

IATI offers a range of policies specifically designed to meet the needs of visitors to destinations such as Brazil. From IATI Basic, ideal for those looking for essential cover, to IATI Backpacker, designed for those planning adventure activities such as trekking or water sports. Also of note is the IATI Star, which includes premium cover such as comprehensive medical expenses and cancellation protection. In all their plans, repatriation to the country of origin is 100% included, a key factor in a destination as vast and diverse as Brazil.

Main policy coverages for Brazil:

- Medical expenses: Up to €5,000,000 (approximately $27,000,000 R / $5,400,000 US).

- Repatriation: 100% included.

- Loss of baggage: Up to €2,500 (approximately $13,500 R / $2,700 US).

- Adventure sports: Covered in advanced plans.

- Flight delays: Up to €300 (approximately $1,620 R / $324 US).

Plans and prices:

- IATI Basic: €32.90 (approximately $178 R / $35 US) for 7 days.

- IATI Standard: €38.88 (approximately $210 R / $42 US) for 7 days.

- IATI Backpacker: €53.99 (approximately $291 R / $57 US) for 7 days.

- IATI Star: €70.87 (approximately $382 R / $77 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Includes adventure sports in various plans | Some optional coverages increase the price |

| Efficient multilingual customer service . | Somewhat limited luggage loss cover in basic plans |

| No need to advance money in emergencies | Doesn’t cover travel cancellations on all plans |

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Chapka Seguros: Flexibility and focus on active travellers for Brazil

Chapka Insurance, founded in 2002 in France, is an insurer that has established itself as one of the best options for travellers looking for simple but effective cover. Its focus on adventure activities and extreme sports makes it ideal for those planning to explore Brazilian nature and beaches, from hiking in the Amazon rainforest to surfing in Florianópolis. In addition, it stands out for its customer service in different languages and its global support network, providing peace of mind even in the most remote areas.

Chapka offers various policies to suit the needs of travellers. Its most popular plan, Cap Trip Basic, covers the essentials for a safe holiday, while Cap Trip Plus includes extras such as trip cancellation and higher limits for medical expenses. These options are ideal for the different profiles of travellers visiting Brazil, a destination known for its geographical diversity and outdoor activities. In addition, their insurance policies include cover for sports such as diving and trekking, making them a very attractive option for the more adventurous.

Main policy coverages for Brazil:

- Medical expenses: Up to €250,000 ($1,350,000 R / $270,000 US).

- Repatriation: 100% included.

- Loss of baggage: Up to €800 (approximately $4,300 R / $ 865 US).

- Adventure sports: Included in all plans.

- Flight delays: Up to €150 ($800 R / $162 US) in the basic plan.

Plans and prices:

- Cap Trip Basic: €26.76 (approximately $145 R / $29 US) for 7 days.

- Cap Trip Plus: €35.59 (approximately $193 R / $39 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Coverage for adventure sports without any additional cost | Lower limit on medical expenses than other premium options |

| Competitive pricing for comprehensive coverage | Basic cancellation coverage is somewhat limited |

| 24/7 multilingual assistance | Less flexible customisation options |

InterMundial: Flexibility and personalised service for Brazil

InterMundial, founded in 1994 in Spain, is an insurer renowned for offering flexible plans to suit different types of travel. Its experience in the tourism sector makes it a reliable option for those looking for comprehensive cover without compromising on budget. Among its strong points are its customer service in different languages and the possibility of managing incidents quickly, either through its website or by telephone contact 24 hours a day.

InterMundial offers several plans ranging from the basics to more comprehensive options such as Totaltravel Premium, designed for those seeking maximum peace of mind in destinations such as Brazil. This insurance includes comprehensive medical cover and protection in the event of travel cancellations, flight delays or lost luggage. It’s an ideal alternative for visitors to Brazil, especially those planning a variety of activities in its large cities or natural surroundings.

Main policy coverages for Brazil:

- Medical expenses: Up to €1,000,000 (approximately 5,400,000 R / $1,080,000 US) in the Premium plan.

- Repatriation: Unlimited on all plans.

- Luggage loss: Up to €2,500 (approximately $13,500 R / $ 2,703 US).

- Trip cancellation: Optional on all plans, with compensation of up to €2,500 ($ 15,744.32 R / $2,675.63 US).

- Liability: Up to €100,000 ($540,000 R / $108,000 US) in advanced plans.

Plans and prices:

- TotalTravel Mini: €33.31 (approximately $180 R/ $36 US) for 7 days.

- TotalTravel: €41.74 (approximately $225 R / $46 US) for 7 days.

- Totaltravel Premium: €65.78 (approximately $335 R / $72 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Comprehensive medical coverage in superior plans. | Adventure sports are not included in basic plans |

| 24/7 multilingual assistance | Higher costs for premium plans |

| Flexibility in cancellation and rescheduling | Limited loss of luggage cover in basic plans |

AXA Assistance: Global care and premium service for Brazil

With a history dating back to 1958, AXA Assistance is one of the world’s leading insurers. Renowned for its focus on quality of service, this French company offers a global assistance network that guarantees coverage anywhere in the world, including Brazil. Its personalised attention and rapid response in medical emergencies are some of its main attractions.

AXA Assistance has a range of policies, from the basic Mini Insuranceplan, ideal for short trips, to Total Plus Insurance, which covers everything from comprehensive medical expenses to lost luggage and cancellations. Its flexibility and additional options, such as coverage for adventure sports, make it a suitable choice for those seeking peace of mind during their trip to Brazil.

Main policy coverages for Brazil:

- Medical expenses: Up to €150,000 (approximately $810,00 R / $162,000 US).

- Repatriation: Unlimited on all plans.

- Luggage loss: Up to €1,500 (approximately $8,100 R / $1,622 US).

- Adventure sports: Additional option for €33.61 ($211.79 R / $35.98 US).

- Civil liability: Up to €30,000 (approximately $162,000 R / $32,000 US).

Plans and prices:

- Mini Insurance: €37.65 (approximately $203 R / $41 US) for 7 days.

- Total Insurance: €58.07 (approximately $313 R / $63 US) for 7 days.

- Total Plus Insurance: €80.28 (approximately $432 R / $87 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Extensive global assistance network | Lower basic medical coverage than in premium options |

| Customisable plans | Adventure sports require an additional cost |

| Excellent coverage in emergencies | More affordable prices compared to other insurers |

HeyMondo: Innovation and convenience for travellers to Brazil

HeyMondo is a young and innovative insurer that combines technology and personalised service to offer a hassle-free experience. Its mobile app, which allows incidents to be managed in real time, is one of its main attractions. In addition, the company stands out for its focus on international travel, offering coverage tailored to destinations such as Brazil.

Its plans include the Essential Travel, ideal for those looking for basic cover, and the Premium Travel, which includes extensive medical cover and protection for adventure sports. Its digital approach and 24/7 service in English make HeyMondo a practical option for those looking for convenience during their stay in Brazil.

Main policy coverages for Brazil:

- Medical expenses: Up to €10,000,000 (approximately $54,000,000,000 R / $10,800,000 US) in the Premium Travel plan.

- Repatriation: Unlimited on all plans.

- Luggage loss: Up to €3,500 (approximately $18,900 R / $ 3,778 US) on the Premium plan.

- Adventure sports: Included in all advanced plans.

- Civil liability: Up to €60,000 (approximately $324,000 R / $65,000 US).

Plans and prices:

- Essential Travel: €30.55 (approximately $165 R / $33 US) for 7 days.

- Ease of Mind Travel: €35.59 (approximately $193 R / $39 US) for 7 days.

- Top Travel: €57.18 (approximately $311 R /$63 US) for 7 days.

- Premium Travel: €76.01 (approximately $414 R / $82 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Mobile app to manage incidents quickly | High price for superior plans |

| Full medical cover and sports included | Limited coverage for flight delay compensation |

| 24/7 multilingual assistance | Doesn’t include specific extreme activities |

Which is the best travel insurance for Brazil?

Still have doubts? If you need a little more help, you should know that after taking a closer look at the major insurers and their policies for Brazil, there seems to be one that stands out from the rest. That is IATI. Its coverages are tailored to the needs of travellers visiting a destination as diverse and complex as Brazil. This is attested to by the thousands of adventurers who have already hired their services to visit places such as the Iguassu Falls or the Lençóis Maranhenses National Park. On its own website, the insurer recommends the IATI Estrella plan as the ideal choice for travellers to the South American country. It’s the best in terms of its balance between cost and coverage.

One of the main reasons why IATI Estrella is the best choice is its medical coverage, which is up to €1,000,000 ($5,400,000 R / $1,080,000 US). This is especially relevant in Brazil, where access to private healthcare can be costly and necessary for tourists. This insurance includes medical expenses for accidents and illnesses, including epidemiological outbreaks such as dengue, zika or chikungunya, which are common concerns in several regions of the country. In addition, you won’t have to advance money for medical treatment, a key advantage to avoid mishaps during the trip.

It’s also notable for including adventure sports, which is essential if you plan activities such as hiking in the Amazon, surfing on the beaches of Florianopolis or trekking the Iguazu Falls. IATI Estrella also covers 100% repatriation, a crucial service if you need assistance in serious emergencies or transfers from remote areas.

Another strong point of this policy is the protection for lost or stolen luggage, with coverage of up to $13,500 R ($2,703 US). This is especially useful for those travelling with specialised equipment or valuables. In addition, 24-hour customer service in English ensures that you can resolve any issues quickly and effectively, no matter where you are in Brazil.

With this overview of what the most popular insurers have to offer, we think you’re one step closer to enjoying your trip to Brazil with peace of mind. Still not sure about your destination? Check out our guides about travel insurance for Cuba or for insuring yourself in other destinations such as the UK.

Language

Language

No results found

No results found