Best expat health insurance for Peru

If you’re a foreigner, health insurance in Peru will help you travel safely and avoid high medical care costs.

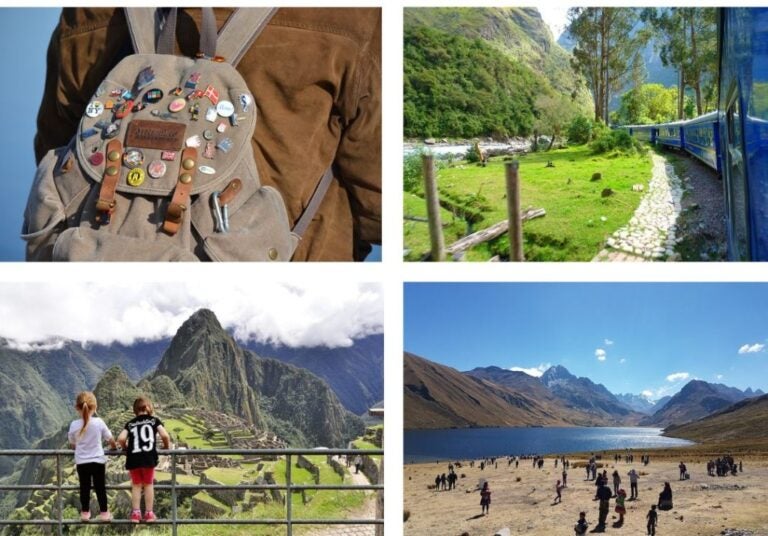

Peru is a jewel of South America. This country, famous for the Inca city of Machu Picchu, holds countless treasures to discover: A vibrant capital, beautiful beaches on the Pacific coast, endless archaeological sites (Kuelap, Choquequirao, Ollantaytambo, Pisac, etc.), and towns immersed in the Andes and the Amazon rainforest. It also surprises with its tasty gastronomy and, above all, with the kindness and warmth of the locals, always welcoming to travellers. Therefore, spending time exploring the country’s wonders is an excellent idea. If it’s already on your list, gettingan expat health insurance in Peru will help you enjoy its attractions with peace of mind, knowing you’ll be covered against any accident or health issue.

Peru has a good healthcare system, with both public and private options available for residents and foreigners. For visitors, accessing private clinics and hospitals ensures faster, higher-quality care compared to the public sector. Of course, this comes at a cost, often high (depending on the type of treatment required). That’s why having health insurance guarantees access to these services without paying large sums out of pocket.

That said, today we’ll help you choose the best health insurance to travel to Peru. We’ll analyse different options, including plans and prices, plus the advantages and disadvantages in each case.

Why get health insurance in Peru?

There are many reasons to invest in health insurance in Peru. From avoiding excessive medical costs to receiving assistance in remote areas (imagine falling ill in the Amazon), this type of coverage will save you a lot of stress.

Here are the main reasons to get health insurance in Peru:

- Care in remote areas: Public hospitals save you money but waiting times are long, which isn’t ideal for urgent cases.

- Care in remote areas: Peru is vast, with deserts, the Andes and the Amazon. Exploring remote regions means limited healthcare. Insurance ensures access even in areas with basic facilities.

- Avoid unexpected expenses: medical costs can be very high for tourists, especially if you need emergency care, hospitalisation, or treatment for altitude sickness or stomach problems. Without insurance, you’d cover these costs yourself, which increases discomfort and leads to a poor travel experience.

- Medical evacuation: Nobody wants this, but in serious emergencies insurance covers repatriation or transfer to better-equipped hospitals. This matters most in remote regions lacking specialised care.

- 24/7 assistance: Most travel insurances (especially international ones) provide round-the-clock help, giving peace of mind in emergencies.

- Adventure activity coverage: Peru is perfect for adventure lovers. Planning trekking in the Cordillera Blanca? Walking the Inca Trail to Machu Picchu? Diving? Insurance covering accidents during adventure sports ensures total peace of mind.

What foreigners need health insurance in Peru?

There are many reasons to visit Peru (tourism, business, work, studies, etc.). Any foreigner planning to stay should consider health insurance. Whether you’re a digital nomad, an expatriate or an exchange student, the benefits of healthcare coverage are significant.

Here’s a summary of the main foreigner profiles who should have health insurance in Peru:

1. Tourists:

As mentioned before, Peru is one of the most beautiful countries in South America, so thousands arrive every year drawn by its tourism. For this group, health insurance, even for a short period, is essential. While travelling, you’ll face risks like unexpected illnesses, accidents, food poisoning (common in some areas), or altitude sickness (especially in Cusco or Arequipa). Don’t forget that private healthcare is expensive, so investing in insurance helps you save money during unforeseen events. Money you can instead spend on excursions, guided tours, dining out, quad bike rides, shopping, and much more.

2. Digital nomads

You may travel to Peru planning to live in Lima, Cusco, Arequipa or another city while working remotely. The digital nomad lifestyle is ideal because it lets you discover new destinations without stopping work. In this case, you should also consider health insurance during your stay.

As a digital nomad you may spend months or even years in Peru, so at some point you’ll probably need medical care, not only for emergencies but also for regular check-ups, mild illnesses or chronic conditions.

Some nomads work for international companies that provide health insurance, but not always. If you don’t have coverage, you’ll need international health insurance to stay protected in Peru.

Want to become a digital nomad in Peru? Don’t miss this complete guide with valuable information.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 160 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

3. International students

Many foreigners travel to Peru to study, either at universities or language schools. This group also needs health insurance. Some institutions offer basic health services, but they don’t usually cover serious emergencies or complex illnesses.

4. Expat workers

Another group benefiting from health insurance in Peru are expatriates moving for work. Some may have coverage through local social security (like EsSalud) or private insurance from their employer. If that’s not your case, the smartest option is to buy health insurance.

This matters whether you work in cities like Lima or in rural or remote areas, where medical access is limited.

5. International volunteers

Did you know many international volunteers travel to Peru for humanitarian programmes? If you’re joining one, you’ll also need health insurance. These projects often take place in remote communities, like the Amazon or Peruvian Andes. Here, diseases such as dengue or Zika, as well as accidents, are common. Healthcare infrastructure is limited, so having insurance guarantees quality medical attention in case of emergency.

As you can see, regardless of your reason or length of stay, health insurance always guarantees peace of mind in Peru.

Health insurance in Peru: What are the options for foreigners?

You now know which foreigner profiles need health insurance in Peru. Let’s now see the types of insurance available, including both local and international options.

In general, health insurance for foreigners in Peru can be international or local. The choice depends on your stay length, the coverage you need and your personal situation. It’s not the same if you have a pre-existing condition like diabetes, or if you’re a young student in perfect health. Nor is it the same if you stay two weeks or several months. For short trips, travel or short-term health insurance is usually enough. But if you’ll live permanently or want wider coverage, international or expatriate insurance is the best choice.

Here are the types of health insurance useful for foreigners in Peru:

1. International health insurance

International health insurance is highly recommended for foreigners visiting Peru, since it offers global coverage (you’re protected abroad too). Expatriates, digital nomads, long-term tourists and international volunteers often choose these plans. Some well-known examples include: Allianz Care, Bupa Global, Cigna Global, and AXA PPP.

Main benefits:

- Wide coverage for emergencies, hospitalisation, surgery, medical visits and emergency repatriation.

- 24/7 assistance in multiple languages.

- Can include coverage for pre-existing conditions.

2. Travel health insurance

Travel health insurance is perfect for tourists and short-term visitors staying days or a few months. World Nomads, SafetyWing and Travel Guard are common choices. These policies focus on urgent medical needs, such as accidents or sudden illnesses (like food poisoning).

Main benefits:

- Access to both public and private hospitals in Peru.

- Includes medical repatriation for serious emergencies.

- Usually cheaper than international insurance, but with more limited coverage.

3. Local health insurance

This type of insurance is for residents and foreigners working in Peru, though some tourists choose it for cheaper coverage. It focuses on healthcare within the country, granting access to both public and private hospitals.

Examples include Pacífico Seguros, Rimac Seguros, La Positiva. Main benefits:

- Access to consultations, treatments and hospitalisation in local hospitals and clinics.

- More affordable prices, though coverage abroad is limited.

4. Short-term health insurance

If you’ll stay briefly in Peru, as a tourist, digital nomad or remote worker, short-term insurance is a good choice. It offers similar coverage to travel insurance but often designed for slightly longer stays (a few months). This makes it an affordable option for those not planning long stays but wanting coverage for emergencies. Examples: IMG Global, Seven Corners, GeoBlue.

Main benefits:

- Access to urgent and emergency care.

- Covers illnesses and accidents during the policy’s duration.

- Cheaper than international insurance but with limited coverage.

5. Expatriate health insurance

Expat health insurance is similar to international plans, but designed for people moving permanently or semi-permanently to Peru.

It offers wider coverage than travel insurance, including urgent care, regular consultations, preventive services and sometimes pre-existing conditions (depending on the policy). Benefits include:

- Coverage in both international and local hospitals.

- Medical evacuation and repatriation.

- Access to healthcare in Peru and other countries.

Examples in this group: Allianz Care, Aetna, Cigna Global, Bupa Global.

How much do medical services cost in Peru?

Here’s a table with approximate prices of common medical services in Peru, expressed in dollars. Costs vary depending on the region, clinic or hospital, but this helps you understand the average expenses for medical care in the country.

| Medical Service | Approximate cost |

|---|---|

| Hospitalisation (per day) | $50-200 (€46-184) (depending on clinic quality and location) |

| General medical consultation | $20-50 (€18-46) (in private clinics) / $5-10 (€5-9) (in public hospitals) |

| Consultation with a specialist | $30-100 (€28-92) (depending on specialist and clinic) |

| Basic blood test | $10-30 (€9.50-28.60) |

| X-ray | $10-30 (€9.50-28.60) |

| Ultrasound | $30-70 (€28-64) |

| CT scan | $150-300 (€138-276) |

| Magnetic Resonance Imaging (RM) | $250-500 (€190-476) |

| Minor surgery (outpatient) | $300-1,000 (€476-950) |

| Emergency care | $50-150 (€46-138) (depending on clinic) |

| Dental consultation | $20-60 (€18-55) |

| Medication (basic) | $5-50 (€5-46) (depending on medicine) |

Medical service costs in Peru

Medical insurance to travel to Peru which one to choose?

By now it’s clear how important health insurance in Peru is. But with so many options available, which one should you choose?

First, evaluate your health needs, especially if you’re prone to illness or require treatment for chronic conditions. Then, plan how long you’ll stay in the country, since this also defines whether you’ll need broad or basic coverage. Finally, and just as important, set a budget for your insurance, keeping in mind that health and peace of mind are always priorities when travelling.

While choosing travel insurance in Peru is personal, here are five recommended options:

1. Allianz Care: The best health insurance in Peru

Allianz Care is one of the world’s biggest insurers, with international medical plans for professionals, students and families abroad. You can choose short-term cover (3–9 months) or an international plan if you’ll stay in Peru over 12 months.

Coverage is broad, including outpatient and inpatient care, emergencies, treatments, repatriation, maternity and more. Plans cost more than local insurance, but you’ll receive fast, quality care. Basic plans start at $75 (€70.90) per month, while more complete coverage costs around $450 (€425.70) monthly.

| Pros | Cons |

| Worldwide medical coverage, including Peru | Higher prices than local insurance |

| Access to a network of high-quality hospitals and clinics | Requires medical exams in some cases |

| 24/7 assistance | Not all plans cover pre-existing conditions |

| Options with coverage for pre-existing conditions and maternity |

Advantages and disadvantages of Allianz Care

2. Cigna Global

Cigna is another international insurer offering plans for expatriates, travellers and digital nomads. Its plans are flexible, letting you tailor coverage to your needs. Cigna has a wide hospital network in Peru and worldwide.

Plans include emergency care, medical repatriation, outpatient treatment, telemedicine, and sometimes pre-existing conditions (depending on plan). The cost of plans starts at $150 (€138) per month for the most basic coverage, and can reach $400 (€368) monthly. In this last case, you’ll have full coverage, including medical evacuation, serious illnesses, maternity, and mental health.

| Pros | Cons |

| Coverage inside and outside Peru | High prices for complete plans |

| Flexible and customisable plans | Pre-existing condition coverage limited in basic plans |

| Telemedicine included | Some claims involve bureaucracy |

| Good medical provider network in Peru |

Advantages and disadvantages of Cigna Global

3. AXA PPP Healthcare

AXA is another leading international insurer, with comprehensive health plans for travellers and expatriates. Its coverage includes access to private clinics and top-quality hospitals in Peru, from general consultations to complex treatments.

Prices vary: The Essential plan starts at $100 (€94.60) monthly and includes basic emergency and hospital care

| Pros | Cons |

| Large medical network in Peru and worldwide | High prices for complete plans |

| Strong support for expatriates, with multilingual services | Some plans include waiting periods for pre-existing conditions |

| Medical evacuation and repatriation in higher plans | Not the most affordable for short stays |

| Wide coverage for serious illnesses |

Advantages and disadvantages of AXXA

4. Pacífico Seguros

Pacífico Seguros is one of Peru’s largest insurers, with plans for residents and tourists. It’s a good choice if you’ll live in the country temporarily or permanently. Coverage includes general and specialised consultations, hospital care, emergencies, maternity, medicines, preventive healthcare and more.

Prices are lower than international insurance, with policies from $40 (€37.80) monthly to $120 (€113.50) for full coverage. It’s perfect for travellers on lower budgets who won’t leave Peru.

| Pros | Cons |

| More affordable than international insurance | Limited coverage abroad |

| Wide hospital and clinic network in Peru | Some plans lack international coverage |

| Coverage for pre-existing conditions (sometimes) | Plans less flexible than international ones |

| Option to add dental and optical cover |

Advantages and disadvantages of Pacífico Seguros

5. Rimac Seguros

Rimac Seguros is another large local provider in Peru, offering plans for residents and tourists. Coverage includes both public and private hospitals.

Costs are similar to Pacífico: Basic policies start at $30 (€28.40) monthly, while complete plans cost $100 (€94.60) per month.

| Pros | Cons |

| Affordable for residents and foreigners | Limited international coverage in basic plans |

| Private clinics and top hospitals in Peru | Not enough for expatriates needing full global cover |

| Some plans include international cover | Some require additional copayments |

| Good customer service |

Advantages and disadvantages of Rimac Seguros

Which is the best health insurance in Peru?

Now that you know some options, we’ll share which we believe is the best health insurance in Peru for foreigners. The answer is Allianz Care, and the reasons are many. First, the coverage in higher plans is truly extensive. This is a major advantage for expatriates, digital nomads or long-term tourists travelling beyond Peru, since you’ll access a worldwide network of quality hospitals and clinics.

If you have pre-existing conditions, higher plans cover serious illnesses and specialised treatments, something not all insurers provide. We also highlight their multilingual customer service (essential if you don’t speak Spanish) and their mobile app for fast, easy management.

In short, Allianz Care gives you the security you need to explore Peru’s wonders without worrying about paying huge sums for medical care.

If you’ll only stay in Peru for a limited time, or prefer a cheaper local option without international cover, Pacífico Seguros is an excellent choice. Its plans are more affordable and include a wide local network of quality hospitals and doctors.

Health insurance in Peru: Frequently asked questions

Yes, you can buy health insurance in Peru even if you already have insurance at home. Some international policies may include Peru, so you wouldn’t need a local one. Always compare both policies to see if one covers Peru internationally. In some cases, you can combine local and international insurance for broader protection.

If you’re a tourist in Peru with international insurance, you can usually use it in private hospitals or within the insurer’s network. Show your insurance card or policy number when receiving care. Some insurers also offer reimbursements if you pay upfront.

Health insurance isn’t mandatory for foreigners in Peru, but it’s the smartest choice. Emergencies can be costly, especially in private hospitals. Some visas or residence permits may also require proof of health insurance during your stay.

Generally, health insurance in Peru doesn’t cover pre-existing conditions, or only does so under conditions. Some insurers allow including them if declared during sign-up, but they may impose a waiting period. Some international policies offer more flexible cover for pre-existing conditions, usually at higher cost.

If you don’t have insurance in Peru and need urgent care, you can use public hospitals. However, costs are higher for foreigners and you must pay directly. Private hospitals are also available but are expensive. Having health insurance can save you a significant amount of money and provide access to quality care.

Language

Language

No results found

No results found