Financial planning for international students

A fun, simple guide to financial planning. Learn how to budget abroad, save money, avoid debt, and stay on top of your finances.

So, you’re heading abroad to study? Amazing. New country, new food, new friends…and unfortunately, a whole lot of new expenses. If you’ve ever watched your money disappear faster than your phone battery on a night out, you already know why financial planning is essential.

When you study in another country, literally everything changes — the currency, the cost of a coffee, the price of a bus ride, even how banks work. And unexpected expenses? Oh, they love to show up uninvited. But don’t panic. Once you understand the importance of financial planning, you’ll feel way more confident and in control. Think of this as your cheat sheet to staying organised, stress-free, and financially sane while studying abroad.

Why financial planning matters for international students

While studying abroad is awesome, it’s not cheap. Here’s why planning ahead is non-negotiable.

Cultural adjustments = different spending habits

Prices might surprise you. Maybe groceries are double what you expected. Maybe public transport is way cheaper. Either way, without a budget, it’s easy to overspend in the first week.

Aside from tuition, you’ll deal with:

- Visa costs

- Housing deposits

- Transportation passes

- Insurance payments

- Academic materials

It adds up fast.

Money stress is distracting. A proper financial plan means you can focus on your classes, not your bank balance.

How to build a budget as an international student

A budget isn’t just for “responsible adults.” It’s your blueprint for not going broke abroad — and it’s easier than you think.

1. Start with fixed expenses

These don’t change:

- Rent

- Utilities

- Insurance

- Transport pass

- Tuition instalments

Once you know these, you know what’s left to play with.

2. Then list your variable expenses

These can be flexible:

- Groceries

- Nights out

- Coffee (yes, it counts)

- Clothes

- Textbooks

3. Keep an eye on exchange rates

If your money comes from home, the exchange rate can suddenly make your month more expensive — or cheaper. Track it through your bank app so you don’t get surprised.

4. Use apps that make budgeting…not boring

Try:

- Mint Intuit

- GoodBudget

- Your bank may also have an online budgeting tool

Most of them do the maths for you.

Essential financial tips for students studying abroad

Find here simple tricks that will save you money and stress.

Track every expense carefully

Look, no one wants to manually enter every purchase. But when you’re abroad, small expenses can snowball. A budgeting app or quick daily check-in helps you know where your money really goes (and where it shouldn’t have gone).

Open a local bank account or multi-currency account

You’ll avoid extra fees, get paid locally if you work, and pay local rates for things such as campus facilities, gyms, buses, and museums.

Understand the cost of living before you land

Do quick research on:

- Grocery prices

- Public transport

- Rent ranges

- Healthcare

- Study materials

This stops you from arriving and thinking: “Wait…this is how much milk costs here?!”

Use student discounts everywhere

Transport, clothing shops, cafés, cinemas, museums, software subscriptions…you name it. Flash that student ID like your life depends on it.

And, don’t forget to check out country-specific student deals:

- Best student discounts in the USA

- Student discounts in Australia

- Student discounts in Canada

- Best student discounts in the UK

Plan for emergency funds and unexpected costs

Life happens. Lost luggage, sudden travel changes, health appointments…an emergency fund keeps everything manageable. Even a small amount set aside helps a lot.

Avoid unnecessary debt

Credit cards abroad can be dangerous if you’re not careful. Interest hits harder than a deadline you forgot about. If you do use a credit card, set yourself strict limits.

Smart ways to save money while studying abroad and make financial planning a long-term habit

Cook at home or meal prep

Eating out is fun — until you check your bank balance. Cooking at home (or with roommates) saves serious money.

Take public transport (student passes = magic)

Most cities offer amazing student discounts. Use them!

Share accommodation

Rent is often your biggest expense, so splitting it makes a huge difference.

Go to free university events

Sports events, job fairs, workshops, movie nights — campuses are full of free stuff.

Buy second-hand or digital textbooks

Never buy new books unless you absolutely have to. There are cheaper alternatives everywhere.

Save money abroad and stay connected

Let’s be honest: Nothing drains your budget faster than surprise roaming fees. And when you’re abroad, you need reliable data — for maps, banking apps, communication, budgeting tools, literally everything.

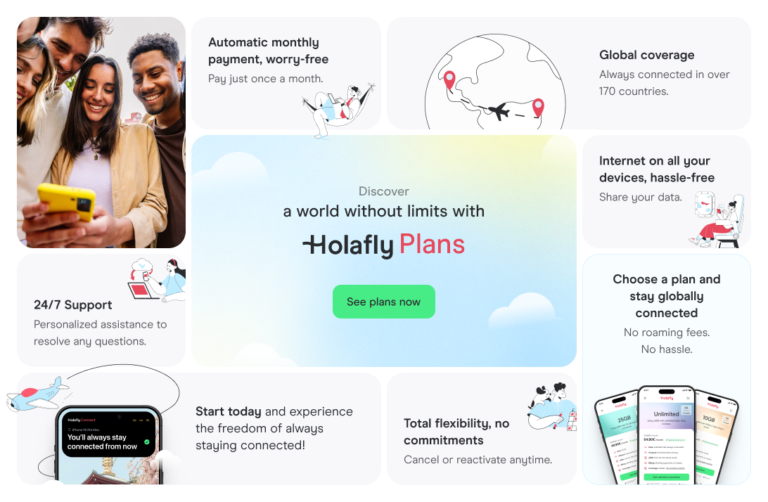

With Holafly, you get:

- Instant connection when you land.

- No roaming fees (ever).

- Unlimited data options.

- Regional, destination-based, and global plans.

- Monthly renewable plans.

Stay connected. Stay in control. Stay on budget.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 160 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Language

Language

No results found

No results found