How to make international business payments: 7 Secure ways to send money globally

A practical overview of international business payments for companies operating across borders.

According to McKinsey, the global business payments market is projected to reach $3 trillion by 2029.

International payments are essential for companies with global suppliers, customers, or employees. However, they’re burdened by high fees, currency conversion costs, slow processing, and compliance requirements.

Managing these payments also requires secure mobile access to banking platforms and payment systems, which is where business eSIM solutions like Holafly for Business help ensure uninterrupted financial operations.

This guide explains the primary international payment methods and outlines best practices for secure, cost-effective transactions.

What are international business payments?

International payments for businesses are cross-border money transfers between companies. They typically involve currency exchange and the movement of funds through international banking or payment networks.

Businesses use international payments to pay overseas suppliers, receive payments from global customers, process employee salaries, and purchase goods or services from foreign vendors.

These payments, however, are more complex than domestic business money transfers due to the use of multiple currencies, differing banking systems, varying regulatory requirements, and higher transaction and conversion fees.

How do international business payments work?

Overseas business payments begin when a company submits a transfer with the amount, recipient details, and chosen payment method.

If the transaction involves different currencies, a currency conversion is applied, often accompanied by additional fees or markup on the exchange rate. The payment is then routed through one or more intermediary banks, commonly using SWIFT codes and IBANs. During this stage, compliance checks such as AML (Anti-Money Laundering) and KYC (Know Your Customer) are performed.

Once approved, the funds are delivered to the recipient in their local currency, with processing times varying by method from same-day settlement to more than five business days.

7 ways to send money internationally for business

Businesses can send money internationally through various methods, each offering different trade-offs between speed, cost, and convenience. The right choice depends on your transaction size, frequency, currency needs, and whether you’re paying suppliers, employees, or customers.

1. International wire transfers (SWIFT)

International wire transfers move funds directly between banks using the SWIFT network, which connects more than 11,000 institutions across over 200 countries. Payments typically take one to five business days and cost between $15 and $50 or more per transaction.

This method is best suited for large, one-time, high-value transfers. Wire transfers are secure, widely accepted, and reliable, but they are often slow, expensive, and subject to unfavorable exchange rate markups.

2. ACH transfers

ACH transfers are electronic payments that are processed through automated clearing systems, mainly in US dollars.

Typically, these transactions settle in one to three business days and incur a fee of between $0.50 and $3 per transfer. This method is particularly well-suited for regular payments, such as payroll. While ACH transfers are both reliable and cost-effective, they tend to be slower than some other options and have a limited international reach.

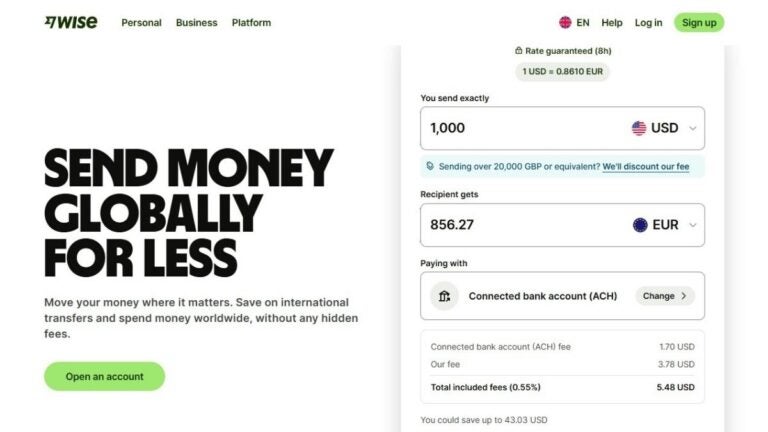

3. International payment platforms (Wise, Payoneer)

Specialized payment platforms such as Wise and Payoneer provide businesses with multi-currency accounts designed for cross-border transactions. Payments typically settle within one to two business days, with costs ranging from 0.5% to 2% using mid-market exchange rates.

These platforms are well-suited for small and mid-sized businesses making regular international payments. They offer low fees, favorable exchange rates, and straightforward account management. Still, transaction limits or account restrictions may apply.

4. Payment gateways (Stripe, PayPal)

Payment gateways, such as Stripe and PayPal, enable businesses to accept card payments and digital wallet transactions in multiple currencies. Transactions are processed instantly or within one business day, with fees typically ranging from 2.9% to 3.5%, in addition to a fixed charge.

This option is best suited for e-commerce and online customer payments. Both Stripe and PayPal offer easy integration, fast processing, and fraud protection. Still, the percentage-based fees are higher than most bank or platform-based methods.

5. SEPA transfers

SEPA transfers enable euro payments across 36 European countries through a standardized banking framework. Most transactions settle within one business day and are either free or carry low fees.

This method is best suited for euro payments within the European Union.

SEPA transfers are fast, low-cost, and consistent across participating countries, but are limited to Europe and the euro currency.

6. Letters of credit

A letter of credit is a bank-issued guarantee that payment will be released upon the seller meeting the agreed-upon contract terms. Processing time varies by transaction and institution, while costs typically range from 0.75% to 1.5% of the transaction value.

Letters of credit are best suited for large trade transactions or dealings with new suppliers. They reduce payment risk for both parties, but they require complex documentation and involve slower settlement compared to direct payment methods.

7. Multi-currency accounts

Multi-currency accounts allow businesses to hold, receive, and send multiple currencies from a single account. Transfers are often instant or completed within one business day, with low monthly account fees.

This option is best suited for companies that handle regular multi-currency transactions.

Such accounts reduce the need for repeated currency conversions and offer more favorable exchange rates, but some providers require minimum balances or account thresholds.

Note: Companies choosing a multi-currency account should evaluate the best business bank account for international payments based on the supported currencies, fees, and balance requirements.

Best practices for international business payments

Effective international payment management requires careful planning, compliance awareness, and attention to cost structures.

- Understand all costs, including transaction fees, currency conversion fees, intermediary charges, and exchange rate markups.

- Compare exchange rates carefully, as banks often apply markups of 3–5%, while specialized platforms offer more transparent pricing.

- Choose the correct payment method based on transaction size, using wire transfers for large one-time payments and platforms for smaller, recurring transfers.

- Ensure compliance by understanding applicable AML and KYC regulations, as well as country-specific requirements.

- Verify recipient details by checking SWIFT codes, IBANs, and account information to ensure accurate fund transfers.

- Use secure platforms that offer encryption, two-factor authentication, and fraud monitoring.

- Keep detailed payment records for accounting, tax reporting, and audit purposes.

- Plan for processing times by accounting for weekends, holidays, and potential compliance delays.

Common challenges and solutions

The table below outlines the most common challenges associated with international business payments and suggests how to address them.

| Challenge | Description | Solution |

|---|---|---|

| High fees | Traditional banks often charge $25–50 or more per transfer. | Utilize specialized payment platforms that offer transparent fees. |

| Slow processing | Bank transfers typically take 3–5 business days to settle. | Use faster payment platforms or SEPA transfers where available. |

| Exchange rate risk | Currency rates can fluctuate between the time of payment initiation and completion. | Use forward contracts or hold funds in foreign currency accounts to mitigate currency risk. |

| Regulatory complexity | Different countries impose varying compliance requirements. | Work with providers that handle AML and KYC compliance. |

Support your business’ international payments with secure mobile access

International business payments require secure, reliable access to banking apps, payment platforms, and financial systems. When approving urgent transfers, verifying transactions, or coordinating with suppliers across time zones, your team needs dependable mobile data without connectivity gaps or expensive roaming charges.

Holafly for Business provides reliable 4G/5G coverage in 160+ destinations, enabling your finance team to approve time-sensitive payments, use VPNs for secure banking access, and communicate with suppliers without interruption.

Manage everything through the Holafly Business Center, deploy business eSIMs instantly, eliminate roaming charges, and maintain a consistent connection for critical financial operations. Holafly Business Plans offer scalable solutions with no long-term contracts.

Request a demo to see how Holafly keeps your international payment operations secure and connected.

Disclaimer: The information provided in this article is for informational purposes and reflects research conducted on 15 January 2026.

Language

Language

No results found

No results found