Taxes in the UK for digital nomads: All you need to know

We help you understand how the UK digital nomad taxes work so you don't miss out on any of your tax obligations.

Are you going for the full UK experience but have no idea whether or not you’re taxed as a digital nomad in the UK? Better check this post and find out what are the digital nomad taxes in the UK: How much you’ve to pay, how to calculate them and if you’re exempt from any of them. Make sure you don’t overlook your tax obligations during your stay in this European nation, at Holafly we’ll guide you.

How do taxes work for a digital nomad?

Each country has its own rules, but in general digital nomad taxes in the UK and most are directly linked to:

- Tax residency: If you reside in a country for more than 183 days a year, you’re likely to be considered tax resident there.

- Global income: As a tax resident, you may be taxed on all your income, no matter where it’s generated.

- Double taxation treaties: Countries that have agreements to prevent you from paying tax twice on the same income.

Your tax situation can be as changeable as your travel destinations. In our article on taxation for digital nomads you can read more about this topic.

Which law governs taxation for digital nomads in the UK?

In the UK, digital nomads don’t have a special tax law, but if they live there, they must follow the same tax rules as everyone else. This includes paying taxes on what they earn, VAT (a tax on goods and services) and other taxes that may apply.

In the United Kingdom, His Majesty’s Revenue and Customs (HMRC) is the government agency responsible for collecting taxes, paying benefits and enforcing tax laws. It ensures that individuals and companies pay the taxes due to them as well as overseeing customs, social security and tax refunds.

Conditions for starting to pay tax in the UK

As we said at the beginning of this post, your tax obligations as a digital nomad are determined primarily by your tax residency, and in the UK you’re one if you spend more than 183 days in the territory during a year. In addition, if you derive income from sources within the UK, you may be subject to local taxation, even if you aren’t a tax resident.

For example, if you’re a freelance web developer who resides less than 183 days a year in the UK, you aren’t considered a tax resident, but you decide to take on a project for a UK company for which you receive remuneration. This income is by its nature generated within the UK and is therefore subject to Non-Resident Income Tax (NRI). In this case, you’ll have to declare and pay tax in the UK on that specific income, regardless of your tax residence.

Visa types and tax implications for a digital nomad in the UK

Although there’s no specific visa for digital nomads in the UK, the following options are the most viable for this lifestyle. Find out how they affect your tax returns:

1. Standard Visitor Visa

- Duration: Allows stay of up to six months.

- Permitted activities: it isn’t permitted to work for UK companies, but there are no explicit restrictions on remote working for foreign companies.

- Tax implications: If you stay in the UK for less than 183 days in a tax year and your income is derived exclusively from a foreign company, you won’t be considered tax resident and won’t be subject to UK income tax.

2. Innovator Visa

- Duration: Valid for three years, with the possibility of extension.

- Permitted activities: Setting up or running a business in the UK. It requires the presentation of an innovative business idea and the backing of an authorised entity.

- Tax implications: By residing and operating a business in the UK, you’ll be considered a tax resident and will be subject to tax on your global income.

In short, with the Standard Visitor Visa, if you stay for less than 183 days and don’t generate income in the UK, you wouldn’t be liable to pay tax in the UK. On the other hand, with the Innovator Visa, by residing and operating a business in the UK, you’d have tax obligations.

How much should I pay in taxes in the UK?

As a digital nomad in the UK, the taxes you may be subject to depend on a number of factors, such as the length of your stay, the source of your income and your tax residency. We explain in simple terms the taxes you could face:

1. Income tax

- If you work for an overseas company and you don’t have a UK business, but you’re tax resident, you’ll pay tax on that income at standard rates.

- If you’re a non-tax resident and only work for a foreign company, you’d generally not be subject to this tax.

| Exempt (without tax) | The first £12,570 ($15,000) you earn isn’t taxed. |

| Basic rate (20%) | From £12,571 to £50,270 ($15,000 to $63,000), you pay 20% tax. |

| Highest rate (40%) | From £50,271 to £150,000 (about $63,000 to $187,500), you pay 40%. |

| Extra rate (45%) | If you earn more than £150,000 (more than $187,500), you pay 45%. |

2. Capital Gains Tax

If you’re a digital nomad and decide to sell assets, such as shares or property, you may be subject to this tax if you make a profit on those sales, if you’re a UK tax resident. If you aren’t and have no assets within the UK, you’d probably not be subject to this tax.

- Basic fare: 10 % on profits.

- High rate: 20 % on profits.

3. Dividend Tax

If you’re a shareholder of a company and receive dividends (profits distributed to shareholders), you’d be taxed on that income, even if you work remotely for a foreign company.

- If you’re UK tax resident, you’d pay tax on the dividends you receive, but if you aren’t tax resident, you wouldn’t pay tax in the UK.

| Exempt (without tax) | The first £2,000 is exempt. |

| Basic rate | 7.5% on dividends exceeding £2,000 ($2,585). |

| Highest rate | 32.5% on dividends exceeding £2,000 ($2,585). |

| Extra rate (45%) | 38.1% on dividends exceeding £2,000 ($2,585). |

4. Value Added Tax (VAT)

This tax doesn’t affect a digital nomad working for a foreign company, but if you decide to sell products or services within the UK, you should register for VAT if your income exceeds the £85,000 ($106,250) threshold. The standard rate is 20%.

Tax benefits for digital nomads in the UK

Importantly, until April 2025 there’ll be a “non-domiciled” regime, which allows certain residents to be taxed only on income generated in the UK, i.e. full exemption for income generated abroad as long as there is no transfer to the UK.

The British government announced the abolition of this tax status, with the aim of raising around £2,700,000,000 a year (over $3,000,000,000) to finance tax reductions for British households. Thus, the closest thing to a tax benefit for digital nomads vanished. Travellers living and working from the UK must therefore follow the general UK tax system.

Double taxation and agreements with the UK

Double taxation occurs when an individual or company is taxed on the same income in more than one country. This can happen if you work in one country but live in another, or if you earn income from sources in different countries.

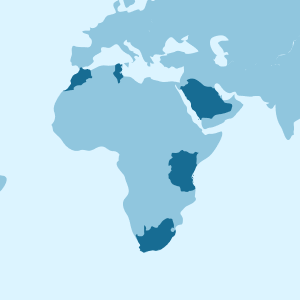

To avoid this, the UK has entered into agreements with a number of countries. These agreements determine in which country taxes must be paid on certain types of income and may allow for tax credits or exemptions.

Some of the countries with which the UK has double taxation treaties include:

- Spain

- Colombia

- Peru

- United States

- France

- Germany

- Italy

- Australia

- Canada

- South Africa

How to connect to the internet as a digital nomad in the UK?

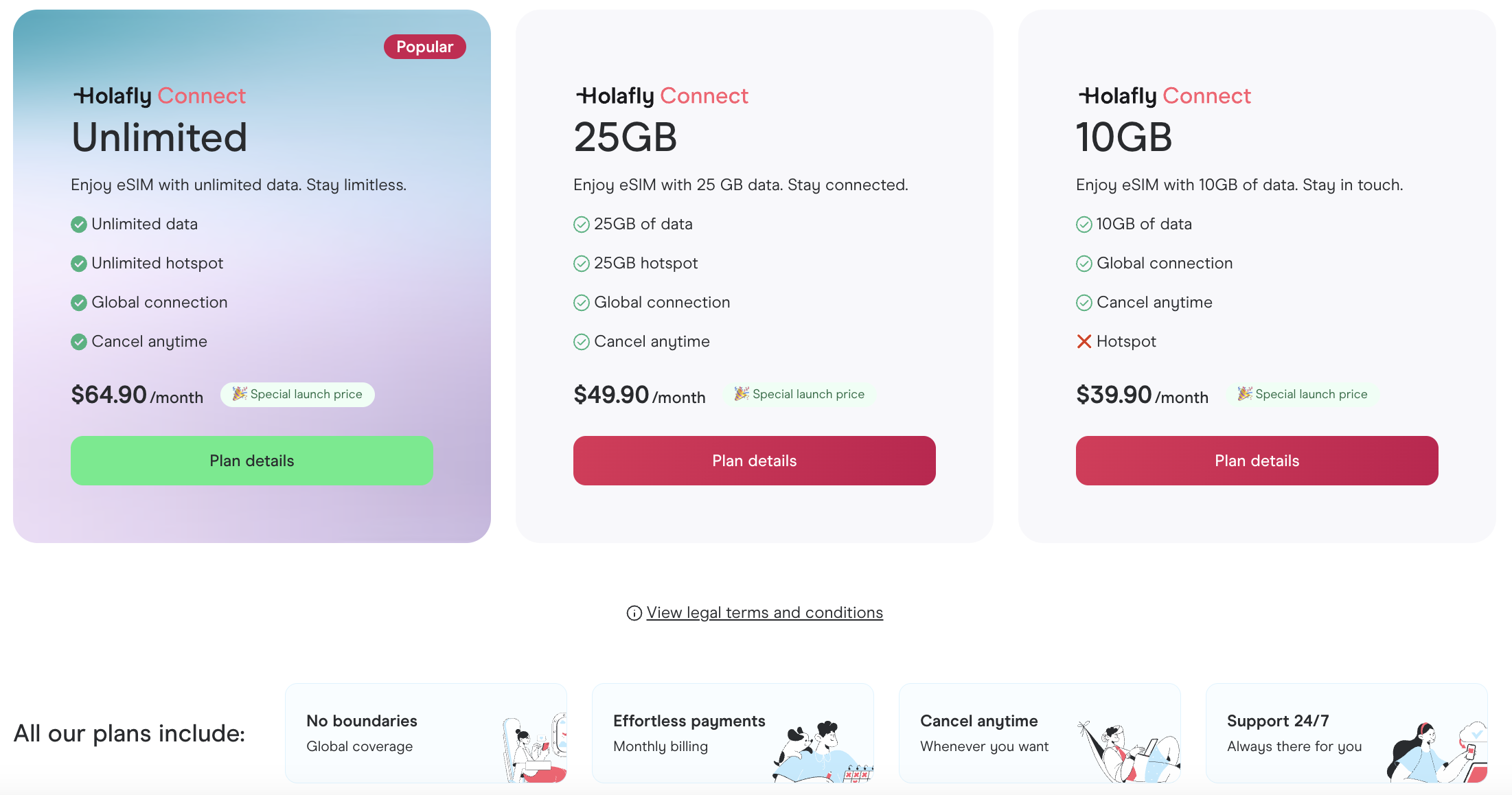

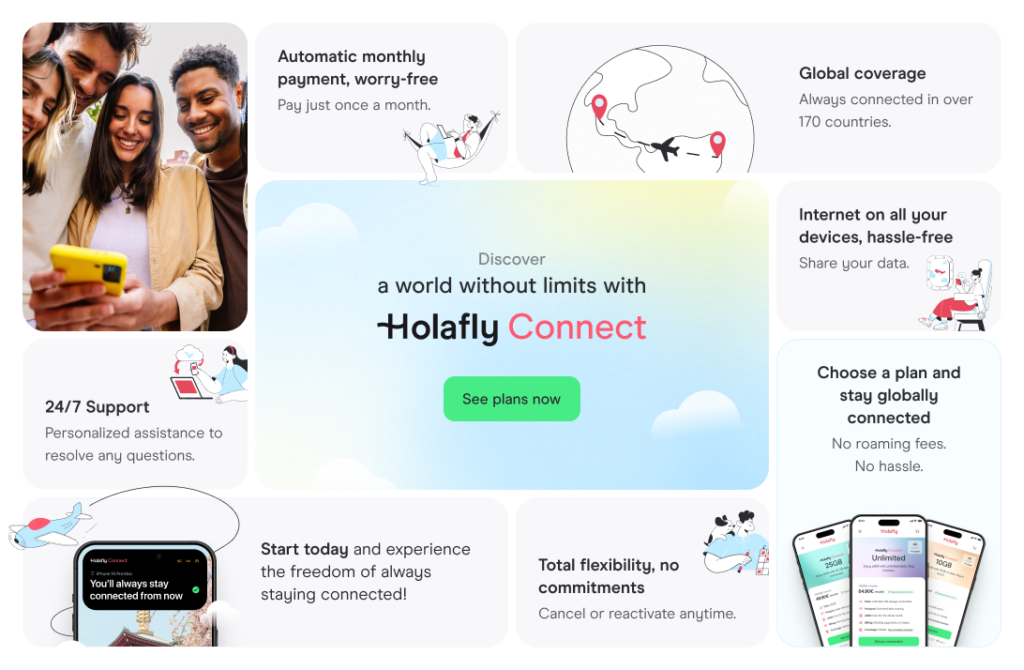

We know that for a digital nomad like you, being always connected is a challenge! So, to take the stress out of searching for W-ifi, local sims and top-ups, we bring you Holafly Connect‘s globally connected plans for surfing the UK and making your connection as free as your lifestyle.

Holafly Connect’ plans benefits:

- 30 days of connection: 10 GB, 25 GB AND unlimited GB plans.

- No roaming charges: No surprises on your bill. With Holafly, there are no additional roaming charges.

- Instant activation: Buy your virtual eSIM and activate it instantly. You’ll receive a QR code in your email so you can log in in seconds.

- Compatibility: Works on most eSIM compatible devices.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Personalised advice on taxes in the UK

Nobody wants tax surprises! If you’re a digital nomad in the UK, we know that dealing with HMRC can be as tricky as finding free Wi-Fi. But don’t worry, we’ll help you navigate the tax maze with these recommendations for personalised advice! Because the only thing you should be managing is your next trip, not your tax returns.

| Consultancy | Services | Contact |

| Taxd | Company and partnership tax returns. Services forboth resident and non-residentowners. Advice for expatriates and sole traders. Tax management for employees and LTD directors. Tools such as tax residency calculator, remittance basis, net salary, and pension expenses. | Web: www.taxd.co.uk. Telephone: 03333 050499. |

| RMS UK | Tax consultancy for individuals and businesses, including tax planning and tax compliance. | Web: www.rsmuk.com. |

| Caroola Accountancy | Complete management of accounting, advice on tax planning and compliance with tax obligations. | Web: www.caroola.com Telephone: 0333 034 2481. |

Frequently Asked Questions about taxes for digital nomads in the UK

Tax residency is based on the Statutory Residence Test (SRT), which assesses factors such as the number of days you spend in the UK, your personal and professional ties, and your history of residence in previous years.

You’ll mainly be subject to Income Tax, Dividend Tax (if you receive dividends from companies) and Capital Gains Tax if you sell assets. As a digital nomad, you shouldn’t have to worry about VAT, unless you sell products or services within the UK.

Non-Dom status allows certain UK residents not to pay tax on income earned outside the UK, provided they don’t bring it into the UK. This tax measure will cease to exist in April 2025.

Yes, if you’re a UK tax resident, your global income is subject to UK tax, regardless of the location of your employer.

The UK has double taxation treaties with a number of countries to avoid you paying tax in both places on the same income. These treaties can reduce or eliminate the obligation to pay tax in the country of origin of your income.

Pay

Pay  Language

Language  Currency

Currency

No results found

No results found