Taxes in Monaco: What You Need to Know for 2025

This small principality is a perfect tax haven for investment. Discover the taxes in Monaco and its tax benefits!

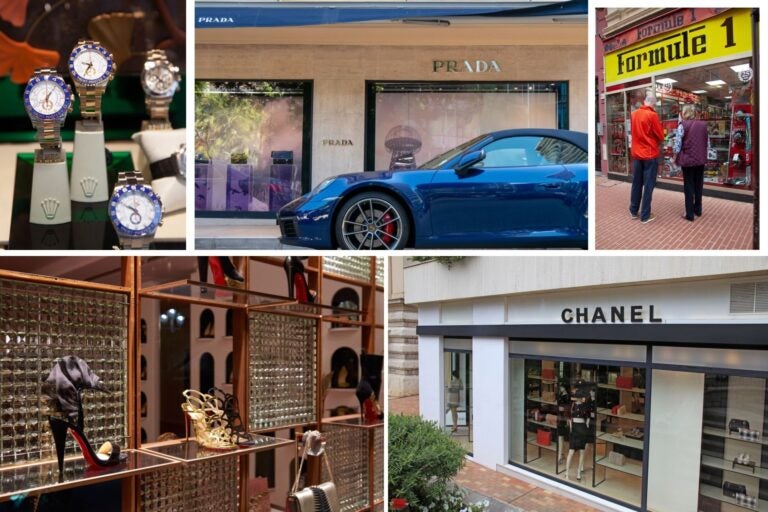

The Principality of Monaco is a small, independent state on the French Riviera, located between the Mediterranean Sea and the Alps. Known for its luxury and exclusivity, it attracts investors from around the world, thanks to its highly favorable tax system. This reputation has even earned it the label of a tax haven. Curious about the taxes in Monaco?

If you’re thinking about relocating to Monaco—whether for work, launching a business, or simply enjoying its lifestyle—it’s essential to understand the local tax system. Your obligations will depend on your financial and personal situation, but the good news is that Monaco is known for its highly attractive tax benefits. In this guide, we’ll explore the key taxes for both individuals and businesses, along with the main advantages of its fiscal policies.

Taxes for individuals in Monaco

Individuals are considered independent legal entities with rights and obligations based on their country of residence. This category includes employees, freelancers, digital nomads, students, and retirees who choose Monaco as their home, whether for work, study, or leisure.

Monaco offers significant tax advantages for this group, including no income tax, exemptions on VAT, inheritance and gift taxes, as well as minimal local fees. Here’s a closer look at these benefits:

1. Income tax

Monaco does not impose income tax on individuals, meaning residents are not required to report earnings, whether generated locally or abroad. This is a major advantage, especially compared to most European countries, where income tax is mandatory for all citizens.

The only exception applies to French citizens who move to Monaco but fail to prove to the French authorities that they are no longer tax residents in France. In that case, they must continue paying income tax under the French system, even while living in Monaco. This measure is designed to prevent individuals from using Monaco as a quick tax haven to avoid obligations in France.

2. Value added tax (VAT)

Monaco’s VAT system is administered by the Principality’s Tax Directorate, though it adheres to France’s rules, with a standard rate of 20%. This arrangement allows Monaco to benefit from a simplified tax system, as its small economy is closely connected to that of France.

These partnerships ensure the economic stability of the principality, its integration into the European framework, and facilitate trade and tax administration between both countries. Like in other countries, this tax is applied to goods and services purchased by consumers. Here are the rates:

- Standard rate: General VAT rate in Monaco of 20%, identical to that in France.

- Reduced rate of 10%: Applied to certain services such as hospitality and transport.

- Reduced rate of 5.5%: For certain commodities such as unprocessed foods.

- Super-reduced rate of 2.1%: For medicines and some specific publications.

3. Gift and inheritance tax

Monaco, like other European countries, also taxes donations and inheritances. However, the rates here are quite low and are determined based on the degree of kinship. Additionally, there are often exemptions for immediate family members.

- 0% rate: For transfers between ascendants, descendants and spouses.

- Rate of 8% to 16%: For other degrees of kinship, depending on proximity.

- Example: An inheritance of €100,000 ($103,296), between siblings, may be subject to an 8% rate, resulting in €8,000 ($8,263) of tax.

4. Indirect taxes and local fees

Since Monaco doesn’t have taxes on income or property, it relies on other forms of taxation, like indirect taxes and local fees. These help fund public services, maintain high-quality infrastructure, and keep the area attractive for both residents and visitors. Here are a few examples:

| Local rate | Details | Fee |

| Registry of a luxury car | Allows the car to be used within the principality and to obtain a Monegasque license plate. | For a sports car like a Ferrari this would be about €5,000 ($5,165). |

| Renewal of residence permit | Residence permits must be renewed, the fee depends on the number of years. | €200 ($207) for 1 year. €600 ($620) for 10 years. |

| Stay in a luxury hotel | A nightly rate is applied to encourage tourism in the principality. | For a room rate of €1,000 ($1,033) per night, a rate of €5 ($5.16) applies. |

5. Real estate taxes

Monaco doesn’t have annual property taxes, but there is a one-time fee of 6% on the property’s value when purchasing. For instance, if an apartment is priced at €2,000,000 ($2,065,280), the tax would be €120,000 ($123,951) at the time of purchase.

Taxes for legal entities or companies in Monaco

Monaco attracts over 300,000 tourists every year, making it an ideal location for businesses, especially those in the tourism and luxury sectors. Its proximity to countries like France, Spain, and Italy also means that many entrepreneurs travel regularly to the principality to oversee their ventures.

If that’s your situation, we suggest looking into Holafly’s new plans. They offer subscriptions starting from 10GB and 25GB, or even unlimited data, all with a global eSIM. This allows you to use your phone in any country, without the need to swap SIM cards.

While Monaco is well-known as a tax haven for investors and entrepreneurs, businesses and corporations must still comply with certain taxes. These taxes include those on profits earned within the principality, commercial properties, and activity registrations, among others.

1. Corporate income taxes

This tax mainly applies to companies that generate more than 25% of their profits from activities outside of Monaco. Businesses engaged in patented activities or industrial property rights must also pay this tax.

- Rate: 33.33% of the company’s net profits.

- Example: A company with an annual net profit of €1,000,000 ($1,032,930), whose main activity generates income abroad, will have to pay €333,330 ($344,309) in taxes.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

2. Corporate social contributions

In Monaco, companies or legal entities that employ people on contract must pay taxes through contributions deducted from their employees’ salaries. These contributions ensure workers receive benefits such as pensions, sick leave, unemployment, and social security. Here are the rates:

- Rate: Between 25% and 35% of each employee’s gross salary.

- Example: An employee with a gross salary of €4,000 per month ($4,131), the company will have to pay approximately €1,000 to €1,400 ($1,033 to $1,446) per month in social contributions.

3. Activity registration fee

In Monaco, businesses must also pay an activity registration fee. This annual fee is required for all companies operating in the principality. The amount typically depends on the business type, with most businesses paying around €500 ($516). For example, a marketing agency would need to pay this fee each year to keep its registration active.

4. Taxes on the transfer of commercial real estate

Businesses in Monaco that purchase real estate for commercial use, such as offices, stores, warehouses, or land, are subject to a transfer tax based on the purchase value. This tax is set at a fixed rate of 6%. For example, if a company buys an office for €2,000,000 ($2,065,680), it would pay €120,000 ($123,951) in transfer taxes.

Tax benefits in Monaco

As we’ve seen in previous sections, Monaco offers very favorable tax rates for both individuals and businesses. Despite the tax exemptions and low rates, the principality also offers several other tax incentives aimed at promoting business growth, creating jobs, and enhancing the services offered to tourists, who are a major source of revenue for the region. Here are a few examples:

| Tax benefits | Features |

| Income tax exemption | Companies generating income with activity within Monaco are exempt from this tax. |

| Tax stability | The principality has a very stable tax system, without major changes, providing greater security. |

| Facilities for startups and new businesses | Simplified procedures and institutional support for technological and innovative sectors. |

| Residency for entrepreneurs and key employees | Ease of obtaining residence permits for foreign entrepreneurs and important employees. |

Frequently asked questions about taxes in Monaco

Individuals in Monaco must pay VAT on the goods and services they purchase. Depending on their relationship to the person involved, they may also be subject to inheritance and gift taxes. When buying property, they will need to pay a 6% fee based on the property’s value at the time of purchase. However, they are exempt from income tax.

The 33.33% corporate tax rate only applies to businesses that earn more than 25% of their revenue outside of Monaco or through industrial property rights. Companies that operate solely within Monaco are exempt from this tax.

Yes, there is a value-added tax (VAT) system in place, similar to France’s, with a standard rate of 20%. This tax applies to most goods and services, although some essentials, such as food and medicine, are subject to reduced rates of 5.5% and 2.1%, respectively.

Foreigners who move to Monaco are generally exempt from income tax. The only exception is for French citizens, who remain subject to French tax laws unless they can prove they were fiscally resident outside of France before relocating to Monaco.

Monaco is often regarded as a tax haven due to its lack of income and wealth taxes. The principality also offers fiscal stability and a strong legal framework, making it an attractive place for both living and working with access to high-quality services.

In addition to VAT, businesses in Monaco are required to pay specific fees, such as a 6% tax on property transfers and annual administrative fees for registering business activities, which typically amount to around €500 ($516).

Language

Language

No results found

No results found