Taxes in Malta for digital nomads: All you need to know

Are you a digital nomad in Malta and want to know about taxes in this country? Stay and we'll tell you how its tax system works

Taxes for digital nomads in Malta depend on their annual earnings and residency status. This small country is a place where many teleworkers come to settle here for a season. The main reasons are the good climate, the crystal-clear beaches and the cost of living, which is much cheaper than in other European countries.

In this article we’ll answer all your questions about Maltese taxes for Travellers. We’ll see how they work, their laws, tariffs, tax benefits and where you can get advice to ensure that your stay in this island country is up to date with the payment of your tax obligations.

How do taxes work for a digital nomad?

Digital nomads in Malta must pay taxes subject to local tax laws if they spend more than 183 days a year in the country. If they exceed this number of days, they’re considered tax residents and are subject to Maltese taxes on the income they generate within the country. However, if you don’t reach this period of residence, you’ll be considered a non-resident. In this case you’ll only be taxed on income earned within Maltese territory.

In summary, a digital nomad’s tax liability in Malta depends on their residency status and the source of their income. To find out more about the general functioning of taxation for digital nomads, you can read our article: Taxes in Malta: What are they and how much do I have to pay?

Which law governs taxation for digital nomads in Malta?

The tax law, which regulates taxes for a digital nomad in Malta, is regulated by the general laws of the country. This law focuses mainly on income tax and tax residency regulations. If you’ve obtained the Nomad Residence Permit, you can be within a specific legal framework and not be considered a tax resident.

Income tax in Malta has a progressive scale that can vary between 15% and 35%, depending on income and tax residence. For nomads who qualify for the Nomad Residence Permit, they’ll only be taxed on income generated within the country, but not on their global earnings.

When do I have to start paying taxes in Malta?

From 2021, the Maltese government offers nomads a specific visa, which we have already mentioned in the previous section, called Nomad Residence Permit. This visa allows remote workers to live and work legally in the country without being subject to the global taxation of a full tax resident. It’s a permit designed for digital nomads whose income comes from foreign sources, but doesn’t allow paid work for Maltese companies. To maintain this exemption you must meet these conditions:

- Demonstrate foreign income: Your main source of income must not be related to economic activities in Malta.

- Don’t exceed 183 days of residence per tax year as a visitor: If you exceed this period and don’t have a visa, you’ll be considered a tax resident and will therefore have to declare your international income in the country.

In short, as long as you have an active visa and don’t exceed the residence threshold, you won’t be taxed on your foreign earnings. For more information, please visit our article: Malta Digital Nomad Visa: How to Apply and Qualify.

Tax benefits for digital nomads in Malta

The Maltese government has designed a series of tax benefits to reduce the tax burden for a digital nomad residing in Malta digital nomad residing in Malta. In this way, it encourages international talent to come to the country by offering them a competitive tax environment. Here are some of these tax advantages:

| Tax benefit | Features |

|---|---|

| Global income tax exemption. | With the Nomad Residence Permit, you’ll only be taxed on income generated in Malta. |

| Absence of wealth taxation. | Digital nomads with international investments won’t have to declare this wealth. |

| Double taxation avoidance agreements. | Malta has tax treaties with over 70 countries, ensuring that you don’t have to pay duplicate taxes on your foreign income. |

| Renewable and flexible visas | The Nomad Residence Permit is valid for an initial period of one year and can be renewed. |

How much should I pay in taxes in Malta?

As we’ve already seen in previous sections, the taxes for a digital nomad in Malta will depend on his type of residence and whether he’s a beneficiary of the nomad visa that the government has designed for this sector. Below, we outline the main taxes you should consider.

Income Tax

If you have the Nomad Residence Permit, you won’t be taxed on your global income, only on the income generated in Malta. For nomads who are considered tax resident in Malta, the income tax system is progressive in nature and rates range from 0% to 35% depending on income:

- 0% rate: Up to €9,100 ($9,475).

- 15% rate: From €9,101 to €14,500 (up to $15,100).

- 25% rate: From €14,501 to €19,500 (up to $62,400).

- 35% rate: For income over €19,501 (over $62,400).

Value Added Tax

If you’re a nomad providing digital services or selling products within Malta, you may be required to register for VAT. It’s a way of raising money through the consumer actions of citizens. The standard rate for this type of activity is 18%, although there are reduced rates for certain goods and services.

Social security contributions

Another tax that a digital nomad has to declare in Malta is the social security contributions that all employees are obliged to pay. It’s a way for the government to finance services to its citizens such as health care or pensions. These would be their rates, differentiating between employees and the self-employed:

- Employees: 0 % of monthly salary, maximum €50.93 per week ($53.03), in 2025.

- Self-employed: Between 15% and 23% of annual net income, depending on declared profits.

- Nomad Residence Permit: This obligation doesn’t apply to nomads on this visa, as it’s assumed that you continue to pay social security in your home country.

Double taxation and agreements with Malta

The Maltese government has double taxation treaties with more than 70 countries. With this type of agreement, it’s guaranteed that a digital nomad doesn’t have to pay tax in Malta and at home on the same income.

If you’re a tax resident in your home country, but reside and work in Malta, the bilateral treaty may prevent you from having to pay tax in both countries. Income earned in this country is deducted as a tax credit in your country of tax residence.

In order to benefit from this tax advantage, you have to apply for a certificate of tax residence in Malta if you’ve spent more than 183 days in Malta or if you have the Nomad Residence Permit. You’ll then have to submit the required documentation when filing your tax return in both tax systems.

Where can I get advice before paying taxes as a digital nomad in Malta?

As a digital nomad with taxes to pay in Malta, you can count on the help of companies specialising in foreign workers residing in Malta. In this way, you can be sure that you’ll comply with local regulations and you’ll be given solutions to make the most of the benefits available according to your personal and professional profile. Here are some consultancies dedicated to digital nomads:

| Consultancy | Description | Services |

|---|---|---|

| KPMG Malta | Specialised in tax consultancy for expatriates and international companies. | Tax planning, tax optimisation and assistance with double taxation treaties. |

| Credence Malta | It provides tax advice, business start-up and legal services for digital nomads. | Management of residence permits and tax obligations |

| CSB Group | They attend to clients remotely and in person. | Tax advice, company registration and residency procedures. |

| EY Malta | Globally recognised, specialising in tax and business consulting. | Solutions for digital nomads, including analysis of double taxation treaties. |

How to connect to the internet as a digital nomad in Malta.

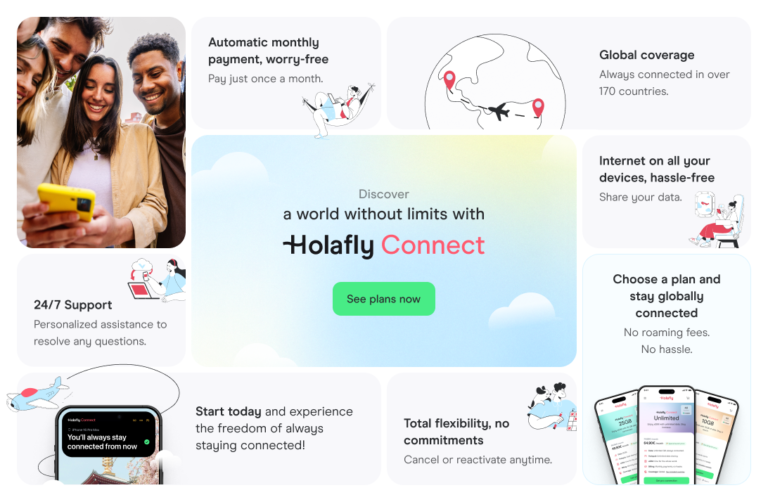

Nowadays, tax formalities can also be carried out online and a digital nomad can pay his taxes in Malta, telematically from any destination. That’s why we’d like to recommend the new Holafly Connect plans for Malta and other countries, allowing you to stay connected anytime, anywhere.

In particular, we’d like to talk about the Unlimited Plan, the most complete of all, suitable for digital nomads who travel frequently abroad or in the best cities of Malta best cities in Malta and who need to connect from several devices simultaneously. It guarantees you a constant connection with 5G speed and unlimited data for a monthly fee of €64.90 ($67.90).

With Holafly Connect you have a global eSIM valid in 170 destinations, with quick and easy activation via the app. All you need to do is download it before you travel and you’ll be connected as soon as you arrive at your destination – it’s that easy! Check out the other subscriptions available to you:

- 10 GB: For short trips or basic needs, for €39.90 per month ($40.93).

- 25 GB: Perfect for video calls and downloads, for €49.90 per month ($51.19).

- Unlimited: The best option for digital nomads, for €64.90 per month ($67.90).

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Real case: Paying taxes as a digital nomad in Malta

We want to tell you about Laura, a 34-year-old graphic designer from Spain who moved to Malta as a digital nomad to telecommute with her international clients. The first thing you had to do was to apply for your tax identification number (TIN) at the Malta Inland Revenue Department. This number is mandatory to pay taxes in the country:

- Form submitted: IRD1 – Application for Tax Identification Number.

- Where to file: At local IRD offices, but it is also possible to file online.

After staying in the country for more than 183 days a year, she was declared a tax resident, so as a digital nomad in Malta she had to pay her taxes globally. Thanks to the double taxation treaties, she didn’t have to pay tax on the same income in both countries by filing form DT1.

With annual earnings of €35,000 ($36,511), she was required to file his return using form FS3 and was taxed at a rate of 25% of his net income after allowable deductions.

In order to carry out the whole process, Laura was advised by a specialised nomad tax agency in Malta, to which she had to pay €250 euros ($260) for this service. It’s a small investment, but very important to know how the tax laws of this country work.

Frequently Asked Questions about taxes for digital nomad in Malta

Yes, if you stay in Malta for more than 183 days a year, then you’ll be considered a tax resident and will have to declare your global income, even if it comes from a foreign company. However, you can benefit from a double taxation treaty if your home country has an agreement with Malta.

Yes, if you’re self-employed in Malta, you’ll need to register for VAT, especially if you invoice local or EU businesses.

You must apply for a Tax Identification Number from the Inland Revenue Department. You’ll need a valid passport, proof of residence in Malta and documentation proving your employment or freelance activity.

Yes, Malta allows you to deduct certain expenses related to your professional activity, such as the rental of co-working spaces, technological equipment or tools necessary for your work.

Malta has double taxation treaties with more than 70 countries, including Spain, Italy, the UK and Germany. This allows you to avoid paying tax twice on the same income.

Language

Language

No results found

No results found