Thailand Digital Nomad Tax: Learn All about Thai Taxes

Paying taxes as a digital nomad in Thailand? Find out what are the tax responsibilities as a nomad in this country.

Do digital nomads have to pay taxes in Thailand? In this article, we’ll dive into a key question that many digital nomads ask before settling temporarily in Thailand: What taxes do I need to pay, and how can I meet my tax obligations? We’ll explain Thailand’s tax regulations, how taxes work for digital nomads, the laws that govern them, when you should start paying, and what potential tax benefits you might be able to take advantage of

We understand why Thailand is increasingly becoming a hotspot for digital nomads. The country has so much to offer, from its rich culture and world-famous landscapes, like Phuket Island, to vibrant cities such as Bangkok and Chiang Mai. On top of that, its affordable lifestyle is a major draw, with monthly living costs typically ranging between $1,000 and $2,000. If you’re a digital nomad considering making the move, this is essential information to keep in mind.

Do digital nomads pay taxes in Thailand?

Digital nomads are professionals who work remotely for companies based anywhere in the world. Because of the international nature of their work, tax regulations can differ depending on several factors, such as the length of their stay, the type of income they earn, and any tax agreements between their home country and the country where they are residing.

In Thailand, the general rule for tax residents is that you’re required to pay taxes on your global income if you live in the country for more than 180 days in a fiscal year. Thailand’s fiscal year aligns with the calendar year, running from January 1 to December 31. This means that if a digital nomad stays in Thailand for more than six months, the Thai government may classify them as a tax resident and require them to pay taxes on income earned both locally and abroad. However, if you stay in Thailand for less than 180 days, you won’t pay taxes on your foreign income unless you transfer it into the country.

Thailand uses a progressive tax system, meaning the higher your income, the higher the tax rate you’ll pay. For tax residents, rates range from 5% to 35%, depending on your annual income.

What law regulates digital nomad taxes in Thailand?

The Thai tax system is governed by the Thai Revenue Code. It outlines the rules for taxation on both individuals and businesses. These regulations apply to all tax residents and non-residents, including digital nomads who either stay in the country for more than 180 days or generate income locally.

The Thai government is working to modernize its tax laws to accommodate the growing number of remote workers choosing Thailand as their base. Although Thailand hasn’t designed a specific visa for digital nomads yet, the country offers several options that allow foreigners to live and work there temporarily. These include the Smart Visa and Business Visa, each with specific requirements.

In 2022, the Thai government announced plans to introduce clearer tax regulations for remote workers as their presence in the country continues to grow. Digital nomads considering a move to Thailand are advised to stay updated on any changes to tax policies or consult a tax advisor familiar with Thai regulations.

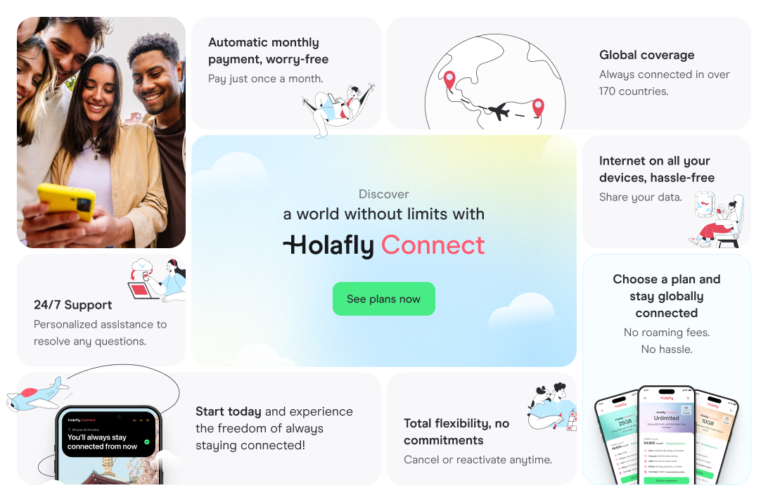

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

When should I start paying taxes as a digital nomad in Thailand?

Your tax obligations as a digital nomad in Thailand depend primarily on your residency status. If you stay in the country for more than 180 days in a fiscal year, you’ll be classified as a tax resident and will be required to pay taxes on your global income.

Visas for digital nomads in Thailand

Although Thailand doesn’t have a dedicated visa for digital nomads, there are several options that allow foreigners to work remotely from the country. The most popular choices include:

- Smart Visa. This visa was designed to attract professionals from key sectors such as technology and startups. While it isn’t specifically for digital nomads, it’s a great option for those working in certain fields who want to live in Thailand long-term without needing a traditional work visa.

- Business Visa (Non-Immigrant B). This visa targets individuals looking to start a business or work in Thailand. It’s a great option for freelancers and digital nomads working with Thai clients or planning to set up a company.

- Tourist visa. Some digital nomads opt for a tourist visa, which typically grants a stay of 30 to 60 days, depending on their country of origin. However, this is only a short-term option, as it doesn’t allow for extended stays or the establishment of legal tax residency.

Tax benefits for digital nomads in Thailand

Thailand doesn’t offer specific tax benefits for digital nomads. However, there are some incentives for those who qualify under certain visa programs, like the Smart Visa. This visa exempts highly skilled professionals from the work permit requirement. While it’s not a direct tax benefit, it can simplify things for digital nomads in fields like technology, engineering, and science.

Another advantage is that income earned outside of Thailand and not transferred into the country isn’t subject to taxation. This is especially helpful for digital nomads who choose to keep their money in overseas accounts while living in Thailand.

What type of taxes do digital nomads pay in Thailand?

Thailand has a progressive tax system, meaning taxes are based on your total income. For digital nomads who become tax residents in the country, tax rates range from 5% to 35%.

Here is a breakdown of the applicable tax rates according to the level of annual income in Thailand:

- Up to 150,000 THB: 0% (approximately $4,050 USD)

- From 150,001 to 300,000 THB: 5% (approximately $4,050 to $8,100 USD)

- From 300,001 to 500,000 THB: 10% (approximately $8,100 to $13,500 USD)

- From 500,001 to 750,000 THB: 15% (approximately $13,500 to $20,250 USD)

- From 750,001 to 1,000,000 THB: 20% (approximately $20,250 to $27,000 USD)

- From 1,000,001 to 2,000,000 THB: 25% (approximately $27,000 to $54,000 USD)

- From 2,000,001 to 5,000,000 THB: 30% (approximately $54,000 to $135,000 USD)

- More than 5,000,000 THB: 35% (more than $135,000 USD)

Digital nomads working for foreign companies or earning income from abroad will need to follow this tax structure if they are considered tax residents in Thailand. Additionally, there are indirect taxes like VAT (7%) on goods and services purchased within the country. However, this kind of tax doesn’t directly affect a digital nomad’s income.

Double taxation and agreements with Thailand for digital nomads

One of the main challenges digital nomads face when settling in a new country is double taxation. This happens when a person is required to pay taxes on their income in both their home country and the country where they are living or working. In Thailand, this is especially relevant for nomads who spend more than 180 days in the country each year.

What is double taxation?

Double taxation happens when two different countries tax the same income. For digital nomads, it can happen if they earn money working for companies based in their home country or elsewhere, while living in Thailand for an extended period. Without a treaty to avoid double taxation, the nomad may have to pay taxes in both Thailand and their home country, leading to a significant tax burden.

Double taxation treaties in Thailand

Luckily, Thailand has established double tax agreements with more than 60 countries. These agreements are designed to prevent citizens and residents from being taxed twice on the same income. They outline how tax obligations will be shared between the two countries, ensuring that income is only taxed once.

Countries that have a double taxation treaty with Thailand include:

- Spain

- Mexico

- Chile

- Argentina

- United Kingdom

- Germany

- United States

- France

- Canada

These treaties are a big advantage for digital nomads. If their home country has an agreement with Thailand, they may only need to pay taxes in one country. This will depend on their tax residency status and the details of the specific treaty.

How do double taxation treaties work?

Double tax treaties vary slightly from country to country, but they typically work in one of two ways:

- Tax exemption: In some cases, your home country may offer a tax exemption on income earned abroad. This means that if you’ve already paid taxes in Thailand, you won’t be taxed again on the same income back home.

- Tax credits: In other cases, your home country may grant a tax credit for the taxes you’ve paid in Thailand. Essentially, if you’ve already paid a certain percentage in Thailand, you could subtract that amount from the taxes you owe in your home country.

How to avoid double taxation?

To avoid double taxation as a digital nomad, it’s crucial to:

- Check if your home country has a double tax treaty with Thailand.

- Keep thorough records of your income and taxes paid in Thailand.

- Seek advice from a tax professional who specializes in international tax law to ensure compliance with regulations in both countries.

Benefits of the agreements

Double tax treaties offer peace of mind for digital nomads in Thailand. They prevent double taxation while promoting transparency and clarity about tax obligations. This allows nomads to work remotely without the stress of excessive tax burdens or unexpected surprises when filing taxes.

To sum it up, if you’re a digital nomad and your home country has a double tax agreement with Thailand, you can use these treaties to avoid paying taxes twice. It’s a good idea to consult with a tax professional to ensure you comply with all regulations, allowing you to enjoy your stay in Thailand without any concerns.

Where to seek advice before paying taxes as a digital nomad in Thailand?

To comply with Thailand’s tax regulations, it’s a good idea to seek specialized advice. Many companies and agencies in Thailand offer tax consulting services, and some of the most well-known ones include:

- Siam Legal: A law firm with offices across Thailand providing tax consultancy services for expatriates and digital nomads.

- Baker Tilly Thailand: Member of a global network of accountants and tax advisors, offering tax guidance to individuals and businesses.

- PWC Thailand: Tax planning, compliance and advisory services for foreign residents.

These companies offer services in English, helping digital nomads navigate Thai taxes. They ensure compliance with tax regulations, so you can avoid fines and penalties.

Frequently asked questions about taxes for digital nomads in Thailand

With the growing number of digital nomads in Thailand, there are also increasing questions about tax responsibilities and how to meet them. Here, we answer some of the most frequently asked questions digital nomads have about taxes in Thailand.

Your tax situation depends on the length of your stay in Thailand. If you stay for more than 180 days in a fiscal year, you’ll be considered a tax resident and will need to pay taxes on your global income, no matter where it’s earned. However, if you stay for a shorter period and don’t earn income within Thailand, you won’t have to pay taxes unless you transfer your income to a Thai bank account.

That said, if you work for foreign companies and don’t move the money to Thailand, you may not be subject to local taxes. However, each case should be carefully reviewed.

Digital nomads in Thailand may face several types of taxes, including:

Income tax. Income tax for tax residents is progressive, ranging from 0% for annual income below 150,000 THB to 35% for income exceeding 5,000,000 THB.

VAT (Value Added Tax). While not affecting income directly, digital nomads will have to pay 7% VAT on goods and services in the country.

For tax residents, taxes apply to all income, both local and global. However, for non-residents, only income earned within Thailand is subject to taxation.

If you’re paying taxes in your home country, Thailand may not tax you again on the same income, thanks to its double tax treaties with over 60 countries. These agreements help ensure that you’re not taxed twice on the same earnings, either in your home country or in Thailand, depending on your tax residency and the applicable rules.

Countries like Spain, the United States, the UK, Germany, Australia, France, and Canada have such treaties with Thailand. If your home country is one of them, you could avoid paying taxes twice. Just make sure you have documentation proving your tax residency and payments in your home country to present to Thai authorities.

There are several steps you will need to follow in order to comply with your tax obligations in Thailand:

Register with the tax authorities: If you stay in Thailand for over 180 days and become a tax resident, you’ll need to register with the Revenue Department to obtain a tax ID number.

Declare your global income: As a tax resident, you must report all income, including foreign earnings. You still need to declare foreign income, even though you won’t pay taxes on it unless you bring it into the country.

Filing tax returns: Tax returns are filed annually, with a typical deadline before March 31st. To make sure you meet the deadlines and submit accurate information, it’s a good idea to seek help from a tax advisor.

Although there is no specific tax regime for digital nomads, Thailand offers some incentives that may benefit these remote workers:

Exclusion of foreign income not transferred: Foreign income that isn’t transferred to Thailand is exempt from taxation. This can be particularly beneficial for digital nomads who prefer to keep their earnings in foreign accounts.

Exemptions under the Smart Visa: Qualifying for a Smart Visa may allow you to obtain some tax exemptions and benefits. This visa targets entrepreneurs, investors, and professionals in specific sectors such as technology and startups.

Language

Language

No results found

No results found