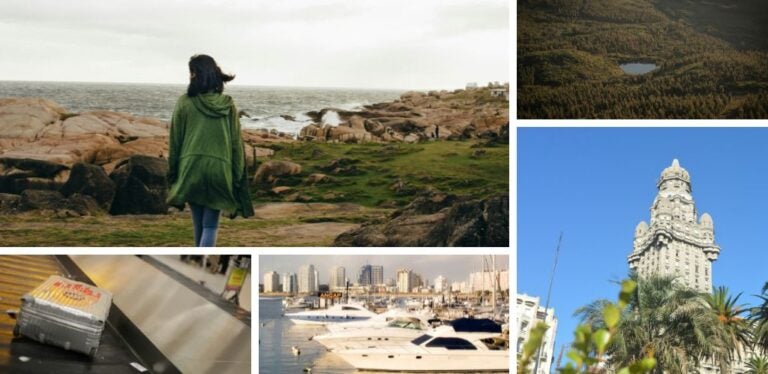

Travel Insurance for Uruguay: Our Top 5 Will Help You Pick One

Without travel insurance for Uruguay, you won’t be allowed entry. Explore the best options to ensure a safe and secure trip.

Besides being one of the most amazing countries in Latin America, Uruguay is also one of the safest. However, to fully enjoy it you should take some precautions. As in any other place in the world, you could have medical problems or incidents that could ruin your vacation. That is why today we bring you the solution to one of the biggest challenges you will face when preparing your trip: finding the best travel insurance for Uruguay.

We will review the coverage, advantages and rates of the most popular insurance companies in the market. The aim is that, when you arrive in Montevideo, Salto or any other place you are going to visit, your only concern is to enjoy its cuisine, its folklore and its many charms. Plus, you’ll meet a crucial entry requirement, as having medical coverage has been mandatory for all tourists visiting Uruguay for years.

Why purchase travel insurance for Uruguay?

For some years now, non-residents in Uruguay have been required to have insurance with medical coverage in order to enter the country. Upon arrival, you may be asked to provide proof that you have one. But beyond this requirement, having a policy is essential to protect your health and your pocket during your stay.

Uruguay has a modern and accessible health system, but it is not free for tourists. In case you have a health problem and have to go to a private clinic for a medical consultation, you would have to pay between $150 and $300. If things get bad and you need hospitalization, the bills could exceed $1,000 per day. Also, if you are in a rural area when you start to feel unwell, it will be very helpful to have your back covered by an insurer that is used to expediting procedures and has an extensive network of hospitals or clinics to contact.

Uruguay is a perfect destination for outdoor adventures, but medical mishaps can happen anywhere. If you have an accident during a sporting activity and require rescue or repatriation, the costs can quickly escalate to unaffordable levels for most travelers.

But medical problems are not the only thing you should worry about on a trip. What if your bags get left on the bus during an internal transfer. Or what if you miss a connection and therefore your flight home? Having travel insurance for Uruguay with compensation for delays, cancellations or lost luggage will help you avoid doubling your budget in case things go wrong and you have to book extra nights in a hotel or replace your personal belongings.

What should a travel insurance for Uruguay cover?

If travel insurance has never been a priority for you but you’ve discovered it’s a mandatory requirement for visiting Uruguay, you might feel overwhelmed by the various options and coverage differences. Don’t worry! The key is to choose your travel insurance based on the trip you’re planning, the type of traveler you are, and your specific needs. Here are some essential features you should look for in your travel insurance for Uruguay:

- Emergency medical care: As we said, Uruguay has an efficient health care system, but it is not free for tourists. A medical consultation in a private hospital costs between $150 and $300. A hospitalization can exceed $1,000 per day. Therefore, your insurance should cover at least $200,000 in medical expenses, including hospitalization, consultations and transfers in case of emergencies.

- Medical or death repatriation: A medical transfer from Uruguay to your country of origin can cost more than $50,000. Especially if it requires a medical aircraft. This coverage (which is included in almost all policies) ensures that, in serious situations, you will not have to worry about transportation costs or specialized assistance.

- Outdoor activities coverage: If you plan to enjoy the waves in Punta del Este, explore the dunes of Cabo Polonio or cycle along the coast, make sure your insurance includes protection for outdoor activities. Many standard policies do not cover sports or adventure-related injuries, so make sure this coverage is included.

- Lost or stolen luggage: Can you imagine arriving at Carrasco Airport and discovering that your suitcase has not arrived? This situation, although rare, can become a problem if you need to replace clothes, electronic devices or important documents. A good insurance will cover these expenses and help you manage the claim.

- Flight delays and cancellations: Connections from Uruguay to other destinations are efficient, but there is always the possibility of a delay or cancellation. Adequate insurance will reimburse you for additional expenses for accommodation, food or transportation.

- Legal assistance at destination: While Uruguay is considered a safe country, it’s always wise to be prepared for potential legal issues, like traffic accidents or rental disputes. Access to legal assistance can help you avoid unnecessary stress and extra costs.

- 24/7 support and digital support: The best insurers offer 24-hour assistance and mobile apps to handle emergencies at any time. Make sure it’s easy to get the help you need from your cell phone – remember to sign up for your Holafly eSIM so you can contact them at any time!

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Comparison of the best travel insurance for Uruguay

You already know that travel insurance is a must to enjoy Uruguay stress-free, and you’re familiar with the basic coverages your policy needs. But which provider should you choose? The options are vast, ranging from long-established companies to newer ones winning travelers over with innovative services. With so many choices, finding the perfect fit can feel overwhelming.

To make it easier for you, we have prepared a comparison table with the five best travel insurances for Uruguay in 2024. You will see more clearly the main coverages of each policy and their prices. It will be much easier for you to make a decision.

| Coverage | Chapka (CAP TRIP Basic) | HeyMondo (Travel Tranquility) | IATI (Backpacker) | AXA Assistance (Total) | Intermundial (Totaltravel mini) |

| Price (7 days) | 26.76 euros ($28.90) | 35.59 euros ($38.49) | 53.99 euros ($57) | 58.07 euros ($62.80) | 33.31 euros ($36.10) |

| Medical expenses | 250,000 euros ($269,946) | 600,000 euros ($648,837) | 500,000 euros ($540,697) | 150,000 euros ($162,209) | 300,000 euros ($325,083) |

| Repatriation | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Lost or stolen luggage | 800 euros ($865 dollars) | 1,500 euros ($1,622 dollars) | 1,500 euros ($1,622 dollars) | 1,500 euros ($1,622 dollars) | 1,500 euros ($1,622 dollars) |

| 24/7 support | Yes | Yes | Yes | Yes | Yes |

| Trip cancellation | Optional | Optional | Optional | Optional | Optional |

| Adventure sports coverage | Yes | Yes | Yes | Optional: Sports Insurance (33,61 euros) | No |

| Third party liability | 40,000 euros ($43,191). Franchise 150 euros ($162) | 60,000 euros ($64,883) | 60,000 euros ($64,883) | 30,000 euros ($32,441) | 50,000 euros ($54,180) |

| Flight delay compensation | At the beginning of the trip only, up to 150 euros ($162) | 300 euros ($324) | 270 euros ($291) | 150 euros ($162) | 150 euros ($162) |

The 5 best travel insurances for Uruguay

As you can see in the table above, the coverages and prices do not differ much from one insurer to another. They usually offer similar things. The biggest differences between some companies and others are in their response to emergencies, the ways in which you can communicate with them and the details of their services. Which one is the most suitable to hire your travel insurance to Uruguay? Let’s learn more about these five companies.

IATI

Founded in 1885, IATI is a Spanish insurance company very popular among all types of travelers. It stands out, especially, for its personalized attention in Spanish, available 24 hours a day. In addition, its mobile app allows you to manage incidents easily. You can report lost luggage, search for nearby hospitals or make online medical consultations through it. Users can also contact IATI via WhatsApp, email or telephone.

For those visiting Uruguay, IATI offers plans designed to suit different needs, from family trips to adventure getaways. If you plan to explore destinations such as Cabo Polonio or practice water sports in Punta del Este, the Backpacker plan is an excellent option as it includes coverage for risky sports and assistance in remote areas. In addition, all IATI plans guarantee medical repatriation and protection against common unforeseen events.

Main coverages:

- Medical expenses: From 100,000 euros (4,093,000 Uruguayan pesos, $108,000) up to 5,000,000 euros (204,650,000 Uruguayan pesos, $5,398,000) in the Star plan.

- Repatriation: 100% covered in all plans.

- Luggage loss or theft: 500 euros (20,465 Uruguayan pesos, $540) in the Basic plan and 2,500 euros (102,325 Uruguayan pesos, $2,700) in the Star plan.

- Adventure sports coverage: Included in the Backpacker plan. Activities such as rafting or canyoning require the “Premium Adventure” clause.

- Reimbursement for delays: Up to 300 euros (12,279 Uruguayan pesos, $324) in the Star plan.

Plans and prices (for 7 days):

- IATI Backpacker: 53.99 euros ($58).

- IATI Basic: 32.90 euros ($35).

- IATI Standard: 38.88 euros ($42).

- IATI Star: 70.87 euros ($76).

| Advantages | Disadvantages |

| 24-hour customer service in Spanish | More limited coverage on basic plans |

| Intuitive mobile app to manage emergencies | Higher prices on premium options |

| Extensive adventure sports coverage on advanced plans | Trip cancellation not included in all plans |

HeyMondo

HeyMondo is a Spanish insurer that has gained recognition for its innovative approach tailored to the needs of the modern traveler. Its mobile app makes it easy to manage incidents, make medical consultations and access policy documentation. Customer service is available 24 hours a day in Spanish. You can contact them through various communication channels, such as chat on the app, email or telephone. Users value the speed and efficiency in solving problems.

Heymondo offers plans to suit different types of travel, from city breaks in Montevideo to wilderness adventures in places like Cabo Polonio. Its policies include comprehensive medical coverage, lost luggage protection and outdoor assistance. In addition, the ability to customize coverage allows them to adapt to the specific needs of each traveler.

Main coverages of HeyMondo’s travel insurance for Uruguay:

- Medical expenses: Up to 10,000,000 euros (409,300,000 Uruguayan pesos, $10,800,000) on the Premium plan.

- Repatriation: Unlimited on all plans.

- Luggage loss or theft: Up to 3,500 euros (143,255 Uruguayan pesos, $3,780) in the Premium plan.

- Adventure sports coverage: Included in the Top plan.

- Reimbursement for delays: Up to 300 euros (12,279 Uruguayan pesos, $324) in the Premium plan.

Plans and prices (for 7 days):

- Essential Trip: 30.55 euros ($33).

- Tranquility Trip: 35.59 euros ($38).

- Top Trip: 57.18 euros ($61).

- Premium Trip: 76.01 euros ($82).

| Advantages | Disadvantages |

| Mobile app for immediate incident management | Limited coverage in the most basic plans |

| Extensive medical coverage in higher plans | Higher costs for premium options |

| Customer service in Spanish, available 24/7 | Trip cancellation not included in all plans |

Chapka

Chapka is a French insurer specialized in travel insurance and has been in the market since 2002. It stands out for offering plans adapted to different traveler profiles, including backpackers and extreme sports enthusiasts. Its customer service in Spanish is available 24 hours a day. Users appreciate the clarity of coverage and efficiency in resolving incidents.

To go to Uruguay, at Chapka you will find several options. The Cap Trip Plus plan, the most comprehensive insurance, includes comprehensive medical coverage, repatriation and lost luggage protection. This plan is suitable for those exploring the cities as well as those venturing into rural areas. It also includes coverage for adventure sports. Ideal for those who plan to practice activities such as surfing in Punta del Este or hiking in the Sierra de las Ánimas.

Main coverages of Chapka’s travel insurance for Uruguay:

- Medical expenses: Up to 1,000,000 euros (40,930,000 Uruguayan pesos, $1,080,000) on the Cap Trip Plus plan.

- Repatriation: Included in all plans.

- Luggage loss or theft: Up to 2,500 euros (102,325 Uruguayan pesos, $2,700) in the Cap Trip Plus plan.

- Adventure sports coverage: Included in the Cap Trip Plus plan.

- Reimbursement for delays: Up to 150 euros (6,140 Uruguayan pesos, $162) in the Cap Trip Plus plan.

Plans and prices (for 7 days):

- Cap Trip Plus: 35.59 euros ($38).

- Cap Trip Basic: 26.76 euros ($29).

| Advantages | Disadvantages |

| Adventure sports coverage at no additional cost | Lower medical limits than other premium options |

| Competitive pricing for full coverage | Limited cancellation coverage in the basic plan |

| 24/7 customer service in Spanish | Less customization in advanced policies |

InterMundial

InterMundial is a Spanish insurance company founded in 1994. Its experience in the tourism sector and its customer service in Spanish make it a reliable option for those seeking peace of mind during their travels. In addition, its online platform and mobile application allow it to manage incidents quickly and efficiently, facilitating communication in any situation.

This insurer’s policies guarantee comprehensive medical expenses, repatriation and protection against delays or cancellations. Totaltravel Premium, in particular, stands out for including coverage for risky activities, ideal for water sports or hiking in places such as Punta del Este or the Uruguayan sierras.

Main coverages:

- Medical expenses: Up to 300,000 euros (12,279,000 Uruguayan pesos, $324,000) in the Totaltravel Mini plan and 2,500,000 euros (102,325,000 Uruguayan pesos, $2,700,000) in the Totaltravel Premium.

- Repatriation: Unlimited in all plans.

- Luggage loss or theft: Up to 1,500 euros (61,395 Uruguayan pesos, $1,622) in the most basic plan and up to 3,200 euros (131,744 Uruguayan pesos, $3,459) in Totaltravel Premium.

- Liability: Up to 100,000 euros (4,093,000 Uruguayan pesos, $108,000) in the Premium plan.

Plans and prices (for 7 days):

- Totaltravel Mini: 33.31 euros ($36).

- Totaltravel: 41.74 euros ($45).

- Totaltravel Premium: 65.78 euros ($70).

| Advantages | Disadvantages |

| Extensive medical coverage in superior plans | Adventure sports not included in basic plans |

| Flexibility to modify dates and coverages | Limited baggage coverage in initial plans |

| 24-hour customer service in Spanish | High prices on premium options |

AXA Assistance

AXA Assistance is one of the most recognized international insurance companies. It stands out for its extensive global assistance network and its expertise in handling emergencies. Its customer service is available 24 hours a day in Spanish and its channels include telephone, email and an online platform to manage incidents. This is especially useful for those seeking quick and efficient attention in unforeseen situations, such as health problems or lost luggage.

AXA offers policies with flexible coverages to suit different needs. Its Total plan is ideal for those who need protection against medical expenses, repatriation and common mishaps such as flight delays. In addition, the option of adding coverage for adventure sports makes it an interesting option for activities in destinations such as Punta del Este or the mountains of Minas.

Main coverages of AXA’s travel insurance for Uruguay:

- Medical expenses: Up to 150,000 euros (6,139,500 Uruguayan pesos, $162,000) in the Total plan.

- Repatriation: Unlimited in all plans.

- Luggage loss or theft: Up to 1,500 euros (61,395 Uruguayan pesos, $1,622).

- Adventure sports coverage: Optional, with an additional cost of 33.61 euros (1,374 Uruguayan pesos, $36).

- Liability: Up to 30,000 euros (1,227,900 Uruguayan pesos, $32,400).

Plans and prices (for 7 days):

- Mini Insurance: 37.65 euros ($41).

- Total Insurance: 58.07 euros ($62).

- Total Plus Insurance: 80.28 euros ($86).

| Advantages | Disadvantages |

| Global assistance network, with coverage in remote areas | Basic medical coverage inferior to other premium insurers |

| Fast and efficient customer service, available 24 hours a day in Spanish | Additional cost for adventure sports |

| Customization options to include adventure sports | Higher prices for advanced plans |

What is the best travel insurance for Uruguay?

Still unsure which insurance to choose? The travel insurance for Uruguay that’s right for you depends on your specific needs. As highlighted in the detailed descriptions of various providers, there are excellent options for traveling with peace of mind. However, based on the experiences of other travelers, one stands out above the rest: IATI.

IATI Seguros stands out as the best option for travel insurance in Uruguay because of the variety of policies it offers, its experience and personalized attention. On its own website, the insurer recommends its IATI Backpacker plan for those who are going to visit the country. Especially for those who are thinking of practicing some outdoor activity or visiting remote areas.

IATI Backpacker offers comprehensive medical coverage of up to 500,000 euros (20,465,000 Uruguayan pesos, $540,000). This includes hospitalization, emergencies and medical transfers, without the need to advance money. Another of the strong points of this insurance is its coverage for loss or theft of luggage, up to 2,500 euros (102,325 Uruguayan pesos, $2,700), ideal for those traveling with cameras, computers or valuable belongings. It also includes reimbursement for flight delays and protection in case of cancellations.

We hope that, after this review, you are now clearer about the differences between the different companies that offer travel insurance for Uruguay and you are closer to finding the ideal one for you. Oh! One last thing, if you plan to spend several months exploring the country, a medical insurance for foreigners in Uruguay may be the best option for you.

Language

Language

No results found

No results found