Travel insurance review: Seguro de Viaje Mundial

Read our travel insurance review of Seguro de Viaje Mundial, analyze their prices and coverages. Find out if it's suitable for you.

When planning a new adventure, it’s important to remember that having international insurance is a requirement for entry in many countries—ensuring you’re covered not just for your stay, but also for any medical needs. Whether you’re traveling solo or with family, choosing a policy that gives you peace of mind should definitely be on your travel prep checklist. In this guide, we’ve put together a travel insurance review of Seguro de Viaje Mundial, based on user feedback and real experiences from people who’ve used their coverage.

At Holafly, we’re all about making your travels smooth and memorable. That’s why we’re committed to giving you all the info you need about this U.S.-based insurance provider—to help you make smart, confident choices for your trip. Let’s dive in!

What is Seguro de Viaje Mundial and what travel insurance does it offer?

Seguro de Viaje Mundial is an international travel insurance provider based in Weston, Florida, with operations in countries like Colombia, Ecuador, Spain, Argentina, Peru, Mexico, Bolivia, and Venezuela. According to their website, segurosdeviajemundial.com, the company specializes in offering coverage and assistance to travelers heading abroad. They offer two main insurance plans, both of which include the following core services:

- International medical assistance: Covers medical expenses in case of illness or accident abroad, including hospitalization, treatment and medication.

- Medical repatriation: Guarantees the transfer to the country of origin for medical reasons, if necessary.

- Luggage loss or theft coverage: Provides compensation in situations of loss, theft or damage of luggage during the trip.

- Trip cancellation or interruption insurance: Reimburses non-recoverable expenses if the trip is cancelled or interrupted for justified causes.

- Liability: Covers unintentional damage to third parties occurring during the trip.

What does their international travel insurance cover?

Seguro de Viaje Mundial offers two main plans: the Basic Plan and the Premium Plan, whose most outstanding features are:

Basic plan

- Medical coverage: Includes medical care abroad for illnesses or accidents.

- Luggage coverage: Protection against loss, theft or damage of luggage.

- 24/7 assistance: Access to telephone assistance at any time.

- Liability coverage: Protection in case of damage to third parties.

- Price: Starting at $1 per day.

Premium plan

- Enhanced medical coverage: Includes overseas medical care for illness or accident, with higher limits.

- Enhanced baggage coverage: Protection against loss, theft or damage to baggage, with higher limits.

- 24/7 assistance: Access to telephone assistance at any time.

- Liability coverage: Protection in case of damage to third parties.

- Trip cancellation coverage: Reimbursement of expenses in case of trip cancellation for covered reasons.

- Trip interruption coverage: Reimbursement of expenses in case of trip interruption for covered reasons.

- Flight delay coverage: Compensation for additional expenses if the flight is delayed for more than a specified number of hours.

- Price: Starting at $1.20 per day.

Here’s a comparison table that breaks down the full coverage details of Seguro de Viaje Mundial’s Basic and Premium plans—so you can easily see what each one offers and choose the best fit for your needs:

| Feature | Basic plan | Premium plan |

| Price | $1/day | $1.20/day |

| Medical Services | $30,000 | $50,000 |

| Accident medical coverage | $30,000 | $50,000 |

| Sickness medical coverage | $30,000 | $50,000 |

| Co-payment | Not applicable | Not applicable |

| Telemedicine | Included | Included |

| 24/7 Helpline | Included | Included |

| Hospitalization | Included | Included |

| Specialist care | Included | Included |

| Complementary tests | Included | Included |

| Medications for outpatient care | $200 | $500 |

| Pre-existing condition emergencies | $500 | $500 |

| Emergency dentistry (does not include extraction) | $250 | $500 |

| Gynecological/urinary events | $100 | $150 |

| Legal services | ||

| Counseling for lost documents | Included | Included |

| Mailing and transfer of funds | $500 | $1,000 |

| Transfer of funds for legal bond | $15,000 | $15,000 |

| Civil liability (damages to third parties) | Not available | $500 |

| Legal assistance for traffic accidents | Not available | $5,000 |

| Extension of days for hospitalization | Not available | 3 days |

| Transfer Services | ||

| Funeral repatriation | $30,000 | $40,000 |

| Medical repatriation | $30,000 | $40,000 |

| Transfer of minors | $800 | $1,000 |

| Relocation of a family member | $600 | $600 |

| Travel Services | ||

| Hotel for recovery (max. $50/day, does not include COVID) | $1,000 | $3,000 (includes COVID, $80/day max.) |

| Flight delay (more than 12 hours) | $100 | $100 |

| Loss of baggage | $380 | $1,000 ($20/kg) |

| Baggage Tracking | Included | Included |

| Loss of passport | Not available | $75 |

| Changes in assistance (up to 24 hours prior to travel) | Not available | Included |

| Loss of connection | Not available | $100 |

| Flight cancellation | Not available | $100 |

| Maximum global amount | $30,000 | $50,000 |

What is left out in their international travel insurance?

Like with any insurance plan, there are a few things that Seguro de Viaje Mundial doesn’t cover. That’s why it’s a good idea to read the fine print and talk to their customer service team if you have any questions before signing up. Here are some of the key exclusions to keep in mind:

- Pre-existing conditions: Emergencies arising from pre-existing medical conditions are often limited or excluded from coverage.

- High-risk activities: Injuries or accidents occurring during extreme sports or activities considered high-risk may not be covered.

- Cosmetic or elective treatments: Non-urgent medical procedures, such as cosmetic surgeries or elective treatments, are not covered.

- Pregnancy and childbirth: Complications related to pregnancy or childbirth may have limited coverage.

- Mental or nervous disorders: Care related to psychological or psychiatric disorders is generally not covered.

- Participation in war: Injuries or situations arising from participation in acts of war or armed conflict are not covered.

- Use of prohibited substances: Incidents occurring under the influence of alcohol or illegal drugs may invalidate coverage.

Reviews of Seguro de Viaje Mundial and customer service

Overall, reviews of Seguro de Viaje Mundial—especially when it comes to their customer service—are quite positive on platforms like Trustpilot. Users often highlight the variety of ways to get in touch, as well as the friendliness, patience, quick responses, and personalized support provided throughout the purchasing process.

| Customer service channels | |

| Phone | Availability of direct telephone lines and WhatsApp for immediate attention in case of emergencies or queries. |

| Email address | Response to concerns and requests through their email address. |

| Social media | Active presence on platforms such as Facebook and Instagram, where they interact with users and respond to inquiries. |

| Website | Contact section and forms for personalized assistance. |

Reviews of Seguro de Viaje Mundial and its website

Users appreciate the Seguro de Viaje Mundial website for its clean, user-friendly design and how easy it is to find information quickly. It’s built for a smooth, hassle-free browsing experience.

Outstanding features

- Usability: User-friendly interface that allows easy access to information.

- Online contracting: Agile insurance purchase process, with clear and precise steps.

- Payment methods: Various payment options, facilitating the transaction for users from different regions.

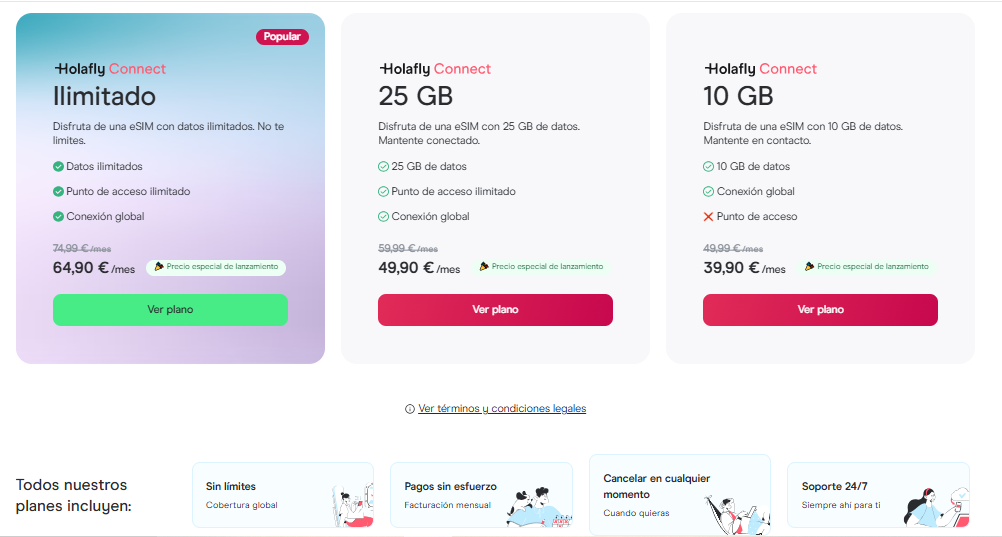

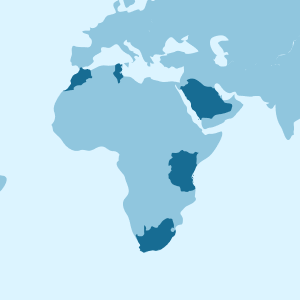

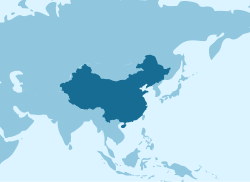

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Pros and cons of choosing international travel insurance with Seguro de Viaje Mundial

Based on reviews of Seguro de Viaje Mundial, it’s important to highlight both the strengths and areas for improvement of this insurance provider. This will help you determine whether their service aligns with your needs, while also giving the company insight into its weaknesses through user feedback, which can help improve the quality of their services.

| To maintain | To improve |

| Broad international medical coverage. | Inclusion of high-risk activities in the coverage. |

| Customer service available 24/7. | Greater clarity on exclusions related to pre-existing conditions. |

| Simple and fast online contracting process. | Expand coverage for pre-existing medical conditions. |

| Diversity of payment methods. | More detailed information on procedures in case of complaints. |

| Transparency in the information provided on the website. | Offer customized plans for frequent travelers or those with specific needs. |

User reviews of Seguro de Viaje Mundial

Overall, user experiences with Seguro de Viaje Mundial have been positive, especially in recent years. Many people highlight the quick customer service and the effective handling of medical issues during their travels.

In contrast, some users have mentioned that the policy exclusions, particularly concerning pre-existing conditions, high-risk activities, and refunds, could be clearer. If you’re considering this insurance, it’s a good idea to contact the company directly to clarify any questions before making a purchase.

Join us as we evaluate this company’s service through the feedback and testimonials (both positive and negative) from customers, covering key areas of their insurance plans.

Medical care and expenses abroad

Many users highlight the speed and efficiency of medical care during their trips, although some report delays and lack of professionalism in specific situations.

Trustpilot

“Excellent service, quick responses and immediate solutions. I suffered a fall arriving in Spain, I contacted Seguro de Viaje Mundial and they solved my problem right away. When the clinic they sent me to requested a deposit for my care, the response was immediate. Thank you very much and I would recommend your services without hesitation. Excellent!”

~ Elizabeth Lopera.

Trustpilot

“I traveled from December 31 to January 21 to Spain and in the course of this time my 15 month old baby had frequent vomiting. I requested assistance via WhatsApp and they were very prompt and timely in their response…they were very attentive to the evolution of the disease, as well as asking about medication expenses in order to make the reimbursement.”

~ Alex Salcedo.

Trustpilot

“In the past I had bought it, it went very well, I even recommended this insurance. I bought the insurance again for my new trip, I had a mishap in the country I was visiting, and it took me 3 days to get a solution… It took me almost 2 days to be told where I had to be treated. And what happened? My wound got infected, I was unable to walk for 5 days, a week of antibiotics and pain…”

~ VQB.

Trip cancellation and reimbursement

When it comes to trip cancellations and refunds, several customers have shared frustrating experiences, mentioning denied reimbursements and limited support in resolving those kinds of issues.

Trustpilot

“During the purchase process everything was flawless, the customer service was impeccable, all very attentive before paying…The real problem came when I missed my flight and had to wait more than 8 hours at the airport, as I was told it was necessary to activate the coverage. However, after that long wait, the excuses began. The insurance supposedly covered this situation, but they refused to offer me any kind of solution.”

~ Leonard Hernandez.

Trustpilot

“Due to problems with the weather it was not possible for me to travel to my destination; I asked for the cancellation of the insurance since I wouldn’t use it, and their answer was ‘payment is low cost, we don’t do reimbursements’, when on the page it says that cancellations can be made before the trip if required. Don’t trust them.”

~ Sugey Jimenez.

Trustpilot

“I had a delay of my flight while out of the country (I had no phone line or WhatsApp). I reported the incident 24 hours later when I arrived at my final destination to request compensation for flight delay. They argued that I should have done it immediately since otherwise I was not entitled to compensation…”

~ JL.

Activities and liability

Reviews about Seguro de Viaje Mundial’s coverage for activities abroad and liability protection are mixed. For instance, Laura shared a negative experience, and Saiduvis Jaramillo also voiced dissatisfaction.

Trustpilot

“I had emergency care in Egypt and they never refunded my money.”

~ Laura.

Trustpilot

“I must rate the insurance this time very badly since they refused to do diagnostic tests and give us an appointment with a traumatologist, in view of the fact that my mother had a fall. The answer was that the insurance does not cover these tests or consultations with specialists, and that according to the conditions of the insurance, they never send it to you until after the policy is contracted. It is unfortunate and unreliable to get this travel insurance.”

~ Saiduvis Jaramillo.

Despite the mixed reviews, Seguro de Viaje Mundial currently holds a 4.8 rating on Trustpilot. Many users praise the efficiency of their customer service and claims management, while also pointing out areas where coverage and reimbursement processes could be improved. This suggests the company has been making efforts to address past issues, showing a real commitment to customer satisfaction and service quality.

Traveling with insurance might take some thought—but staying connected doesn’t have to. With Holafly Connect, you can choose from our monthly plans of 10 GB, 25 GB, or even unlimited data, and land at your destination worry-free, with internet ready to go.

Pay

Pay  Language

Language  Currency

Currency

No results found

No results found