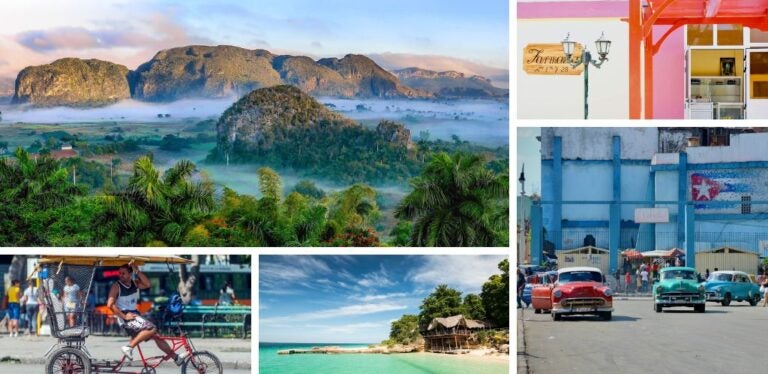

Travel Insurance for Cuba: All You Need to Know

Are you going to visit Havana or another corner of the island? Take out insurance and minimise risk. Discover the best travel insurance for Cuba.

Cuba is a destination that leaves no one indifferent. It’s not a secret that the reality in the country is harsh, that certain services are scarce and that communication isn’t exactly good. However, everyone who visits it comes back fascinated. If you’re planning to visit Havana, Varadero or other destinations in the archipelago, you should know that, unlike other popular destinations, Cuba travel insurance is mandatory to enter the country.

You’ll be asked for it when you enter. If you don’t have one, you’ll have to buy it there and it’ll cost a lot more than if you take one out before you go. As well as being compulsory, it’ll help you to receive quality medical care, speed up procedures and be covered for lost flights and lost luggage. Although we’ve already talked about international travel insurances in the past, today we’d like to talk about the ones that are more suitable for the particularities of Cuba. Read on to find the insurance company that fits for your needs and requirements.

Why take out a travel insurance for Cuba?

As you’ll have seen if you’ve already started to prepare your trip to Cuba, since 2010 it’s compulsory to take out travel insurance with medical cover from an insurance company recognised by the country. Checks are carried out on arrival to ensure that you’re sufficiently covered for your stay. If you don’t have insurance, you’ll have to get one on the spot at less competitive prices and with rather limited coverage.

Moreover, the health care system in Cuba, despite it’s good quality, it isn’t free for tourists. In case you’ve a mishap and need care at an international clinic, you’ll have to go to specific clinics, such as the Centro de Investigaciones Médico-Quirúrgicas (CIMEQ) (Center for Medical and Surgical Research). And you’ll have to pay for the services before you’re discharged. A basic medical consultation can cost between $717 and 1,195 CUP ($30-50 US). And for a day of hospitalisation? You might have to pay around $7,174 CUP ($300 US). Without taking into account the cost of medication or possible ambulance transfers, it’ll cost between $1,195 and 2,391 MXN ($50-100 US), depending on the distance.

As if facing potential incidents that could arise elsewhere weren’t enough, the recent increase in cases of dengue and Oropuche fever, along with recurrent outbreaks of chikungunya and Zika, reinforce the need to be protected. The authorities don’t let tourists leave the country if they’ve outstanding health care debts.

But the setbacks don’t end there. What would you do if you loose your luggage at Havana airport? Or if your flight is delayed and it affects your connections? Travel insurance can help you deal with these situations quickly. It’ll offer you financial compensation and on-the-spot assistance . This backup can make all the difference when you’re away from home.

If you plan to explore Cuba’s natural wonders, such as the Viñales Valley or the beaches of Cayo Coco, you’ll also want to be covered in case of accidents. A fall on a hiking trail or a mishap while scuba diving won’t only ruin your trip, but it’ll also make your expenses go up in smoke.

What should a travel insurance for Cuba cover?

If you’ve never taken out travel insurance (or have done so, but not for destinations with as many particularities as Cuba), probably you don’t know what coverages you should demand from one. Although, like anywhere else, the policy you’ll need depends on the holiday you’re organising and the plans you’ve in mind. Here are some of the essential covers you should look for when buying insurance for Cuba:

1. Medical coverage: Cuba has a well-organised health care system, butfree care isn’t available to tourists. You’ll have to go to specific clinics such as the Clínica Central Cira García (Cira García Central Clinic) in Havana. There, a medical consultation can cost between $1,500 and 2,500 CUP (approximately $62-104 US). If you need hospitalisation or medication, the bill will be much higher. Make sure your policy covers at least $250,000 CUP (about $10,454 US) for medical expenses. This amount includes hospitalisation, ambulance transport and essential medicines.

2. Medical or funeral repatriation: if you suffer a serious emergency that requires your transfer to home, the costs can exceed $500,000 CUP ($20,908 US). This service, included in most insurance policies, is indispensable to protect you in critical situations.

3. Lost or stolen luggage: in airports such as Havana or Varadero, with high tourist traffic, problems with luggage are common. Make sure your policy covers up to $40,500 CUP ($1,693 US) to replace essential items in case of theft or loss.

4. Flight delays and cancellations: flights to and from Cuba may be subject to unexpected changes. Good insurance should compensate you for additional expenses, such as extra nights in hotels or meals. The most comprehensive coverages typically offer between $2,700-5,400 CUP ($110-216 US) per day of delay.

5. Civil liability: If, for example, you rent a classic car in Havana and accidentally damage another vehicle, you’ll need a policy to back you up. Insurances typically include between $810,000-1,620,000 CUP ($33,871-65,000 US) for such legal claims.

6. Coverage for extreme sports: Are you planning to explore the caves of Viñales or to snorkel in Varadero? Accidents in these activities may require immediate medical attention or even repatriation. Insurers usually include this coverage in plans designed for active travellers.

7. 24/7 assistance: Unforeseen events don’t have timetable, but in Cuba contacting your insurer can be complicated. Internet connections aren’t available everywhere, and while there are public Wi-Fi hotspots, they aren’t as convenient as using a Holafly eSIM, which unfortunately doesn’t work in the country. Before travelling, confirm that your insurer offers multiple means of care, such as email or text messaging, to facilitate communication in the event of an emergency.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Comparison of the best travel insurances for Cuba

Now that we’re clear on what travel insurance for Cuba is compulsory and what coverage should be required of a policy, it’s time to choose the most suitable option for your needs. Given that with so many alternatives available choosing can be difficult, it’s better to set out clearly the most important information about each. This table will help you get an overview of what each offers.

| Coverage | Chapka (CAP TRIP Basic) | HeyMondo (Ease of Mind Travel) | IATI (Backpacker) | AXA Assistance (Total) | Intermundial (Totaltravel mini) |

|---|---|---|---|---|---|

| Price (7 days) | €26.76 ($28.90 US) | €35.59 ($38.49 US) | €53.99 ($57 US) | €58.07 ($62.80 US) | €33.31 ($36.10 US) |

| Medical expenses | €250,000 ($269,946 US) | €600,000 ($648,837 US) | €500,000 ($540,697 US) | €150,000 ($162,209 US) | €300,000 ($325,083 US) |

| Repatriation | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Lost or stolen luggage | €800 ($865 US) | €1,500 ($1,622 US) | €1,500 ($1,622 US) | €1,500 ($1,622 US) | €1,500 ($1,622 US) |

| 24/7 assistance | Yes | Yes | Yes | Yes | Yes |

| Trip cancellation | Optional | Optional | Optional | Optional | Optional |

| Coverage for extreme sports | Yes | Yes | Yes | Optional: Sports insurance:€33.61 ($34.67 US) | No |

| Civil liability | €40,000 ($43,191 US). Deductible €150 ($162 US) | €60,000 ($64,883 US) | €60,000 ($64,883 US) | €30,000 ($32,441 US) | €50,000 ($54,180 US) |

| Compensation for flight delay | Only at the beginning of the trip, up to €150 ($162 US) | €300 ($324 US) | €270 ($291 US) | €150 ($162 US) | €150 ($162 US) |

The 5 best travel insurances for Cuba.

Likely, after reviewing the comparison table of the best travel insurances for Cuba, you’ll have a clearer idea of the options available. However, before deciding, it’s important to look more closely at what each insurer offers. Cuba is a unique destination, with particular challenges for travellers: a healthcare system that requires paying bills in cash, outdoor activities that can involve risks, and a limited infrastructure that can complicate matters when it comes to dealing with unforeseen events. That’s why good insurance shouldn’t only cover medical emergencies, but also protect you in case of cancellations, lost luggage or flight delays. Let’s take a closer look at what the five most popular insurers offer for travel insurance to Cuba:

IATI Travel Insurance: Experience and personalised service for Cuba

Founded in 1885, IATI Travel Insurance is one of the oldest and most recognised insurance companies in Europe. In its more than a century in this sector, it’s managed to offer coverages designed to suit both those seeking basic policies and those who prefer more advanced options. Its customer service, available 24/7 in Spanish, is one of its strong points.

IATI offers a range of policies to suit the needs of travellers to Cuba. From IATI Basic, ideal for those looking for essential cover, to IATI Star, which includes a more complete medical cover and extreme sports protection. They also have the IATI Backpacker, designed for those who plan more hazardous activities during their stay on the island.

Main policy coverage for Cuba:

- Medical expenses: Up to €5,000,000 ($138,000,000 CUP / $5,400,000 US).

- Repatriation: 100% included.

- Loss of luggage: Up to €2,500 ($69,000 CUP / $2,703 US).

- Extreme sports: Covered in superior plans.

- Flight delays: Up to €300 ($8,280 CUP / $324 US).

Plans and prices:

- IATI Basic: €32.90 ($908 CUP / $35 US) for 7 days.

- IATI Standard: €38.88 ($1,072 CUP / $42 US) for 7 days.

- IATI Backpacker: €53,99 ($1.363 CUP / $57 US)

- IATI Star: €70.87 ($1,954 CUP / $77 US) for 7 days.

Advantages | Limitations |

|---|---|

| Comprehensive medical coverage in superior plans | Higher costs in premium policies |

| 24/7 personal assistance in Spanish | Limited coverage in basic plans |

| Simple incidents management | Doesn’t include pre-existing conditions |

Chapka: Economic and practical coverage for Cuba

Since its founding in 2002, French insurer Chapka has stood out for its focus on the most adventurous travellers. With flexible options and competitive prices, it’s one of the best alternatives for those looking to travel to Cuba without spending too much on insurance. One of Chapka ‘s strengths is its 24-hour service in Spanish. Another one is its standard coverage for extreme sports, a must for those who plan to explore the Cuban wilderness or to snorkel in the cays.

Chapka adjusts to the length of your trip and the particularities of your journey. It offers two policies. The most basic includes essential medical assistance. The most comprehensive covers incidents related to extreme sports and offers more compensation for flight delays or lost luggage.

Main coverages of the travel insurance for Cuba:

- Medical expenses: Up to €250,000 ($6,900,000 CUP / $270,000 US).

- Repatriation: Included.

- Loss of baggage: Up to €800 ($22,080 CUP / $870 US).

- Extreme sports: Included.

- Flight delays: Up to €150 ($4,140 CUP / $162 US).

Plans and prices:

- Cap Trip Basic: €26.76 ($738 CUP / $29 US) for 7 days.

- Cap Trip Plus: €35.59 ($982 CUP / $39 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Coverage for extreme sports included | Limited medical coverage in basic plans |

| 24/7 assistance in Spanish | Travel cancellations poorly covered |

| Competitive prices | Doesn’t cover pre-existing conditions |

HeyMondo: Technology and ease in your travels to Cuba

Founded in 2018, HeyMondo is a young insurer that has revolutionised the industry with its technology-driven approach. Its mobile application allows you to manage incidents quickly and easily. An added value for travelling to a destination like Cuba, where, as we know, the internet is not reliable. In addition, its 24-hour customer service in Spanish ensures clear and effective communication in the event of any unforeseen event.

HeyMondo offers a variety of plans including cover for adventure activities, lost luggage compensation and high medical expenses. This makes of it an ideal choice for those seeking a balance between comfort and security on their visit to the island.

Main coverage:

- Medical expenses: Up to €600,000 ($16,560,000 CUP / $648,000 US).

- Repatriation: Unlimited.

- Loss of baggage: Up to €1,500 ($41,400 CUP / $1,622 US).

- Extreme sports: Included.

- Civil Liability: Up to €60,000 ($1,656,000 CUP / $64,883 US).

Plans and prices:

- Essential Travel: €30.55 ($843 CUP / $33 US) for 7 days.

- Ease of Mind Travel: €35.59 ($982 CUP / $39 US) for 7 days.

- Top Travel: €56.76 ($1,438 CUP / $60 US) for 7 days.

- Premium Travel: €76.01 ($2,097 CUP / $82 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Intuitive and functional mobile application | Lower compensation for delays than others |

| Solid and comprehensive medical coverage | Higher costs in Premium plans |

| 24/7 assistance in Spanish | Doesn’t include specific extreme activities |

AXA Assistance: Premium coverage for Cuba

AXA Assistance is a globally recognised insurer, renowned for its focus on the quality of service and strong emergency expertise. Founded in 1958 in France, it’s been insuring travellers around the world for more than six decades. Its extensive assistance network, which includes hospitals and clinics in many countries, makes of it an ideal choice for those seeking peace of mind on their trip to Cuba. In addition, its customer service is available 24 hours a day in several languages.

AXA offers several plans designed to fit for the specific needs of travellers. From the Mini Insurance, ideal for those looking for basic coverage, to the Total Plus Insurance, designed for those who prefer complete protection. Although extreme sports cover isn’t included in all plans, you can add it for an additional cost, which is perfect if you plan to do activities such as diving or hiking on the island.

AXA Assistance main coverages:

- Medical expenses: Up to €150,000 ($4,140,000 CUP / $162,000 US).

- Repatriation: Unlimited.

- Lost or stolen luggage: Up to €1,500 ($41,400 CUP / $1,620 US).

- Extreme sports: Optional for an additional €33.61 ($928 CUP / $37 US).

- Civil Liability: Up to €30,000 ($828,000 CUP / $32,000 US).

Plans and prices:

- Mini insurance: €37.65 ($1,040 CUP / $41 US) for 7 days.

- Total Insurance: €58.07 ($1,610 CUP / $63 US) for 7 days.

- Total Plus Insurance: €80.28 ($2,230 CUP / $87 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Extensive global health care network | Extreme sports Not Included in all plans. |

| Excellent customer service and quick response | Higher prices than other insurers |

| Customisable options for different types of travel | Doesn’t cover pre-travel conditions |

InterMundial: Flexibility and great value for money

InterMundial, with more than 30 years of experience in the market, it’s a Spanish insurance company specialised in protecting travellers anywhere in the world. Its focus on customisation and flexibility makes of it an outstanding option for those planning to travel to such unique destinations as Cuba. Thanks to its 24/7 customer service and intuitive mobile application, it offers users a hassle-free experience, allowing them to manage incidents, access to medical assistance or make queries from anywhere on the island.

For travellers visiting Cuba, InterMundial offers several options combining medical assistance, baggage protection and compensation for flight delays. Its Totaltravelinsurance, available in three different forms (Mini, Standard and Premium), includes comprehensive medical cover, repatriation and legal assistance, which are essential aspects when travelling to a country with limited infrastructure for tourists in certain regions.

Main coverage of InterMundial:

- Medical expenses: Up to €3000,000 ($8,280,000 CUP / $325,000 US).

- Repatriation: Unlimited.

- Lost or stolen luggage: Up to €1,500 ($41,400 CUP / $1,620 US).

- Civil Liability: Up to €50,000 ($1,380,000 CUP / $54,000 US).

Plans and prices:

- TotalTravel Mini: €33.31 ($920 CUP / $36 US) for 7 days.

- TotalTravel: €41.74 ($1,160 CUP / $46 US) for 7 days.

- TotalTravel Premium: €65.78 ($1,830 CUP / $72 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Flexibility to customise the coverage | Extreme sports Not Included in the basic plan. |

| Competitive prices for value for money | Slightly less medical coverage than premium options |

| 24/7 attention in Spanish, ideal for Spanish-speaking travellers | Exclusions for pre-existing conditions |

Which is the best travel insurance for Cuba?

As you may have gathered, most insurers offer similar things, the difference is in the details. However, taking a look at this detailed analysis we’ve just made and based on the experiences of other travellers who have visited Cuba in recent times, we could say that there’s one insurer that stands out from the rest: IATI. On their own website, they highlight the IATI Backpacker policy as the best option for visiting the country.

Among its main advantages there’s the extensive medical coverage it offers. The IATI Backpacker covers up to €500,000 ($13,800,000 CUP / $540,000 US) in medical expenses. This includes treatment for diseases such as dengue, Zika and chikungunya, which are common on the island. In addition, this policy covers extreme sports such as snorkelling and scuba diving up to 40 metres, activities you can’t miss in places like Cayo Coco or Varadero. On the other hand, you won’t have to advance money for medical treatment, which is key in Cuba, where immediate payment for services is required.

This insurer also covers repatriation at 100 % and in this policy the protection for damage or theft of luggage is up to €1,500 ($41,400 CUP / $1,620 US).

The 24-hour service in Spanish is ideal for travellers seeking peace of mind in case of unforeseen events. If you plan to visit the island, this travel insurance for Cuba will undoubtedly allow you to enjoy your holiday with the security of always being protected.

With this review of the most popular insurers’ policies, you’re sure to be one step closer to finalising your travel arrangements. If you need more information to prepare your trip, you can consult our guides on the best VPN for Cuba or eSIM alternatives for Cuba.

Language

Language

No results found

No results found