Medical insurance for Asia: The best options for expats

We bring you the five best policy options and prices. Compare and decide which is the best medical insurance in Asia for foreigners.

Hey there, traveler! Got your sights set on Asia for your next big adventure? Of course you do—who wouldn’t want to marvel at the Taj Mahal, feel the spiritual vibe of Bangkok’s Grand Palace, or stand in awe of the Great Wall of China? Sounds like a dream, right? If you’re planning to make it a reality, make sure you’ve got medical insurance in Asia to keep you protected wherever you go across this incredible continent—where ancient traditions meet cutting-edge innovation.

We know how overwhelming it can be to compare policies and plans—that’s exactly why we’re here to help. In this article, Holafly brings you the top picks for medical insurance in Asia. We’ll break down the features, coverage, and prices of five different providers to make your decision easier and get you one step closer to your dream trip across Asia.

Which foreigners need medical insurance in Asia?

Health insurance is a must-have for all kinds of travelers planning to settle in Asia for a while. Whether you’re a digital nomad hopping between countries, a student heading abroad for school, or an expat relocating for work, having reliable medical insurance in Asia ensures you’ll have access to quality care wherever you go. Many universities require students to have coverage, and for working professionals or retirees starting a new chapter in Asia, the right plan offers peace of mind and protection in your new day-to-day life.

What types of medical insurance in Asia are suitable for foreigners?

International health insurance plans—designed to provide coverage across multiple countries—are a smart choice for anyone planning to live in or travel around Asia long-term. They offer flexibility and a wide range of services, from hospital stays and doctor visits to specialized treatments, depending on the plan.

On the other hand, local health insurance plans—offered by providers within a specific country—tend to be more affordable and tailored to the local healthcare system and regulations. However, coverage is usually limited to the country where you reside and depends on the services available through that country’s healthcare system. For example, in Thailand, foreign residents can access the public health system, but there are certain restrictions to keep in mind.

Considerations when choosing medical insurance

- Geographical coverage: Make sure the insurance covers all countries you plan to visit or reside in Asia.

- Medical coverage: Check the coverage limits for medical expenses, hospitalization and specific treatments.

- Assistance in several languages: It is advisable that the insurance offers customer service and assistance services in your language to facilitate communication in emergency situations.

- Sports and activities: If you plan to engage in adventure activities, confirm that they are included in the policy.

- Legal requirements: Some Asian countries may require specific health insurance coverage as part of the process for granting long-term visas or residency permits. For instance, Thailand mandates that retired foreign nationals carry private health insurance that meets certain coverage requirements.

How much do health services cost in Asia?

Asia is home to a diverse range of healthcare systems, which can vary widely in terms of quality, accessibility, and cost. Countries like Singapore, South Korea, and Japan offer top-tier medical care and are internationally recognized for their efficiency and excellence. For example, Singapore has been ranked by the World Health Organization as having the best healthcare system in Asia, thanks to its combination of world-class services and relatively low costs.

It’s worth noting that in Japan, the national health insurance system covers a large portion of medical expenses for residents, offering significant savings. In contrast, some other countries in the region still struggle to provide universal healthcare coverage. According to the International Labour Organization (ILO), around 1.6 billion people in Asia and the Pacific lack access to health-related social protection, highlighting the stark inequalities that exist across the region.

That said, here is a table with the approximate costs of some common medical services in various Asian countries.

| Medical service | Singapore (USD) | Japan (USD) | India (USD) | Thailand (USD) |

| Hospitalization | 500 – 1,000/day | 300 – 600/day | 50 – 200/day | 100 – 300/day |

| General medical consultation | 50 – 100 | 30 – 50 | 10 – 20 | 15 – 30 |

| Specialist consultation | 100 – 200 | 50 – 100 | 20 – 50 | 30 – 60 |

| Laboratory tests | 50 – 150 | 20 – 100 | 10 – 50 | 20 – 80 |

| X-rays | 30 – 80 | 20 – 50 | 10 – 30 | 15 – 40 |

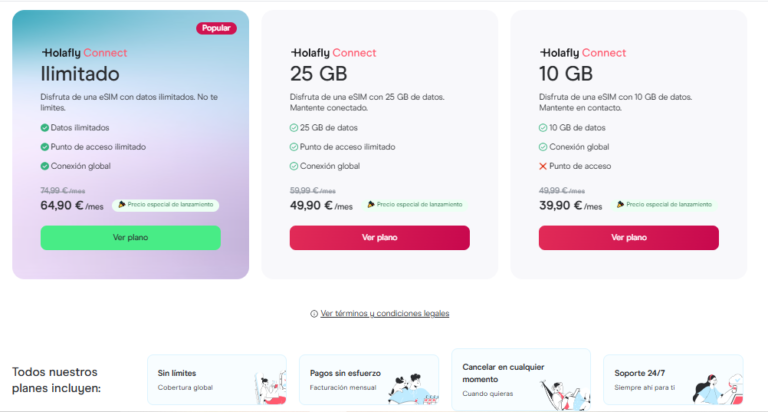

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Medical insurance in Asia: 5 alternatives for foreigners

Given the wide range of healthcare costs and quality across Asia, it’s important to consider getting health insurance that covers your time in the region. Keep in mind that you’re not immune to medical emergencies caused by weather conditions, tropical diseases, or even natural disasters. As promised, let’s now take a look at the top five health insurance options for foreigners in Asia.

1. Cigna Global

Cigna Global is an international insurance company that started in 1982, providing health coverage around the world. Since then, it has been dedicated to offering medical insurance solutions for expats, digital nomads, and international workers. With a presence in over 200 countries, including key Asian markets like China, Japan, India, Thailand, and Singapore, Cigna connects clients to top-tier hospitals and clinics through its extensive global network.

Main coverage:

- General medical consultations and with specialists.

- Hospitalization and surgery.

- Emergency care.

- Coverage for chronic and pre-existing conditions (depending on the plan).

Plans and prices:

- Silver Plan: Basic coverage suitable for short stays (6 months to 1 year).

- Gold Plan: Includes additional coverage for chronic illnesses and some medical specialties.

- Platinum Plan: Full coverage, ideal for extended stays (more than one year) and families.

Estimated prices range from $3,000 to $10,000 per year, depending on the plan and the age of the insured.

| Advantages | Disadvantages |

| Extensive network of hospitals and clinics in Asia. | Some specific coverages may significantly increase the cost. |

| Flexibility to tailor the plan to meet your needs. | Not all plans include dental or mental health coverage. |

| Multilingual customer service available 24/7. | Limited coverage for seniors age 65 and older. |

2. Bupa Global

Bupa Global, founded in 1947, is one of the world’s largest and most respected health insurance providers. Its goal is to offer comprehensive healthcare coverage to individuals, families, and businesses globally. With more than 70 years of experience, Bupa has expanded across many countries, including a strong presence in Asia, where it operates in key markets like Japan, China, Hong Kong, Singapore, and Thailand. Known for its focus on quality service and customer care, Bupa is a popular choice among expats and those seeking international health coverage.

Main coverage:

- Direct access to specialists without referral.

- International coverage in a single plan.

- Inpatient and outpatient treatment.

- Coverage of pre-existing conditions (depending on the plan).

Plans and prices:

- Select Plan: Essential coverage for individuals.

- Premier Plan: Extended coverage with additional benefits.

- Elite Plan: Full coverage with exclusive services.

Estimated prices range from $4,000 to $12,000 per year, depending on the plan and the age of the insured.

| Advantages | Disadvantages |

| Access to a wide network of medical facilities. | Higher costs compared to other insurers. |

| Coverage for pre-existing conditions. | Some exclusions on mental health treatment. |

| Customer service available 24/7. | Restrictions for policyholders over 65 years of age. |

3. IATI Seguros

IATI Seguros is a Spanish insurance provider that has built a strong reputation in the field of health insurance for travelers and expats. Founded in 1880, IATI originally focused on travel insurance but later expanded to offer international health coverage for those moving abroad for extended periods or for work. With a presence in several countries, including major Asian destinations like Thailand, China, India, and Japan, IATI has earned the trust of expats and tourists alike.

Main coverage:

- Medical and hospital assistance.

- Medical repatriation.

- Coverage of emergency dental expenses.

- Assistance in case of accident.

- Coverage for extreme sports.

Plans and prices:

- IATI Standard: Basic coverage for short stays.

- IATI Backpacker: Designed for long term travelers.

- IATI Star: Full coverage with higher limits.

Estimated prices range from $500 to $3,000 per year, depending on the plan and length of stay.

| Advantages | Disadvantages |

| Competitive prices and variety of plans. | Limited coverage for pre-existing conditions. |

| Assistance in multiple languages. | Some plans do not include coverage in the U.S. and Canada. |

| Specific options for long-term travelers. | Limits on adventure sports coverage. |

4. Heymondo

Heymondo is a Spanish insurance company that specializes in international health coverage, catering primarily to travelers, digital nomads, and expats. Since its founding in 2017, it has quickly become a popular choice for people looking for medical insurance while living abroad. Expanding its reach in international markets, Heymondo now offers services in several Asian countries, including Thailand, Japan, China, India, and Malaysia. The company stands out for its focus on providing easy access to healthcare and offering flexible plans tailored to individual needs.

Main coverages:

- 24/7 international medical assistance.

- Coverage of hospitalization and surgery expenses.

- Repatriation and medical transportation.

- Coverage for theft and luggage damage.

- Civil liability and legal assistance.

Plans and prices:

- Temporary travel insurance: Ideal for short stays, with prices starting at $2.00 per day.

- Long-term travel insurance: Designed for extended trips, with prices starting at $2.50 per day.

- Annual multi-trip insurance: For trips throughout the year, with personalized prices according to duration and destination.

| Advantages | Disadvantages |

| Competitive pricing and customizable plans. | Limited coverage for pre-existing conditions. |

| Assistance in multiple languages. | Some plans do not include coverage in the U.S. and Canada. |

| Mobile app for incident management. | Limits on adventure sports coverage. |

5. Allianz Care

Allianz Care is a global insurer specializing in international health coverage and is part of the renowned Allianz Group, one of the world’s leading insurance and financial services providers. Established in 1890, Allianz Care offers tailored health solutions for expats, digital nomads, businesses, and international families. With operations in over 70 countries, including a strong presence in Asia, Allianz Care is known for its dedication to high-quality healthcare and its wide network of medical providers globally.

Main coverages:

- Inpatient and outpatient treatment.

- Maternity coverage (depending on the plan).

- Care for chronic and pre-existing conditions (depending on the plan).

- Medical evacuation and repatriation services.

Plans and prices:

- Essential Plan: Basic coverage for inpatient treatment.

- Classic Plan: Includes outpatient treatment and some additional coverage.

- Premier Plan: Full coverage with additional benefits, including maternity.

Estimated prices range from $3,000 to $9,000 per year.

| Advantages | Disadvantages |

| Wide network of medical providers worldwide. | Higher costs compared to other insurers. |

| Coverage of pre-existing conditions (depending on plan). | Some exclusions on mental health treatments. |

| Customer service available 24/7. | Restrictions for policyholders over 65 years of age. |

What is the best medical travel insurance for foreigners in Asia?

As if that weren’t enough, we don’t just want to recommend the best health insurance options in Asia—we want to help you make the right choice. After carefully evaluating each option, we’ve concluded that Cigna Global stands out as the top choice among them all.

We understand that picking the best health insurance for an expat depends on personal needs, such as how long you’ll be staying, your budget, the coverage you need, and your age. And guess what? Cigna Global checks all those boxes—and more!

Five reasons to choose Cigna Global for your trip to Asia

- Broad international coverage: Cigna offers international health insurance plans that provide coverage for individuals and families living, working, retiring, or studying abroad, including in Asian countries.

- Flexibility in plan customization: Cigna’s plans are flexible and can be tailored to each policyholder’s specific needs, allowing them to choose coverage that fits their requirements and budget.

- Global network of medical providers: Cigna has an extensive global network of hospitals and healthcare professionals, making it easier to access quality medical services across various regions of Asia.

- Additional services: In addition to medical coverage, Cigna provides services like emergency medical evacuation and international crisis assistance, offering an extra layer of security for policyholders.

- Recognition and reputation: Cigna Global is recognized as one of the top international health insurance providers, giving expats confidence in finding coverage across Asia.

Now that all your questions are answered and the information is clear, it’s time to make a decision: Which insurance will accompany you to Asia? Don’t hesitate any longer—choose your preferred provider and start packing with the confidence that you’ll be covered. Still undecided on which Asian destination to start with? We’ve got you covered there too! Check out our latest posts on scholarships to study in South Korea if that’s where you’re heading, or if your dream is to live and work as a digital nomad in Malaysia.

Don’t forget that having uninterrupted connection is crucial while traveling. Holafly is leading the way in global connectivity with their new unlimited internet plans. Pick your monthly plan and stop worrying about losing connection wherever you are!

Language

Language

No results found

No results found