Top 5 of the Best Health Insurance for Digital Nomads

Traveling while working remotely? Protect yourself from health issues. We help you find the best health insurance for digital nomads.

Facing a medical problem in a country whose healthcare system is unfamiliar to you can be frightening. That’s why, before starting a trip as a digital nomad, it’s wise to prepare for potential health problems. As the number of digital nomads has tripled in recent years, this is becoming increasingly easier. Many insurers offer policies that specialize in covering the needs of people who live and travel while working. With this article, we want to help you find the best health insurance for digital nomads in 2024.

We will tell you whether you should take out health insurance or travel insurance. We will also review the coverages to look for in the one you buy and the best options on the market for digital nomads.

When traveling as a digital nomad, is travel insurance or health insurance better?

If this is the first time you take out insurance to prevent possible health problems on your adventure as a digital nomad, you may be wondering whether you need health insurance or whether travel insurance is better for your circumstances. This is normal. On the surface they offer similar things, but there are some key differences that can affect your safety and peace of mind. Before we go on to break down the coverage of the best health insurance for digital nomads, let’s make it clear how they differ from travel insurance:

Travel insurance: this type of insurance is designed, above all, to cover unforeseen situations and emergencies during specific trips. It usually includes protection against flight cancellations, lost luggage, repatriation and emergency medical assistance. However, as its focus is on short stays, it does not usually cover pre-existing conditions or prolonged medical treatment. For a digital nomad, it can be useful if your plan is to move constantly and spend short periods in each location. For continuous and comprehensive medical coverage, it may not be sufficient.

Health insurance for digital nomads: unlike travel insurance, health insurance for digital nomads focuses on providing more extensive and tailored coverage for people who spend long periods of time abroad. This type of insurance ranges from emergency medical assistance to regular care, medical consultations, medication and, in some cases, treatment for chronic illnesses. In addition, many insurers offer customization options to suit your needs. You can add additional coverage in case of accidents or specific care in certain countries.

If you are looking for stability and comprehensive medical care while working and traveling, a specialized health insurance for digital nomads is probably the right choice for you.

What to consider when choosing health insurance for digital nomads?

Facing medical issues outside your comfort zone can be tough. You will need to evaluate what each health insurance offers in order to ensure your health and peace of mind wherever you are. You should know that they don’t all cover the same thing. They don’t have the same coverage or scope, so you’ll need to find one that fits your specific circumstances. Let’s take a look at the most important things you should require from your policy, so you can make your decision more easily.

Global medical coverage

One of the most important aspects is that the insurance offers global medical coverage. This means that you can access quality medical services in different countries. This includes emergency care, routine treatment and, in some cases, care for chronic illnesses. Coverage should be valid in all destinations you plan to travel to, with an accessible network of hospitals and doctors.

Flexibility in duration and renewal

The ability to choose the duration of the insurance and its flexible renewal is another factor to consider. Many digital nomads have changing itineraries, an annual or monthly insurance that you can adjust or renew without difficulty facilitates the process and ensures that your coverage does not lapse when you need it most. Some insurers also offer temporary suspensions if you plan to stay in your home country.

Attention in several languages and channels

Having an insurance company that offers service in several languages and through different channels (telephone, chat, email) will facilitate communication in critical moments. The speed and quality of customer service play a fundamental role in the user experience, especially in emergency situations where you need immediate assistance. Choose one that has 24/7 service and with which you can communicate easily. Thanks to this and your Holafly eSIM, you will be covered at all times.

The 5 best health insurances for digital nomads

Now that we have made clear the differences between travel and medical insurance and also the coverages to look for when buying health insurance, let’s evaluate the most recommended options for 2025. To compile this list, we have chosen companies that are very popular among digital nomads. With good reviews and a policy that perfectly fits the needs of those who travel while working.

Allianz Care

Founded in Germany in 1890, it is one of the world’s largest insurance providers. It has an extensive network of hospitals and clinics in more than 70 countries and a reputation for its strong focus on comprehensive care. It offers insurance tailored to the needs of expatriates and long-term travelers.

Policies focused on digital nomads include comprehensive coverage that is tailored to their needs, with multilingual customer service and a user-friendly application. It also has a fast reimbursement system, making it easy to manage medical payments from abroad.

Plans and pricing

Allianz Care offers different plans starting at $120 per month, with customization options to include additional services. On their website, they themselves propose for digital nomads their short-term Flexicare Plan. For stays of more than 12 months, they recommend taking out short-term international health insurance.

Flexicare Plan Coverage and Services

You can choose between a three, six or nine month policy. The most outstanding coverages are:

- Doctor and hospital visits

- Immunizations

- Surgeries

- Diagnostic tests

- Prescription drugs

- Cancer treatment

- Option to add a repatriation benefit

| Advantages | Disadvantages |

| International coverage and extensive hospital network | High costs for comprehensive plans |

| Variety of plans with customization options | Does not include pre-existing conditions |

| Multilingual care and prompt reimbursement | Excludes cosmetic treatments |

SafetyWing

This Norwegian insurer, founded in 2018, offers an innovative approach to cover the specific needs of digital nomads and remote workers. It includes global medical coverage, ideal for those who do not have a fixed residence and are looking for flexibility in their policies. SafetyWing is popular among digital nomads because its monthly subscription model allows for automatic renewal. It also has an app that allows for quick and easy policy management. As well as access to 24-hour customer service.

SafetyWing is designed with those who live outside their home country for long periods in mind. It offers worldwide coverage. Plus, it will cover you in your home country for up to 30 days. Your unique plan renews month to month.

Coverage and services

Includes essential coverages such as emergency medical consultations, hospitalization, surgery and evacuation in serious cases. Does not cover pre-existing conditions or preventive treatment, but does offer access to a network of hospitals worldwide.

- Consultations and emergency medical care

- Hospitalization, surgery and intensive treatment

- Emergency evacuation and repatriation

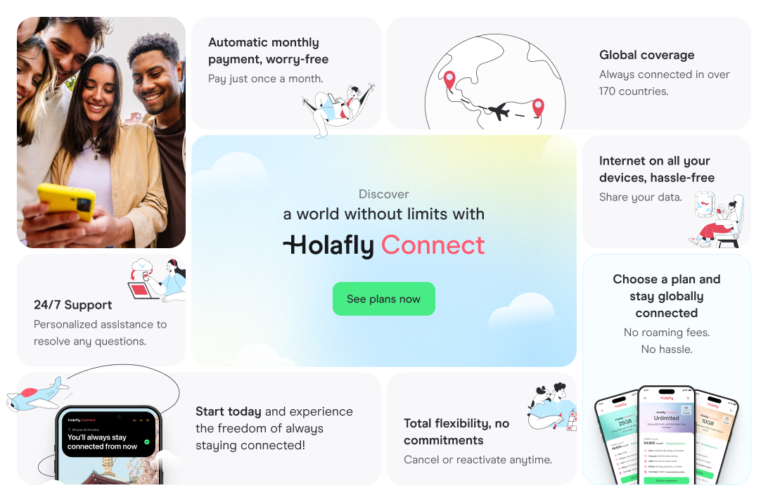

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Plans and pricing

SafetyWing offers a standard policy at a cost of $45. However, if you want it to be valid in the USA, you will have to contract a special one, at a price of $83 per month.

| Advantages | Disadvantages |

| Global care and 24/7 service | Excludes pre-existing conditions |

| Temporary coverage in country of origin | Does not include preventive medicine |

| App management and automatic monthly renewal | Limited to emergency services |

Bupa Global

Founded in 1947 in the United Kingdom, Bupa Global has become one of the world’s leading international health insurance providers. It has a presence in more than 190 countries. It is known for its comprehensive healthcare service and commitment to the long-term health of its policyholders. It offers quality solutions for those seeking medical coverage anywhere in the world.

Bupa’s insurance is particularly attractive to digital nomads and expatriates thanks to its extensive network of hospitals and clinics. This allows quick access to medical care in different regions. Multi-language support and an intuitive application for managing policies and reimbursements make life easier for those who are constantly on the move.

Plans and prices

Bupa Global has several plans tailored to the needs of digital nomads. Prices start at $150 per month, with the ability to customize coverage based on length of stay and type of care desired. One of the recommended plans is Worldwide Health Options, which allows you to include or exclude specific coverage such as maternity, medical evacuation and dental coverage, adapting to your budget and individual needs.

Worldwide Health Options Plan Coverage and Services

This plan is especially suited for digital nomads seeking comprehensive and flexible health coverage. Some of the most outstanding coverages include:

- Medical consultations and hospitalization

- Treatment of chronic and long-term illnesses

- Diagnosis of serious illnesses, including coverage for cancer treatment

- Alternative and wellness therapies, such as physical therapy

- Emergency medical evacuation coverage

- Option to add dental and vision coverage

| Advantages | Disadvantages |

| Global coverage with high quality services | High prices for comprehensive coverage |

| Access to hospitals and specialists worldwide | Does not cover pre-existing conditions in all plans |

| Multilingual customer service | Requires detailed review for customization |

Cigna Global

Headquartered in the United States with more than 60 years of industry experience, Cigna is one of the world’s largest insurance companies. It markets international health insurance that is tailored to the needs of digital nomads and expatriates. It stands out for its extensive network of medical providers, which allows policyholders to access quality care almost anywhere in the world. Its app makes it easy to manage the policy, access medical consultations and request reimbursements in an agile way.

Cigna Global offers customized plans for travelers and digital nomads. Allowing coverage to be added or removed according to the specific needs of each policyholder. While not all policies include adventure sports coverage, its flexibility and multilingual support make Cigna Global an attractive option for those seeking protection while working and traveling.

Plans and pricing

Offers plans starting at $72 per month, price will depend on coverage and location. Plans are customizable, options such as repatriation, emergency evacuation and mental health coverage can be included.

Coverage and services

- Emergency medical care and hospitalization

- General and specialist consultations

- Critical illness and transplant coverage

- Repatriation and medical evacuation services in critical situations

| Advantages | Disadvantages |

| Wide international network coverage | Can be costly in countries with high demand |

| Customizable plans according to needs | Not all adventure activities are covered |

| Multilingual support and management app | Requires medical evaluation in some plans |

IMG Global

IMG Global, founded in 1990, is a renowned insurer specializing in medical plans for travelers, expatriates and digital nomads. Headquartered in Indianapolis, USA, it has a network of more than 17,000 providers worldwide and a wide range of plans offering everything from basic coverage to premium options with emergency protection. IMG stands out for its intuitive policy management platform and 24/7 support.

It allows digital nomads to contract from basic plans to options that include medical evacuation and repatriation. The ability to purchase temporary or annual policies makes it an excellent option for those seeking protection without long-term commitments. It is ideal for nomads who need reliable medical coverage for emergencies, general consultations and hospitalization services.

Plans and pricing

IMG Global plans start at around $50 per month for basic coverage. They increase with additional services. Its Patriot Travel Medical plan, ideal for short trips, is a popular choice among digital nomads. On the other hand, its Global Medical plan covers long-term stays.

Coverage and services

- Emergency medical care and hospitalization

- Evacuation and repatriation coverage

- Specialist consultations and diagnostic services

- Maternity and mental health coverage options in advanced plans

| Advantages | Disadvantages |

| Affordable plans and affordable basic coverage | Excludes some adventure activities |

| Extensive network of providers worldwide | Extended coverage has high costs |

| Easy reimbursement and 24/7 customer care | Maternity coverage is only in advanced plans |

What is the best health insurance for digital nomads?

Still undecided? That’s normal. Choosing such an important service, especially if you have never contracted anything similar, can be complicated. Although all the ones you see in the list above are good options, after analyzing the opinions and experiences of other digital nomads, we could say that the SafetyWing insurance company stands out as one of the best options. In addition to being created with remote travelers in mind, it offers a flexible and affordable plan that covers the basic needs of digital nomads with global coverage options and medical support in several languages. But not only does it offer full medical coverage in different countries, it also stands out for its monthly subscription payment model.

Here are some key points of SafetyWing and other comparable insurances:

- Global coverage: SafetyWing offers coverage in almost every country in the world, including emergencies in your home country for a limited period, which is essential for digital nomads.

- Affordable cost and flexibility: With monthly payments and no renewal commitment, it is an economical plan that makes it easy to adapt to the budget and planning needs of travelers.

- Telemedicine: SafetyWing includes coverage for access to virtual medical consultations, a practical tool for those seeking to resolve doubts without going to medical centers.

- Adventure sports coverage: While SafetyWing covers adventure sports in some situations, those who frequently engage in risky activities may need more specialized coverage.

| Medical Insurance | Geographic Coverage | Emergency Medical Assistance | Hospitalization | Telemedicine | Estimated Monthly Cost | Flexibility |

| SafetyWing | Worldwide (except some countries) | Yes | Yes | Yes | From $45 | High |

| Bupa Global | Broad in more than 190 countries | Yes | Yes | Yes | From $150 | Medium |

| IMG Global | Comprehensive, with worldwide coverage options | Yes | Yes | Yes | From $100 | Low (annual) |

| Allianz Care | Worldwide (with high coverage in EU and USA) | Yes | Yes | Yes | From $80 | Medium (Semiannual) |

| Cigna Global | Worldwide, with expatriate focus | Yes | Yes | Yes | From $150 | Low (annual) |

SafetyWing stands out as the best insurance for digital nomads due to its balance between comprehensive coverage, payment flexibility and access to essential services such as telemedicine.

Frequently asked questions about the best health insurance for digital nomads

When choosing insurance, you should consider comprehensive coverage, cost, ease of obtaining medical care abroad, ability to pay monthly, telemedicine coverage, and assistance in emergency situations such as evacuations. Be sure to also check the coverage for adventure sports if you practice them, and the availability of medical consultations in several languages.

Telemedicine allows for online medical consultations without the need to travel to a hospital or clinic. In many digital nomad insurances, such as SafetyWing and Allianz, this service is included for basic consultations, diagnosis and treatment recommendations, facilitating access to medical care from anywhere.

Some insurances such as SafetyWing offer emergency coverage in the home country for a limited period (usually 30 days), which can be useful if you return briefly and need care. However, this coverage is not as extensive as what is offered abroad.

Yes, but it depends on the plan. Some insurances, such as World Nomads, have coverage for risk and adventure sports. If you are active in sports such as diving, skiing or extreme hiking, it is important to check the conditions to make sure you are covered for these activities.

The cost varies by provider and type of coverage. SafetyWing, for example, has prices starting at $45 per month. Other options such as IMG Global or Cigna Global can exceed $100. Remember to compare prices and coverage to find the insurance that best fits your budget and needs.

In insurances such as SafetyWing, the monthly payment allows you to contract the insurance only for the time you need, without committing to a full year. This modality is convenient for nomads, as you can cancel the insurance at any time if your travel plans change.

Dental coverage in these insurances is usually limited and generally only covers emergency treatment. If you need full dental treatment or maintenance, it may be necessary to take out separate dental insurance or look for insurance that includes advanced dental services.

Language

Language

No results found

No results found