Best USA Travel Insurance in 2025

Find the best USA travel insurance for comprehensive coverage and how to remain connected during your trip. Compare plans now!

When you travel to any place in the world, it is advisable to purchase travel insurance beforehand, both for safety and international travel requirements. In this case, we want to look at the best USA travel insurance. You have to keep in mind things like coverage and out-of-pocket expenses.

But this is not the only type of coverage you’ll need when you’re out of the country. You’ll also need internet access. As with travel insurance, you have to check several aspects of the plan or package that you choose. Coverage is one of the most important, as are rates and services included. Continue reading to find out more about the best USA travel insurance and the best way to connect in the States.

+1M

+1M

With Holafly, you save +30% compared to roaming fees

Plans that may interest you

Why should I get travel insurance?

Travel insurance is an important part of trip planning. It provides financial protection and peace of mind in the event of an unexpected situation during your vacation. For starters, it protects your travel investment by covering unforeseen situations that may compel you to cancel or disrupt your plans. This can include unexpected illness, a family emergency, or bad weather that makes your destination unreachable.

Second, travel insurance provides medical coverage, which is essential when traveling internationally. If you get sick or end up in an accident while traveling, medical costs can quickly mount. This is especially true if you require hospitalization or emergency medical evacuation. Travel insurance can assist in covering these expenses, ensuring that you receive necessary medical treatment without incurring significant financial problems.

Additionally, travel insurance covers lost or delayed baggage. Losing or delaying your luggage can be a huge inconvenience, but with insurance, you can receive the monetary value of your lost possessions. You may also be entitled to assistance while your bags are being located. This perk can greatly reduce the stress and headaches caused by lost or delayed luggage.

Furthermore, travel insurance frequently includes services such as travel support. These services can be quite useful if you run into problems when traveling, such as language hurdles, travel document replacement, or emergency monetary help. 24-hour support from your travel insurance provider can really be a lifesaver during unexpected situations.

What to check for in the policy?

Now that you’ve read an overview of what a travel insurance policy entails, there are several aspects to investigate. When comparing insurance policies, like anything else, you want to set them side by side and scrutinize the details. Here are some important things to look for in a travel insurance policy:

- Trip Cancellation and Interruption: The policy should cover trip cancellation and interruption due to unanticipated situations such as illness, injury, natural disasters, or others. Check the covered cancellation reasons to file a claim and the reimbursement limits.

- Medical Coverage: Sufficient medical coverage must be included, particularly if traveling to a country with high healthcare costs. Check for emergency medical bills, hospitalization, medical evacuation, and repatriation coverage. Generally, a coverage of 30,000 dollars or euros is required at a port of entry. This section includes emergency services and pre/existing conditions.

- Baggage Coverage: This coverage that will reimburse you for lost, stolen, or delayed luggage. Check reimbursement limits and whether it covers necessary items you may need to purchase if your baggage is delayed.

- Travel Delay: This part of the policy covers expenses incurred as a result of travel delays, such as lodging, meals, and transportation.

- Exclusions: Read the policy exclusions carefully to understand what events or conditions are not covered. Risky activities, self-inflicted injuries, and certain pre-existing medical conditions are common exclusions.

- Limits and Deductibles: Review the policy’s coverage limits and deductibles you may be required to pay before the coverage begins.

- Claim Procedures: Read thoroughly the terms and conditions to comprehend how to carry out the claim process. Make sure you have all the documentation required.

Travel insurance providers

International Medical Group is an acclaimed insurance company that offers a range of insurance policies for visitors in the USA. They specialize in providing international medical insurance and travel insurance options for individuals and families visiting the United States.

IMG offers several insurance policies structured to the needs of visitors, including:

- Visitors Insurance: IMG’s Visitors Insurance provides coverage for non-U.S. residents traveling to the USA for a temporary period. This policy offers medical coverage for illnesses and injuries, emergency medical evacuation, repatriation, and coverage for trip interruption or cancellation.

- Patriot America Plus: This is a comprehensive travel medical insurance plan designed for those visiting the United States. It provides coverage for emergency medical expenses, hospitalization, emergency medical evacuation, and repatriation. The plan also includes additional benefits such as coverage for trip interruption, lost baggage, and emergency dental treatment.

- Patriot Platinum America: This particular policy a premium travel medical insurance plan offering higher coverage limits and additional benefits. Besides the comprehensive medical coverage, it includes coverage for acute onset of pre-existing conditions, durable medical equipment, pet return, and emergency dental treatment.

IMG’s insurance policies typically include 24/7 emergency assistance services, access to a network of healthcare providers, and multilingual customer support. Policyholders can submit claims online or through a dedicated claims assistance team. To get additional information, click here.

Trawick International

This insurance company offers travel insurance coverage to visitors to the United States. They have several insurance alternatives among their products and services that adjust to the needs of foreign travelers. Trawick International and its travel insurance plans are summarized below:

- Safe Travels USA Insurance: This package is a complete travel insurance plan for people and families traveling to the United States. It covers medical bills, emergency medical evacuation, remains repatriation, trip disruption, and baggage loss. This itinerary is appropriate for tourists, business travelers, and relatives visiting loved ones in the United States.

- Safe Travels International Insurance: Safe Travels International is a travel insurance plan created for non-residents of the United States who are traveling outside their native country, including vacations to the United States. It covers medical bills, emergency medical evacuation, trip cancellation, and baggage loss. This package is suitable for foreign travelers who need coverage in several countries, including the United States.

- Safe Travels Elite: The plan provides higher coverage limits and extra features, making it appropriate for travelers wanting enhanced safety while visiting the United States. The Safe Travels Elite plan, with its extensive coverage and flexible options, provides travelers visiting the United States with tranquility and financial security.

Trawick International provides optional add-ons that policyholders can include to increase their coverage. Coverage for hazardous activities, sports-related injuries, and enhanced accidental death and dismemberment compensation are examples of optional coverage.

Comparing different insurance providers and their plans is recommended to guarantee you get the greatest coverage for your needs. Consider the insurance company’s reputation, client reviews, pricing, and the degree of customer service provided.

It is critical to properly study the policy material and to contact Trawick International directly if you have any specific questions or concerns about their insurance plans and coverage.

Which insurance has the most coverage?

The previously mentioned insurance companies are just a couple of all the providers out there, available for your travels to the USA. Regarding the one with most coverage, both offer plans and packages with excellent comprehensive protection, however, Tradwick does offer additional add-ons for very specific scenarios.

What’s the best insurance price?

Prices are a huge factor for customers, nonetheless, keep in mind that the final price that you are charged is not just represented by the amount you pay. You have to keep in mind coverage, limitations and the claim process. Determinant factors are things like where the traveler comes from, where they’re going, age, number of defendants and so much more. In the end, the insurance with the best price is the one that covers everything you need from a macro perspective all the way to the nitty-gritty.

How do I stay connected?

When you travel, you definitely want to have an internet connection. The benefits of getting data abroad outweigh the cost by a hundred-fold. You want to share your adventure on social media, let your family know you’re okay and most of all, you would like to be able to navigate your destination with ease. What better way than getting data on your phone?

There are plenty of options to connect abroad. There’s always the traditional local USA SIM card that you can get from a local operator. The downside is that you’ll most likely have to go in person and you won’t have a connection as soon as you land. The pocket WiFi for the USA can also help you and your travel companions connect and get a stable network. However, these are expensive and everything is paid separately, like the device rental, the shipping, the data plan and even loss or damage insurance.

>Got an insurance? Get to know the best destinations to visit on the Weekends in the USA!<

International eSIMs

On innovative connection alternative is the embedded SIM card. This chip comes installed from the factory on high-end phones. They have become a very popular alternative for travelers nowadays. Perhaps this is not an insurance policy, but it is a connection insurance. This eSIM for the USA is easy to get online or through official apps. You can learn more about what is eSIM card with us.

The only requirement for an eSIM is to have a compatible phone with open bands and an email address. This is what most digital SIM providers ask for. The good thing is that there’s no change of loss or theft since there’s no plastic involved.

Holafly

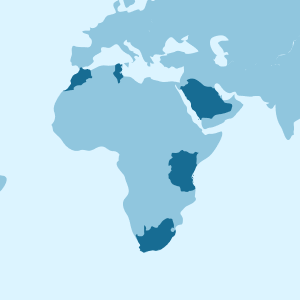

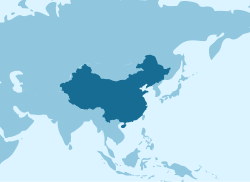

One of the best eSIM for the USA providers is Holafly; they have expanded from Europe to provide internet access to travelers for over 200 destinations around the world. You can easily get one of their products through their website or on their user-friendly app. And with plenty of payment methods available (Visa, Mastercard, PayPal, Apple Pay and Google Pay), you’ll be good to go in not time!

Buy your eSIM by visiting the website and selecting your destination; from there, you can choose the plan or bundle that best suits your needs, and you’ll receive the QR code in minutes! After a quick set up process, you’ll be connected in no time. Remember you can also carry out this process throughout the app in just a few minutes.

Pay

Pay  Language

Language  Currency

Currency

No results found

No results found