Taxes in Cyprus for digital nomads: What do you pay?

If you’re moving to this Mediterranean island, you need to know what the taxes are for a digital nomad in Cyprus. You’ll be surprised.

If you’re planning to live in Cyprus for a period of time while working remotely, you need to be aware of the tax obligations to which you’re subject and, why not, whether you enjoy any benefits in this respect. Foreigners make up more than 15% of the population and there is more to it than just island life. Stay tuned to find out about the taxes of a digital nomad in Cyprus, because taxes do not take a holiday in the Mediterranean.

How do taxes work for a digital nomad?

The tax system for digital nomads in Cyprus varies depending on whether you’re considered a tax resident and the nature of your income. When settling in Cyprus, it’s important that you register with the Cyprus Revenue Authority and obtain a Tax Identification Number (TIC). Another aspect that influences your tax obligations is to determine whether your income is derived from international or local customers. To better understand this issue in general terms, please visit our article on taxation for digital nomads.

Which law governs taxation for digital nomads in Cyprus?

In Cyprus, the tax legislation governing the tax obligations of individuals, including digital nomads, is found in the Income Tax Law and the Special Defence Tax Law (SDC).

- Income Tax Law: Sets progressive tax rates applicable to personal income. For the tax year 2025, the first €19,500 ($21,126.65) of annual income is exempt from taxation. Above this amount, tax rates vary between 20% and 35%, depending on the level of income.

- Special Defence Tax Law (SDC): This tax applies to tax residents who are also domiciled in Cyprus and are taxed on passive income such as dividends, interest and rents. However, those who obtain Non-Domiciled status are exempt from this tax.

When do I have to start paying taxes in Cyprus?

The obligation to pay tax in Cyprus is directly related to the tax residencystatus. According to Cypriot regulations, a person is considered a tax resident if they meet any of the following conditions:

- 183-day rule: Stay in Cyprus for more than 183 days during a calendar year.

- 60-Day Rule: Introduced to provide greater flexibility, this rule states that a person can be considered a tax resident if they: stay in Cyprus for at least 60 days during the year, aren’t a tax resident in any other country, maintain a residence in Cyprus (owned or rented), or have economic ties to Cyprus, such as employment, business involvement, or being a director of a company registered in the country.

On the other hand, Cyprus implemented the digital nomad visa, which allows you to reside in the country while working remotely if you are not an EU/EEA citizen. If you spend more than 183 days in the country during a year with this immigration status, you’re already a tax resident. This means that you’ll have to declare and pay tax on your overall income. This visa doesn’t introduce direct tax benefits, but it facilitates legal stay and can be a first step to access tax benefits.

Tax benefits in Cyprus

For digital nomads, Cyprus is a place to enjoy the sun and it’s also a tax haven! There are tax exemptions and reductions in several cases from which you could benefit and which are a helping hand for any pocket.

1. Non-Domiciled Regime (Non-Dom)

One of the major advantages in Cyprus is the “Non-Domiciled” (Non-Dom) regime. Basically, if you become a tax resident, you can be exempt from Special Defence Duty (SDC) for the first 17 years. What does this mean? That you’ll only declare taxes on your salary but not on certain passive income, such as:

- Dividends: The earnings you receive from being a shareholder of a company.

- Interest: The extra money you earn from having your savings in the bank or investing.

- Rents: The income you get if you rent a property.

To qualify for this regime, you must spend at least 60 days a year in Cyprus, not be a tax resident in another country and maintain a home on the island.

2. Exemptions for remuneration for employment

Cyprus offers tax exemptions for individuals starting employment in the country:

- 50% exemption: If you move to Cyprus for work and earn more than €100,000 ($108,362) a year, you can halve your tax for 10 years.

- 20% or €8,550 ($9,263) exemption: If you earn less than €100,000 ($108,362) per year, you can pay less tax with this exemption (20% of your income or €8,550 ($9,265) whichever is less). Applies for five years for jobs started between 2012 and 2025.

- 100% exemption: If you work outside Cyprus for a foreign company or an international branch for more than 90 days a year, you won’t pay tax on that income.

3. Reduced corporate income tax rate

If a digital nomad decides to establish a company in Cyprus, they’ll benefit from one of the lowest corporate tax rates in Europe, set at 12.5%. In addition, double taxation treaties between Cyprus and other countries favour international operations and minimise the tax burden.

How much should to pay taxes as a digital nomad in Cyprus?

If you decide to reside in the country, the quality of life and the tax regime are favourable and very competitive factors that you’ll still not be able to avoid. These are a digital nomad’s taxes in Cyprus:

1. Income Tax (IT)

- Income tax rates are progressive. The first €19,500 ($21.138) of income is tax-free. The tax rate starts at 20% (for income over €19,500 ($21.138)) and goes up to 35% (for income over €60,000 ($65.042)).

- Non-residents: Taxed only on income generated in Cyprus.

| 20% for income between €19,501 and €28,000 ($21.142-30.359) |

| 25% for income between €28,001 and €36,300 ($30.359-39.357) |

| 30% for income between €36,301 and €60,000 ($39.357-65.053) |

| 35% for income over €60,000 ($65.053) |

2. Social security contributions

- If the nomad works for a Cypriot company or is self-employed and registered in Cyprus, he/she will have to pay into the social security system.

- The contribution is 20.4% , which is broken down into 16.4% for Social Security and 4% for the General Health System (GESY) for the self-employed. If you’re employed by a company, they cover part of the cost.

3. Value Added Tax

VAT isn’t levied directly on the personal income of digital nomads, but on the services or products they offer to their customers, depending on whether they are registered as a self-employed person or a company. Here’s what you need to keep in mind:

- You’re obliged to register if your annual turnover exceeds €15,600 ($16.912) in Cyprus. Once registered, you must collect VAT from your customers (where applicable), file quarterly returns and remit the VAT collected to the Cypriot government.

- If your annual turnover is less than €15,600 ($16.912) you aren’t obliged to register.

- If you work with B2B clients (companies) within the EU, you can register as an intra-EU trader. This allows you to issue VAT-free invoices as long as the customer has a valid VAT number in their EU country.

- If you work with B2C (private) customers within the EU you must charge VAT to the customer according to the rules applicable in their country (this is more relevant for digital services or products sold to final consumers).

4. Special Defence Duty (SDC)

- If you are a tax resident and don’t qualify as a Non-Dom, you’ll have to pay SDC on all passive income, regardless of where it’s generated (Cyprus or abroad).

- If you have no passive income (only active income, such as salary or freelance services), you won’t be subject to SDC, as this tax is only levied on passive income.

Double taxation and agreements with Cyprus

Cyprus made sure that paying taxes is not a double torture for digital nomads and people working internationally. How? Signing agreements with over 60 countries to avoid double taxation.

In other words, if you’ve already declared your taxes in one of these countries, you won’t have to pay the same in Cyprus (or vice versa).

- Spain: The agreement between Spain and Cyprus avoids double taxation and prevents tax evasion in the field of income and wealth taxation.

- United Kingdom: A new agreement based on the 2014 OECD Model Tax Convention for the avoidance of double taxation of income and wealth.

- USA: There’s a Double Taxation Avoidance Agreement (DTAA) between the USA and Cyprus to avoid double taxation on income, including wages, dividends, interest and royalties.

Where can I get advice before paying taxes as a digital nomad in Cyprus?

Navigating the Cyprus tax system can be as complicated as assembling a piece of furniture without instructions. To avoid ending up with leftover parts (or in this case, unexpected fines), we advise you to seek professional advice. Below you’ll find some options for personalised advice:

| Consultancy | Services | Channels of communication |

| Captain Tax | – Tax and accounting advice. – Tax management for companies and individuals. – International tax optimisation services. – Tax returns, accounting and auditing. – Assistance for Cyprus tax residents and relocation programmes. – Advice on company formation. | – Website: capitantax.com. – Email: contacto@capitantax.com. – Schedule a 40 minute or 1.5 hour phone call. |

| Living in Europe | – Consultancy for living and working in Cyprus. – Advice on obtaining residence permits and visas. – Tax management for expatriates. – Recommendations on financial and banking services in Cyprus. – Advice on business relocation. | – Website: vivireneuropa.eu/servicios-chipre/. – Forms for online counselling – Telephone: +39 3332884044. |

| Philippou | – Tax and accounting consultancy. – Tax planning services for individuals and businesses. – Mergers and acquisitions consultancy. – International tax compliance services. – Tax optimisation strategies for European and foreign citizens. | – Website: philippoulaw.com. – Telephone: +E-mail: info@philippoulaw.com. |

How to connect to the internet as a digital nomad in Cyprus?

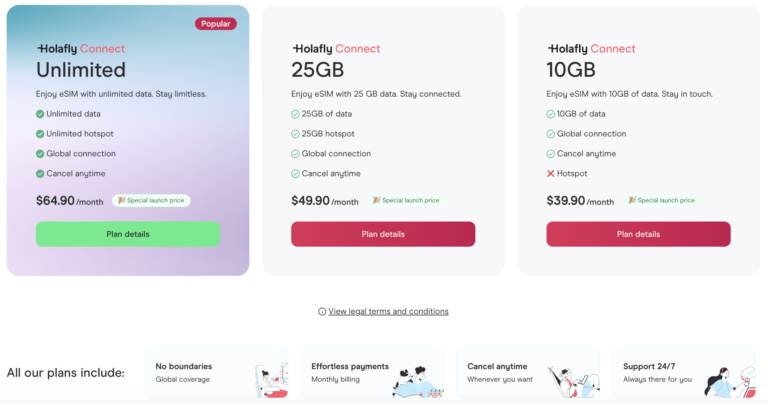

Holafly Connect is the perfect solution for you! With unlimited data plans, you can surf, share your adventures and stay connected in Cyprus and more than 200 destinations around the world. Don’t waste time looking for Wi-fi! Purchase a Holafly Connect plan from 10GB up to unlimited GB and enjoy 30 days of Holafly Connect:

- Global connection.

- Zero roaming charges.

- Connection on multiple devices without changing or buying physical chips.

- 24/7 support.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Frequently Asked Questions about taxes for digital nomad in Cyprus

It depends on your residency status. If you’re a tax resident, you will be subject to Personal Income Tax on a progressive scale. In addition, the self-employed must contribute to the Social Security System and the GESY (Public Health System), with a total contribution of 20.4% of the estimated income.

Non-Dom status in Cyprus refers to individuals who, although they’re tax resident in Cyprus, aren’t domiciled in Cyprus according to local legislation

To obtain tax residency in Cyprus, you must comply with the 60-day rule, which involves spending at least 60 days in the country during the tax year, not being tax resident elsewhere and having a property or lease in Cyprus.

Exemption from Special Defence Tax on dividends, interest and income, as well as from tax on capital gains derived from the sale of shares.

Yes, digital nomads in Cyprus may be subject to Value Added Tax (VAT), especially if they offer services or sell products in the country.

Language

Language

No results found

No results found