Travel insurance for Turkey: Which should we choose?

There are many travel insurances for Turkey. But do you know which one is the best? We'll help you find out!

For some time now, Turkey has become a top destination for many travelers and digital nomads. Why’s that? Simply because the country has it all. Many dream of strolling through the streets of Istanbul, often considered one of the most beautiful cities in Europe, or witnessing the stunning rock formations of Cappadocia (and why not? Taking a hot air balloon ride). Without a doubt, this country—half Asian, half European—offers everything for an unforgettable vacation or an extended stay. But what if something unexpected happens? In that case, taking out a travel insurance for Turkey is a solution for any health problems or accidents that may occur.

So if you’re planning a trip to Turkey, having the right travel insurance is essential. Among the many options available, IATI Seguros stands out for its comprehensive coverage and its focus on travel assistance, but it isn’t the only one. That’s why today we’re taking a deep dive into the best travel insurance options for Turkey and giving you our take on which one you should choose.

Why take out travel insurance for Turkey?

Turkey is a fascinating and diverse destination, but like any trip, unexpected situations can arise—from medical issues to lost luggage or delayed flights. Whatever the case may be, a travel insurance policy will protect you from these setbacks.

Plus, it’s important to keep in mind that medical expenses in Turkey can vary significantly, with some treatments costing thousands of euros if you don’t have a valid insurance policy. Although Turkey is a very advanced country, public health care isn’t the same as in the more westernised countries of Europe, so it is better to go to private health care. You definitely wouldn’t want to spend the money you had set aside for a hot air balloon ride over Cappadocia on medical expenses instead.

In fact, the Ministry of Foreign Affairs repeatedly emphasizes on its website the importance of travelling to Turkey with medical insurance that also covers repatriation, as the European Health Insurance Card does not apply in the country. In other words, the moment you leave your home country, you are no longer covered by Social Security.

And let’s be honest—once you arrive in Turkey, you’ll likely want to dive into plenty of outdoor activities! While the mosques can be very attractive, the country is very popular for nature-based activities. In that case, it’s always best to be covered in case of any accident. Let’s not forget the food—delicious, no doubt, but it might not sit well with more sensitive stomachs.

As you can see, just like with any trip, having insurance is essential to avoid spending money on medical assistance that you could otherwise use for excursions or other activities.

What should a travel insurance for Turkey cover?

Choosing the best travel insurance can be tricky, especially when there are so many options on the market. Therefore, we recommend that you take the time to analyse it, that you always read the fine print and that you make sure that the policy doesn’t oblige you to pay an excess.

Another important aspect to take into account is language. Can you imagine suddenly having to explain your disease to a doctor in Turkish? In that sense, having customer support in different languages is a big plus, especially if you’re not fluent in English.

As you can see, there are many factors to consider when choosing the best travel insurance for Turkey. If you’re not sure where to start, here’s a list of essential coverages your policy should include to ensure you’re fully protected:

- Medical coverage: Access to quality healthcare in case of accident or illness. Ideally covering over €500,000 ($517,156.67 US). If you are travelling to Turkey for a hair transplant or a similar elective procedure, check if your insurance covers this.

- Repatriation and evacuation: In case you need emergency transportation to your home country.

- Lost or stolen luggage: This is something that often arises during travel. That’s why the policy should offer financial protection in case your belongings are lost or stolen.

- Flight delays: Also quite common too. Make sure you get compensation if your flight is delayed or cancelled.

- Coverage for adventure activities: Turkey offers countless outdoor activities, so your insurance should cover any accidents related to them.

- 24/7 assistance: Round-the-clock support in case of emergencies (and if it’s in your language, even better!).

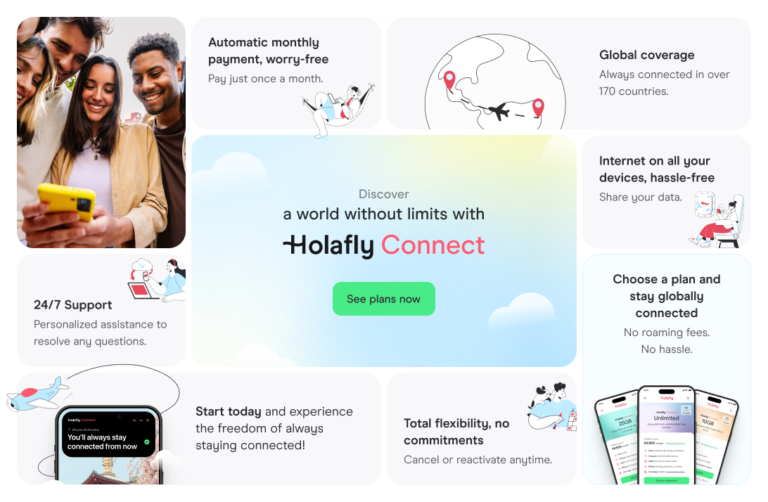

What about Internet connection? Just like having travel insurance is essential, staying connected during your trip to Turkey is just as important. For that, Holafly’s eSIM will be your best ally.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

Comparing the best travel insurance for Turkey

As you already know, a good travel insurance for Turkey shouldn’t only cover medical expenses but also provide assistance for lost luggage, flight delays, or accidents. Fortunately, most insurance agencies do. The problem is that with so many options it can be difficult to choose the best one. Bear in mind that each one has different features and coverages, so you’ll have to carefully consider which one best suits your idea of travel.

Below, we offer a comparison of the best travel insurance for Turkey (including different plans), taking into consideration several features such as cost, medical coverage, 24/7 assistance and other that will help you choose the option that best suits your needs.

| Feature | IATI Seguros (IATI Backpackers) | Chapka (CAP TRIP Basic) | Allianz (Light) | AXA (Mini) | HeyMondo (Ease of Mind Travel) |

| Price (7 days) | €33 ($34.13 US) | €20.40 ($21.10 US) | €59.16 ($61.19 US) | €40.68 ($42.08 US) | €24.59 ($25.43 US) |

| Medical coverage | €500,000 ($517,167.50 US) | €250,000 ($258,583.75 US) | €10,000 ($10,343.35 US) | €25,000 ($25,858.38 US) | €500,000 ($517,167.50 US) |

| Repatriation | 100% | 100% | 100% | 100% | 100% |

| Lost or stolen luggage | €1,500 ($1,551.50 US) | €800 ($827.47 US) | €400 ($413.73 US) | €500 ($517.17 US) | €1,500 ($1,551.50 US) |

| Flight delay | €270 ($279.27 US) | €150 ($155.15 US) | €100 ($103.43 US) | Not included | €200 ($206.87 US) |

| 24/7 assistance | Yes | Yes | Yes | Yes | Yes |

| Civil liability | €60,000 ($62,060.10 US) | €40,000 ($41,373.40 US) Deductible: €150 ($155.15 US) | €10.000 ($10,343.35 US) Deductible: €90 ($93.09US) | €10,000 ($10,343.35 US) | €60,000 ($62,060.10 US) |

| Sports coverage | Yes | No | No | Optional: +€33.61 ($34.76 US) | Basic |

| Trip cancellation | Optional: €3,500 ($3,620.17 US) | Optional: up to €2,000 ($2,068.67 US) | Optional: €1,500 ($1,551.50 US) | Optional: €1,000 ($1,034.34 US) | Optional: €3,000 ($3,103.01 US) |

The 5 top travel insurances for Turkey

Let’s take a closer look at the travel insurances for Turkey mentioned in the table, including the pros and cons in each case. That way, we help you get a clearer picture of what each option offers.

1. IATI Seguros

IATI is a trusted option for travellers planning to explore Turkey for several reasons, especially its excellent value for money. In fact, it’s the insurance we recommend most for this type of adventure.

With IATI, you’ll get medical coverage, repatriation, and protection for outdoor activities. Its adventure sports coverage is a big plus, particularly for those planning activities in places like Cappadocia or the Turkish mountains. Additionally, you can handle any issues without having to pay upfront in most cases—an advantage not many insurers offer. In this case, the plan we recommend the most is IATI Backpacker, which not only offers medical coverage, but also covers for more than 60 outdoor activities.

- Pros: 24/7 assistance in different languages, outdoor insurance, competitive prices, plans for all types of travellers.

- Cons: The price may be slightly higher than other basic travel insurance plans for Turkey.

2. Allianz

The Allianz Light plan is a more basic travel insurance option that covers essential travel situations, but has some limitations in terms of specific coverages. For example, it offers 24/7 assistance, but not for extreme sports. This type of benefit is usually found in more comprehensive or specialised plans, as extreme sports are considered higher risk.

Allianz is known for its international coverage and high level of assistance worldwide, although its price is slightly higher compared to IATI.

- Pros: Good medical coverage, 24/7 assistance.

- Cons: No coverage for extreme sports in its most basic plans. Higher price compared to IATI Seguros.

3. AXA

AXA Assistance offers a good balance between price and quality and is ideal for those who are looking for comprehensive insurance but don’t need additional coverage such as adventure sports. For this type of service, you can take it out for an additional price. Its Mini plan is perfect for travellers looking for basic coverage.

- Pros: 24/7 assistance, repatriation coverage and protection against loss or theft of baggage.

- Cons: The AXA Mini plan doesn’t cover adventure sports or compensation for delayed flights or trips, something that other insurers do offer.

4. Chapka

The CAP TRIP BASIC plan offers extensive medical cover in case of illness or accident during the trip—essential for international destinations such as Turkey. Also includes repatriation coverage in case of emergencies, 24/7 assistance, and an affordable price. Just like the previous option, this plan can be ideal for those looking for essential coverage, but not for those who need extra protection for sports.

- Pros: Affordable price on its basic plan, 24/7 assistance, coverage for theft or lost luggage.

- Cons: Doesn’t offer coverage for extreme sports.

5. Heymondo

Another travel insurance for Turkey we look at today is Heymondo, an affordable option for those looking for basic but reliable cover. In addition to medical care, with the Peace of Mind Travel plan you’ll have 24/7 care and basic sports coverage. While there are better plans available, we consider this a valid option for travellers on a budget.

- Pros: Covers adventure sports and has an affordable price.

- Cons: Medical coverage is more limited compared to other plans.

It’s worth mentioning that in all cases, you can choose more comprehensive plans with higher coverage. Here, we present the most budget-friendly options or those we consider best suited for travellers, such as IATI Backpacker.

Which is the best travel insurance for Turkey?

As we have already mentioned, the travel insurance for Turkey that we recommend is that of IATI Seguros. There are many reasons for this, but we can mention its excellent value for money, the wide range of medical coverage offered by its different plans and the protection for adventure sports. In addition, its 24/7 multilingual service and ease of use in claims management make it ideal for travellers looking for a hassle-free experience.

With IATI’s Backpacker plan (or one of the others in its portfolio) you can venture out and discover Turkey. Whether you want to explore its stunning mosques or take on the Lycian Way—one of the world’s best hiking routes—you can do so with the peace of mind that you’re covered. Plus, it’s the only plan that includes coverage for hot air balloon rides, Capadocia’s must-do experience.

Another big advantage of IATI Seguros is that you won’t face any unexpected deductible costs. What does this mean? It means you won’t have to pay anything out of pocket. Be careful, though—many insurers operate this way and hide this detail in the fine print. Make sure your read the clauses carefully before taking out the contract.

Lastly, we can’t forget to mention that you have the option to add a Trip Cancellation Supplement. Unexpected events can happen, and if for any reason you have to cancel your trip, IATI Seguros will refund you up to €3,500 ($3,619.44 US). This means you can recover non-refundable expenses for accommodations or transportation.

With that said, it’s time to make your dream of visiting this incredible country a reality—and do it with the peace of mind that you’ve chosen the best travel insurance for Turkey.

Travel insurances for Turkey: Frequently Asked Questions

Travel insurance isn’t compulsory to enter Turkey, but is highly recommended. Medical and other unexpected expenses can be high, so insurance protects you in case of emergencies.

Not all, only some policies offer coverage for adventure activities such as hiking, paragliding or hot air ballooning, which are popular in destinations such as Cappadocia. It is therefore important that you choose a policy that includes cover for these types of activities if you plan to undertake one.

Yes, most travel insurance policies include coverage for COVID-19. This may include medical expenses related to the disease and, in some cases, cancellation of the trip if you test positive before departure.

In case you need medical assistance, you should contact the 24/7 emergency line of your insurance company, which will guide you on the procedure to follow. Some insurers pay clinics directly, while others require you to advance the costs and then claim them back.

If you lose your luggage, the first thing to do is to notify the airport. Next, contact your travel insurance company, as most policies offer coverage for lost or stolen luggage, and will compensate you for the lost value. Make sure you have proof of recovery to speed up the process.

Language

Language

No results found

No results found