Travel Insurance for Canada: All You Need to Know

Are you travelling to Toronto or another Canadian city? Take out insurance and minimise risk. Here we analyse the best travel insurance for Canada.

Canada is one of those destinations that has everything for nature and adventure lovers: Mountains, huge national parks, lively cities and opportunities to enjoy all kinds of sports. But, if you’re planning a trip to maple country, there’s one thing you can’t overlook: Travel insurance for Canada. Medical care and other essential services can be very expensive without the necessary coverage.

In this article, we’ll tell you everything you need to know about choosing the best travel insurance for Canada. We’ll explain why it’s essential to have this protection, what cover is essential and how to compare the best options on the market. Ready for safe and worry-free travel? Read on to find out which insurance is right for your Canadian adventure.

Why take out travel insurance for Canada?

Travelling to Canada without insurance is a gamble. Unlike other destinations, where medical care may be more manageable in cost, in Canada the prices of any medical service are surprisingly high. Can you imagine paying $3,000 US for a single night’s hospitalisation? Or maybe $600 US for a basic medical consultation. Even something as simple as an ambulance can cost more than $1,000 US in some regions.

But it’s not just medical care that can throw off the budget on a trip to Canada. Lost or stolen luggage is another common risk. Without adequate insurance, you may not recover even a fraction of what you lost. Canada is also the perfect country for adventure sports such as skiing and hiking in its iconic national parks, activities that carry extra risk. If you’ve an accident while sliding down the slopes of Whistler, the medical and rescue costs without cover can be impossible to afford.

In short, travel insurance for Canada is the safety net any traveller needs. Not only does it cover medical emergencies, it also offers repatriation, trip cancellation and 24/7 assistance (remember to sign up for your Holafly eSIM so that you’re always connected and can report any incident) in your language. These guarantees are essential in a country where the costs of any health service are among the highest in the world. You’ll be glad to be able to explore their landscapes or cities without worry and, most importantly, without astronomical bills in case of unforeseen events.

What should a travel insurance for Canada cover?

Having the right insurance when travelling to Canada is essential, but what’s really important when choosing coverage? The particularities of the country – its high medical costs and the popularity of outdoor activities – make it necessary to take into account certain key aspects to avoid mishaps. In other words, general medical cover isn’t enough: You need insurance that’s flexible and specific to cover possible risks, from emergency hospitalisation to loss of luggage in the middle of a trip.

That’s why a good policy for Canada should include comprehensive cover and back-up services at every stage of your trip. These are some of the main ones:

- Medical care: In Canada, medical care is expensive and hospitalisation costs can easily exceed $3,000 C ($2,098.27 US) per day. Make sure your insurance covers everything from basic consultations ($100-600/$72-431 C) ($69.93-419.63/50.35-301.42 US) to hospitalisation and complex procedures.

- Repatriation and emergency transfer: This cover guarantees that, in case of a serious accident or illness, the insurance will take care of your return to your country of origin, including ambulance or medical plane expenses. This is essential in a country like Canada, where distances are vast and travel can be expensive.

- Coverage for adventure sports: Canada is known for its mountain and snow activities and many policies require a special extension for adventure sports. This includes skiing, hiking and mountain biking accidents, among others.

- Lost or stolen luggage: This cover is vital, without it the traveller faces limited compensation from the airlines. Good travel insurance should offer at least $1,000 C ($718.57 US) to compensate for loss or damage.

- Civil liability: Protects you in case you cause damage to third parties during your trip, a relevant cover in a country where lawsuit costs can be high.

- 24/7 coverage in your language: If you’re not fluent in English or French, having assistance in your language ensures clear communication without misunderstandings.

Comparison of the best travel insurances for Canada

Once it’s clear that it’s essential to take out a good insurance policy for travelling to Canada, how do you choose between so many options? Given the wide variety of insurance coverage available, choosing the right one can seem complex. To help you, we’re going to review what the five best insurance companies in the market offer for this country, in this table you’ll see it much clearer:

| Coverage | Chapka (CAP TRIP Basic) | HeyMondo (Ease of Mind Travel) | IATI (Star) | AXA Assistance (Total) | Allianz Global Assistance (Standard) |

|---|---|---|---|---|---|

| Price (7 days) | €31.06 ($28.90) | €35.59 ($38.49) | €53.99 – ($58.38) | €58.07 ($62.80) | €44.69 ($48.33) |

| Medical expenses | €350,000 ($377,868) | €600,000 ($648,837) | €5,000,000 ($5,398,125) | €150,000 ($162,209) | €75,000 ($81,104) |

| Repatriation | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Lost or stolen luggage | €800 ($865) | €1,500 ($1,622) | €2,500 ($2,700) | €1,500 ($1,622) | €800 ($865) |

| 24/7 assistance | Yes | Yes | Yes | Yes | Yes |

| Trip cancellation | Optional | Optional | Optional | Optional | Optional |

| Coverage for adventure sports | Yes | Yes (Full mode) | Yes (Premium Adventure optional) | Sports insurance: €33.61 ($ 34.68) | No |

| Civil liability | €40,000 ($43,191). Deductible €150 ($162) | €60,000 ($64,883) | €60,000 ($64,883) | €30,000 ($32,441) | €30,000 ($32,441). Deductible €90 ($97) |

| Compensation for flight delay | Only at the beginning of the trip, up to €150 ($162) | €300 ($324) | €324 ($291) | €150 ($162) | €100 ($108) |

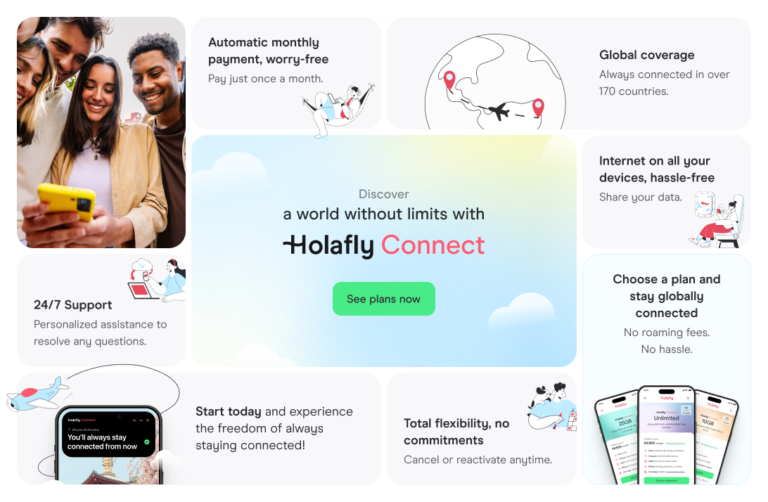

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. Travel without limits and connect easily and securely! 🚀🌍

The 5 best travel insurances for Canada

As you can see from the table above, although all travel insurance policies for Canada offer similar coverage, there are some that stand out in certain areas, such as the inclusion of adventure sports or the amount offered for medical expenses. Therefore, we wanted to take a closer look at what each insurance company offers and explain all the details you need to know about each one in order to make the right choice. Choose the insurance that best suits your needs to enjoy your adventure in Canada without worries.

IATI

IATI is known for its close and personalised service, ideal for those who prefer attention in their own language. With over 135 years of experience, it offers extensive emergency cover and reimbursement options, making it a reliable option for long or multi-activity trips. It’s also notable for its focus on adventure sports, an advantage for those looking to enjoy all that Canada has to offer.

In the case of Canada, the most recommended plan is IATI Star. Includes up to $5,000,000 US in medical expenses and covers adventure sports (optional Premium Adventure).

Main coverage:

- Medical expenses: From €100,000 ($105,465 US) for IATI Basic to €5,000,000 ($5,273,250 US) for IATI Star.

- Repatriation: 100 %

- Luggage loss: €500 ($515.38 US) for the basic plan, €2,500 ($2,576.91 US) for the Star insurance

- Adventure sports cover: Included in advanced plans. For white water, canyoning, rafting, cross-country skiing and other risky sports, you’ll need to take out the “Premium Adventure” clause in any plan.

- Refund for delays: €300 ($316 US) in IATI Star insurance.

Plans and prices:

- IATI Backpacker: €53.99 ($58.39 US) for 7 days.

- IATI Basic: €32.90 ($35.58 US) for 7 days.

- IATI Standard: €38.88 ($42.05 US) for 7 days.

- IATI Star: €70.87 ($76.64 US) for 7 days.

| Advantages | Limitations |

|---|---|

| 24/7 multilingual assistance | Doesn’t include coverage for pre-existing conditions |

| Extensive medical coverage | Lower medical coverage in basic plans |

| Sound coverage for adventure sports |

HeyMondo

HeyMondo is an ideal option for those looking for comprehensive and easy-to-manage insurance. It stands out for its global assistance, extensive coverage options and the advantage of not having to advance money in case of an emergency. In addition, its mobile app allows users to resolve incidents and access a 24/7 medical chat, ideal for those who prefer to have all the necessary support at their fingertips.

Main coverage:

- Medical expenses: Up to €600,000 ($648,837 US) for “Ease of Mind Travel” and up to €10,000,000 ($10,796,250 US) for “Premium Travel”.

- Repatriation: Unlimited.

- Lost or stolen luggage: Up to €1,500 ($1,622 US) for the Ease of Mind plan and up to €3,500 ($3,778 US) for the Premium plan. Up to €2,500 ($2,700 US) on the Top Trip fare.

- Adventure sports: Included in the Complete modality.

- Civil liability: €30,000 ($32.441 US)

Plans and prices:

- Essential Travel: €30.55 ($91.80 US) for 7 days.

- Ease of Mind Travel: €35.59 ($91,80 US) for 7 days.

- Top Travel: €57.18 ($61.82 US) for 7 days.

- Premium Travel: €76.01 ($82.18 US) for 7 days.

| Advantages | Limitations |

|---|---|

| High coverage in emergencies | Limited coverage for flight delay compensation |

| App for quick management | For extreme sports, you’ll have to pay for the “Full” option |

| Direct payment in hospitals | Higher plan prices somewhat higher than other options |

Chapka

Chapka is a highly reputable insurer. It has been simplifying the world of travel insurance since 2002 and offers rates adapted to various types of travellers. It’s particularly notable for its focus on adventure activities. Unlike other insurers, which tend to maintain the price regardless of the destination, it raises its rates somewhat for Canada.

Main coverage:

- Medical expenses: Up to €350,000 ($377,868 US). €1,000,000 ($1,081,395 US) for superior plans.

- Repatriation: Included.

- Lost or stolen luggage: Up to €800 ($865 US). €2,500 ($2,703 US) for superior plans.

- 24/7 assistance: Medical assistance at any time.

- Adventure sports cover: It includes activities such as hiking, diving, surfing or kitesurfing.

- Flight delay: Only at the beginning of the trip, up to €150 ($162 US) €1,500 ($1,622 US) for superior plans.

Travel insurance plans and prices for Canada Chapka:

- Cap Trip Plus: €41.37 ($42.68 US) for 7 days.

- Cap Basic: €31.06 ($32.05 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Affordable price for full coverage | Lower limits of medical coverage |

| Full basic coverage | Lower limit on luggage loss |

| 24/7 multilingual assistance | Doesn’t cover pre-existing conditions |

AXA

AXA is one of the strongest options for travellers looking for comprehensive, quality cover. With an extensive network of affiliated hospitals and emergency assistance, AXA is a reliable choice for those who value efficient service. Although its prices are higher, the Total Plus plan justifies the investment thanks to its coverage for major emergencies and repatriation.

For Canada, AXA offers Mini Insurance, which covers basic needs, and Total Plus Insurance, which includes adventure sports at an additional cost. The latter is ideal for those who plan outdoor activities and want full emergency assistance.

Main coverage:

- Medical expenses: Up to €150,000 ($162,209 US).

- Repatriation: Unlimited.

- Lost or stolen luggage: Up to €1,500 ($1,622 US).

- Adventure sports: Additional option €33.61 ($34.68 US).

- Civil liability: €30,000 ($32,441 US).

Plans and prices:

- Mini insurance: €37.65 ($40.82 US) for 7 days.

- Total Insurance: €58.07 ($62.80 US) for 7 days.

- Total Plus Insurance: €80.28 ($86.81 US) for 7 days.

| Advantages | Limitations |

|---|---|

| High-quality service | Adventure sports coverage at additional cost |

| Options for assistance in major emergencies | Doesn’t cover pre-existing conditions |

| Trusted hospital network |

Allianz Global Assistance

Allianz Global Assistance is renowned for its customer service and flexibility in plans, allowing coverage to be tailored to each traveller’s needs. It offers options adapted to different profiles and its affordable prices make it ideal for those looking for a practical and economical solution for their trip to Canada.

Among its options, Allianz offers the Holiday Assistance Standardplan, a basic cover that includes emergency protection, and the Holiday Assistance Premium, which offers more medical cover and better protection for those who want additional security.

Main coverage:

- Medical expenses: Up to €75,000 ($81,104 US) for Standard and up to €200,000 ($206,350 US) for Premium Assistance.

- Repatriation: Included.

- Lost luggage: Up to €800 ($865 dollars US) in Standard and up to €2,000 ($865 US) in Premium Assistance.

- 24/7 assistance: Available.

Plans and prices:

- Holiday assistance Light: €33.33 ($36.04 US) for 7 days.

- Holiday assistance Standard: €44.69 ($48.33 US) for 7 days.

- Holiday assistance Premium : €51.98 ($56.21 US) for 7 days.

| Advantages | Limitations |

|---|---|

| Reliable assistance in emergencies | Adventure sports coverage at additional cost |

| Affordable price | Sound coverage for adventure sports |

Which is the best travel insurance for Canada?

After comparing different travel insurance options, IATI Star is positioned as the best alternative to travel to Canada. This insurance offers coverage that’s well suited to the needs of a destination where medical expenses can be extremely high and outdoor activities are a major attraction. What makes it stand out? Some of the coverages that position this insurer above others are:

Robust medical coverage with no deductibles

IATI Star includes up to €5,000,000 ($5,398,125 US) in medical expenses, an ideal limit for unforeseen events in Canada. This means that you’ll be covered for both minor emergencies and more complex situations requiring hospitalisation or even medical repatriation, which is also included at no limit of cost.

24/7 multilingual assistance

In a country where you’ve to be understood in French or English, the multilingual language and 24-hour support is an added advantage for foreign travellers. In addition, IATI staff are familiar with the situations common in adventure destinations, allowing for assistance even in unexpected or uncertain times.

Rates

Moreover, IATI’s travel insurance for Canada offers excellent value for money and rates to suit most budgets. Its combination of medical coverage, adventure sports protection, ongoing assistance and multilingual language support makes it a comprehensive option for those who want to travel safely and with peace of mind in Canada.

With this review of the best travel insurance for Canada, you’re one step closer to finding the one that’s right for you. If you need more information to prepare your trip to maple country, you can consult our guides on how to have Internet during your stay or which are the best Canada eSIMs. Have a good trip!

Language

Language

No results found

No results found