Banks in Switzerland: Best options for expats

Discover the best banks in Switzerland for expats and manage your finances efficiently. Protect your money!

You’ve probably heard a lot about Switzerland’s financial system—it’s stable, reliable, and highly efficient. Its global reputation comes from a perfect blend of tradition and innovation. If you’re planning to move to Switzerland, you’re in luck—many banks offer services tailored specifically for expats. But which ones are the best options for foreigners?

When choosing a bank to open an account in Switzerland, you’ll quickly notice that there are several types of institutions, each with different benefits and requirements. To make your decision easier, we’ve broken down what each bank has to offer in detail. Join us as we explore the best options for managing your finances in Switzerland.

Why open a bank account in Switzerland?

Switzerland’s banking system is synonymous with trust. In a country where economic stability and innovation go hand in hand, opening an account is more than just a place to store your money. As a foreigner, gaining access to this financial ecosystem comes with several advantages, making it easier to manage your daily expenses, savings, and investments.

The strength of the Swiss franc makes it an attractive option for those looking to shield themselves from global economic fluctuations. Holding an account in this currency allows you to operate internationally with confidence, without the uncertainty of unpredictable exchange rates. On top of that, Swiss banks are known for their efficiency and personalized customer service.

Another key advantage is technology. Swiss banks are at the forefront of digital innovation, offering advanced online platforms that let you manage your account from anywhere in the world. This is especially convenient for those who travel frequently, as it allows for quick transfers, investment management, and easy access to account details anytime.

And of course, there’s security. Switzerland’s legal framework ensures both financial protection and privacy—something not all banking systems can offer. This high level of trust and discretion makes Swiss banks an appealing choice, whether you’re looking for stability or a reliable service tailored to your needs.

Requirements to open a bank account in Switzerland

Opening a bank account in Switzerland can simplify many things. But what are the requirements? Is it an option for everyone? While Swiss banks are known for their strict regulatory standards, the process isn’t as complex as you might think. The documents you’ll need are fairly standard and similar to those required in other countries. To ensure a smooth process, make sure you have the following ready before applying:

- Valid identity document: The first thing you’ll need is an official identification document. If you’re from the EU, a passport or national ID card will usually be enough. However, if you’re coming from outside the EU, having a valid passport is essential.

- Proof of residence in Switzerland (or your current address): While it’s not mandatory for all banks, many will ask for proof of address, such as a rental agreement or a utility bill. If you’re a digital nomad, they might even accept the co-living contract you’re staying in.

- Proof of income or economic activity: Some banks may ask for a document showing the source of your income, especially if you’re planning to open an account with advanced services or high limits.

- Initial deposit: Many bank accounts in Switzerland require a minimum deposit to be activated. The amount varies depending on the bank and the type of account, but it typically ranges from 100 to 1,000 CHF ($10-1,100).

- Completed application form: As in other countries, you’ll need to fill out a form with your personal details. Many Swiss banks, especially neobanks, offer this process online with fast and simple systems.

- Statement of tax compliance: Since Switzerland adheres to strict international regulations, many banks will ask for a statement regarding your tax status in your home country or proof that you are up to date with your tax obligations. This is one of the few differences you’ll encounter when opening an account compared to other countries.

Types of banks offering services for foreigners in Switzerland

Now that you understand the benefits of having a bank account in Switzerland and the documents you’ll need to open one, let’s dive into the types of banks. Did you know that there are various types of banking institutions? This is true not only in Switzerland but everywhere. In Switzerland, you can choose from international banks, cantonal banks, neobanks, Raiffeisen banks, and private or wealth management banks. Let’s explore what each of these offers.

Neobanks or digital banks

Neobanks are online financial institutions that operate without physical branches. This model focuses on technology to provide fast, efficient, and hassle-free solutions. Their practical approach makes them an ideal choice for foreigners looking to open a bank account in Switzerland without any complications.

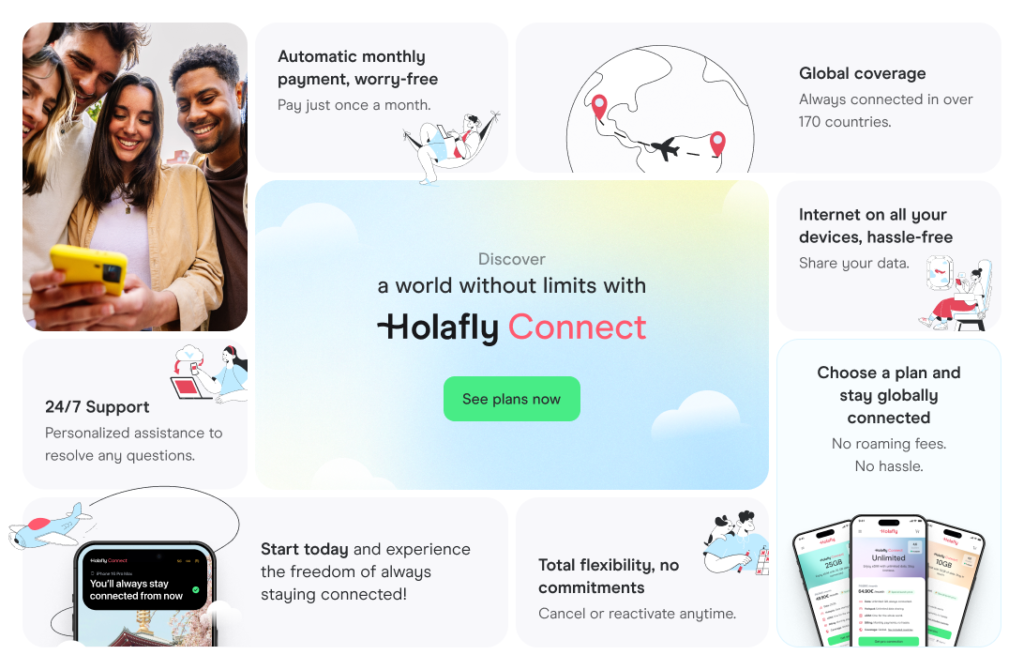

With a neobank, all you need is access to their mobile app and your Holafly eSIM (or a stable connection).

What characterizes neobanks?

- 100% digital opening: From your cell phone and without needing to visit a branch. Some allow you to open accounts even without permanent residence in Switzerland.

- Low or non-existent commissions: They usually eliminate fees associated with maintenance or international transfers.

- Advanced financial management: Apps offer alerts, expense analysis and real-time budgeting tools.

Examples of neobanks in Switzerland:

- N26: Great for expats. It offers international transfers with integrated Wise and financial control from the app.

- Revolut: Perfect for travelers, with commission-free currency exchange and automatic savings functionalities.

- Yuh: Swiss neobank that combines traditional banking with investment options accessible from its platform.

International banks

Major international banks operating in Switzerland are a great choice for those who need to manage finances across multiple countries. They offer sophisticated services, such as tax advice, multi-currency accounts, and optimized international transfers.

For foreigners with complex needs or significant wealth, international banks are also well-versed in the regulations of different jurisdictions, which makes cross-border transactions much easier.

What characterizes international banks?

- Multi-currency accounts: Great for those who work with multiple currencies, facilitating transfers and savings in different currencies.

- Global network: Allow access to services in different countries, useful for expats and people with international businesses.

- International tax consultancy: Specialists in cross-border regulations are usually available. This will help you improve your tax situation.

- Security and prestige: Globally recognized institutions, they offer confidence to those seeking to manage important funds or make large-scale investments.

Examples of international banks in Switzerland:

- HSBC Private Bank: Tailored for high net worth clients, with exclusive private banking and asset management services.

- UBS: Although Swiss, it has a global presence and stands out for its focus on expats and international clients.

- Citibank: Great for those looking for global solutions, with multi-currency account options and customized services.

Cantonal banks

Swiss cantonal banks have a long history of stability and personalized service. While these institutions primarily focus on serving the local population, they also offer attractive products for foreigners.

One of the key benefits of these banks is their strong expertise in the Swiss market, allowing them to offer solutions that are well-suited to the country’s legal and tax requirements. Furthermore, they are often praised for their close-knit, customer-focused service.

What characterizes local banks?

- Direct connection to the Swiss market: They offer products tailored to local financial needs, from current accounts to mortgages.

- Personalized attention: It’s common for these banks to have advisors who can guide you on specific matters, such as paying taxes in Switzerland or legal requirements. This service is especially helpful for those who have just moved to the country.

- Branch network: Cantonal and local banks usually have a strong presence in their regions. This makes it easier to handle transactions in person.

- Regional investment options: Besides current accounts, they offer savings and investment products focused on local and sustainable development.

Outstanding examples:

- Zürcher Kantonalbank (ZKB): The Zurich Cantonal Bank, one of the largest, offers multi-currency accounts and international services for expats.

- Banque Cantonale Vaudoise (BCV): Located in the canton of Vaud, it is known for its focus on small businesses and local residents.

- Basler Kantonalbank: This bank in Basel offers services for both residents and internationals, with a focus on wealth and financial management.

Raiffeisen Banks in Switzerland

Raiffeisen banks are one of Switzerland’s key banking networks, recognized for their cooperative structure and community-oriented service. They stand out by offering a personalized approach and competitive rates, which makes them an attractive option for both locals and expats who prefer a closer connection with their bank. Unlike cantonal banks, which are government-supported and focus on particular regions, Raiffeisen operates as a nationwide network of independent cooperatives with a strong local presence.

Advantages of Raiffeisen banks:

- Cooperative model: When you open an account, you can become a member of the bank, giving you access to exclusive benefits and a say in decision-making.

- Large, local network: With over 200 individual banks and more than 800 branches nationwide, you will always have a branch close by.

- Competitive rates: Raiffeisen banks typically offer checking accounts and services at lower costs compared to other traditional banks in Switzerland.

- Community approach: Each Raiffeisen bank operates autonomously, tailoring its services to the local needs of the community.

- Additional member benefits: They offer discounts on local services, such as health insurance, as well as free or discounted access to museums and cultural events in Switzerland. Additionally, they provide favorable terms on financial products.

Outstanding examples:

- Raiffeisen Schweiz: It’s the organization that oversees the Raiffeisen bank network nationwide. Each local branch operates independently, so you can find services tailored to your specific region.

Banks specialized in wealth management

When reviewing Switzerland’s banking system, we can’t overlook the banks that specialize in wealth management, catering to clients with significant assets. These institutions offer investment services, tax planning, and comprehensive wealth management. Their focus is on preserving and growing their clients’ funds through diversified strategies and top-tier advice.

What characterizes banks specializing in wealth management?

- High-level personalized advice: Focusing on tailored financial strategies, from diversified investments to inheritance planning.

- Asset and investment management: Portfolios are tailored to your objectives, with options in global markets and exclusive products such as private funds.

- Confidentiality and discretion: They keep a very high standard in the protection of data and transactions, essential for those who manage large sums of money.

- Global support: Offering multilingual support and services in different countries, combining Swiss banking tradition with international reach.

Examples of specialized banks:

- Julius Baer: One of the leading private banks in Switzerland, with a focus on international clients.

- Pictet: Renowned for its discreet and personalized management for high net worth clients.

- Lombard Odier: Blends tradition and modernity in family and individual wealth management.

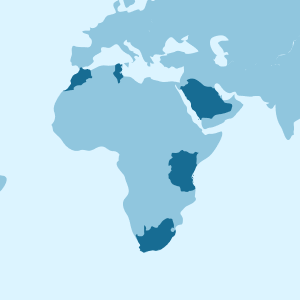

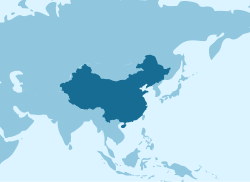

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Top 5 banks in Switzerland for foreigners

Given the variety of banks available, there are numerous choices when it comes to opening an account in Switzerland. While the number of banks has slightly decreased in recent years, there are still over 230 financial institutions in the country. To make it easier for you to decide, we’ve put together a list of the top five banks in Switzerland for expats, based on feedback from others who have been in your shoes and the overall reputation of these institutions.

UBS: Perfect for expats seeking integrated financial management

UBS, headquartered in Zurich, is one of the most renowned and respected banks worldwide. With deep expertise in both Swiss and international finance, it’s a trusted option for expats. The bank operates over 300 branches across Switzerland and has more than 1,200 ATMs. Its digital platform is advanced and secure, making it easy to manage transfers and transactions wherever you are.

This bank is particularly suited for expats looking to manage their finances in multiple currencies, offering multi-currency accounts and personalized financial advisory services. It also provides customer support in several languages, available both in person and via its phone line, Monday to Friday from 8:00 AM to 6:00 PM.

UBS accounts for expats

1. Personal Account

- Description: Basic account for managing payments and accessing debit or credit cards.

- Monthly fee: Between 5 and 15 Swiss francs ($5.40-16.20), depending on the average balance.

- Opening requirements: Valid passport and proof of residence in Switzerland.

2. UBS Key Account

- Description: Designed for expats, includes services such as multi-currency accounts and specialized advice.

- Monthly fee: 10 Swiss francs ($10.80). Can be waived if you maintain a stipulated minimum balance.

- Opening requirements: Valid passport and documentation proving your employment or financial situation in Switzerland.

| Advantages | Disadvantages |

| Extensive network of ATMs and branches | Slightly high maintenance fees |

| Advice in several languages | Face-to-face procedures for some transactions |

| Possibility of multi-currency accounts |

Credit Suisse: Ideal for those looking for a broad international network

Credit Suisse, established in 1856, is one of Switzerland’s oldest and most respected banks. With its extensive global reach, it’s a great option for expats who need flexible banking services across multiple countries. The bank offers specialized financial products for expats and digital nomads. With more than 200 branches and around 1,000 ATMs across Switzerland, Credit Suisse provides convenient access to banking services nationwide.

Credit Suisse is recognized for its multilingual customer support (available in German, French, Italian, and English), which can be accessed in person, by phone, or via online chat. Their regular hours are Monday to Friday, from 8:00 AM to 5:30 PM. Plus, their online platform is easy to navigate, letting you manage your accounts and process transfers in real time.

Credit Suisse accounts for foreigners

1. Bonviva Silver Package

- Description: Comprehensive banking package including checking account, debit card and credit card. Ideal for expats with basic needs and some international transactions.

- Monthly fee: CHF 7.50 ($8).

- Opening requirements: Valid passport, residence permit and proof of address.

2. Bonviva Gold Package

- Description: Intended for expats with higher financial activity. Includes multi-currency accounts and exclusive services.

- Monthly fee: CHF 15 ($16.50).

- Opening requirements: Similar to Silver Package.

| Advantages | Disadvantages |

| Specialized services for expats | Higher rates on advanced packages |

| Extensive network of ATMs and branches | Some conditions can be complicated |

| Multilingual customer service |

PostFinance: Ideal for students and workers on a budget

PostFinance, which is part of Switzerland’s postal service, is a favored option among foreigners looking for low fees and simple services. It’s particularly suitable for students, temporary workers, and people who don’t need complex banking. With over 50 branches and more than 1,200 ATMs, it provides accessible and straightforward banking.

They offer an efficient digital platform and multilingual support (German, French, Italian, and English). Their office hours are typically Monday to Friday, from 9:00 AM to 6:00 PM.

PostFinance accounts for foreigners

1. PostFinance Smart

- Description: Intended for young customers and students. Offers a basic current account with access to digital services.

- Monthly fee: CHF 5 ($5.50).

- Opening requirements: Valid passport and proof of domicile in Switzerland.

2. PostFinance Plus

- Description: Targeted to those who need to manage international payments and deposits in multiple currencies.

- Monthly fee: 12 CHF ($13).

- Opening requirements: Similar to the Smart account.

| Advantages | Disadvantages |

| Low rates | Limited services compared to private banks |

| Large national coverage | More limited investment options |

| Integrated banking services with post office |

Raiffeisen Bank: Perfect for families and local communities

Raiffeisen Bank is the third-largest banking group in Switzerland and an excellent choice for expats who value a more personal, community-oriented approach. With more than 800 branches and around 1,700 ATMs, it has an extensive presence, especially in rural regions and smaller towns. The bank is highly favored by expat families and individuals who prefer a close, personalized service.

The bank offers multilingual services and an intuitive banking app. Branches are generally open from Monday to Friday from 8:00 AM to 5:00 PM.

Raiffeisen Bank accounts for foreigners

1. MemberPlus Account

- Description: A basic account for customers who want simple and efficient services. Includes access to ATMs and online banking.

- Monthly fee: CHF 6 ($6.50).

- Opening requirements: Passport and residence permit.

2. Family Account

- Description: Perfect for expat families looking to manage their finances together. Includes additional cards at no extra cost.

- Monthly fee: CHF 10 ($11).

- Opening requirements: Same as MemberPlus account.

| Advantages | Disadvantages |

| Strong community focus | Less focus on advanced international clients |

| Large branch network in rural areas | |

| Accessible services for families |

Yuh: A modern digital solution for expats in Switzerland

Yuh is a Swiss digital bank that resulted from a partnership between Swissquote and PostFinance. It is known for its innovative and fully online banking experience. It’s an excellent option for those seeking a simple, modern, and easy-to-use service. The bank offers accounts for both residents and non-residents.

Yuh offers a modern banking experience by combining everyday banking services with easy-to-use investment options, like buying stocks or cryptocurrencies, all through its app. With transparent fees and a simple, accessible design, it has become a popular choice for younger, tech-savvy individuals seeking a complete banking solution in Switzerland.

Yuh accounts for foreigners

1. Basic Yuh Account

- Description: Includes Swiss and European IBAN, multi-currency support and a linked Mastercard. Suitable for managing day-to-day finances in Switzerland and abroad.

- Monthly fee: Free of charge, with some fees applicable to specific transactions such as currency exchange.

- Opening requirements: Account can be opened from the app with valid ID and no Swiss residency required.

Additional features

- Management of cryptocurrencies and investments directly from the app.

- Possibility to split accounts with other people, which is useful for couples or expat colleagues sharing expenses.

| Advantages | Disadvantages |

| Fast opening and no Swiss residency required | No physical branches |

| Multilingual support in the app | Some currency exchange fees |

| Integrated investment options | Only accessible through digital channels |

| Free Mastercard | Not suitable for those who need in-person services |

Which is the best bank in Switzerland for expats?

Each bank has different ways of catering to the needs of expatriates in Switzerland. To help you choose the one that fits you best, we’ve put together a comparison table highlighting the main features of each bank. This should make it easier for you to make an informed decision.

| Bank | Best for | Monthly rates | Key Requirements | ATM/branch network | Key Advantages |

| UBS | Expats with comprehensive financial needs | From 5 CHF ($5.40) | Passport and proof of residence | More than 1,200 ATMs, 300 branches | Multi-currency management, personalized financial advice and multilingual support. |

| Credit Suisse | Expats with international needs | From 7.50 CHF ($8) | Passport, residence permit, domicile | 1,000 ATMs, 200 branches | Global services, multi-currency accounts and intuitive online platform. |

| PostFinance | Students and workers on a limited budget | From 5 CHF ($5.50) | Passport and home address | More than 1,200 ATMs, 50 branches | Low fees, digital approach and multilingual support. |

| Raiffeisen Bank | Families and residents in rural areas | From 6 CHF ($6.50) | Passport and residence permit | More than 1,700 ATMs, 800 branches | Community focus, close attention and family accounts with benefits. |

| Yuh | Digital nomads and technology users | Free of charge, with occasional fees | Valid ID | No internal network, 100% digital | Fast opening, Swiss/European IBAN and cryptocurrency investment options from the app. |

There isn’t a one-size-fits-all solution; the best choice depends on your specific needs as an expat in Switzerland. If you’re looking for comprehensive, personalized service, UBS stands out with its multi-currency accounts and expert advice. On the other hand, if saving on fees and managing your finances digitally is a priority, Yuh offers a modern and efficient option.

Steps to open a bank account in Switzerland

Now that you know which bank in Switzerland best suits your needs, the next step is to open your bank account. Keep in mind that the requirements may vary slightly depending on the type of account you want to open (a checking account, a savings account, etc.).

1. Research and choose the right bank

Start by choosing the bank that best fits your needs. If you’re an expat with international requirements, Credit Suisse could be a great choice; if you prefer a digital option, Yuh is a solid alternative. Make sure to research fees, requirements, and services to ensure you pick the right one for you.

2. Make an appointment or open the account online

For traditional banks like UBS or PostFinance, you can visit a branch to open your account. Just schedule an appointment and bring all the required documents. If you go for digital options like Yuh, the whole process can be completed through their app in just a few minutes.

3. Complete the verification

During the appointment or online registration, you’ll need to provide your personal details and verify your identity. Digital banks typically do this via a video call, while traditional banks may require you to present physical documents.

4. Deposit initial funds

Some banks may ask for a minimum deposit to open your account. For instance, UBS might require anywhere from 500 to 1,000 CHF ($540 to $1,080), depending on the account type. Make sure you’re prepared for this.

5. Set up additional services

Once your account is open, you can activate services like online banking, debit/credit cards, or even multi-currency accounts, depending on your needs. Don’t hesitate to ask for assistance if you need instructions in your language.

Frequently asked questions about banks in Switzerland for expats

Not always, but most traditional banks ask for it as a standard requirement. On the other hand, digital banks like Yuh allow you to open an account with just a valid passport and an address in Switzerland.

Yes, many banks like UBS and Credit Suisse allow you to start the process from your home country, although final activation may require you to be physically in Switzerland. Some digital banks offer a fully remote account opening process.

Yes, digital banks in Switzerland follow strict security regulations and are overseen by the Swiss Financial Market Supervisory Authority (FINMA). However, it’s always a good idea to check their reputation before making your choice.

Many of the leading banks in Switzerland for expats offer customer service in English, and sometimes in other languages, particularly in major cities like Zurich and Geneva. They also tend to have online platforms available in several languages.

Yes, digital banks like Yuh offer accounts with no fixed fees, but they may charge for specific transactions. Traditional banks, like PostFinance, have basic accounts with fees starting at 5 CHF ($5.50).

Pay

Pay  Language

Language  Currency

Currency

No results found

No results found