Best banks in Canada for expats: Discover your ideal solution

Knowing which are the best banks in Canada for expats will help you decide which one is best suited to your needs.

Starting fresh in a new country comes with its fair share of challenges. Beyond adapting to a new culture and meeting new people, there are plenty of practical matters to sort out. Finding a place to live, setting up health insurance, figuring out where to shop, and, of course, opening a bank account. If you’ve just arrived and are unsure about the best banks in Canada for expats, don’t worry—we’ve got you covered.

Today, we’re diving into the world of banking in Canada to help you find the best options as a newcomer. Whether you’re looking for a local, international, or digital bank, we’ve got you covered. We’ll also walk you through essential details like how to open an account, potential fees, where to withdraw cash, and more. Our goal is to make this part of your transition as smooth as possible. So, let’s get started!

10 reasons to open a bank account in Canada

If you’ve just arrived in Canada, you might be wondering whether you can open a bank account as a foreigner. The good news is—yes, you can! Whether you’re a temporary resident working, studying, or living in the country, you’ll be able to set up an account as long as you have the required documents.

Several banks in Canada, such as RBC, TD, and Scotiabank, offer special accounts designed for newcomers. Many of these come with perks like no-fee banking for the first year, credit card options even without a local credit history, and access to rewards programs.

Let’s talk about why opening a bank account is one of the first things newcomers to Canada typically do. While it’s not a requirement, it’s definitely a smart move. Having a local account makes it easier to manage your finances. Whether it’s receiving your salary, applying for a credit card, making payments, sending money, or handling everyday transactions. Here are 10 key reasons why opening a bank account in Canada is a great idea:

1- Increased financial security

Opening an account with a Canadian bank as a foreigner gives you a secure and convenient way to manage your finances. Canada’s banking system is known for its stability and reliability, and your deposits are protected by the Canada Deposit Insurance Corporation. This federal organization, established in 1967, safeguards customer funds in case a bank faces financial trouble. Simply put, you can rest easy knowing your money is in safe hands.

2- Ease of daily transactions

It’s no secret that cash is becoming less common in everyday life, and Canada is no exception. Digital payments, online shopping, and bank transfers have taken over. Having a local bank account makes it easy to access these services seamlessly. Plus, Canadian debit and credit cards are widely accepted across the country, making transactions hassle-free.

3- Ease in receiving your salary

If you plan to work in Canada, chances are your employer will require you to have a local bank account for direct deposit of your salary. This makes payroll processing smoother and eliminates the need to handle cash. Once you have your Social Insurance Number (SIN), you’ll be able to receive your pay directly into your account without any hassle.

4- Access to credit services

Opening a bank account in Canada will make it easier to access services like getting a credit card or applying for personal or mortgage loans. It can also help you build a credit history in Canada, which is essential for qualifying for financial products. If you plan to stay in the country for an extended period, or even just for a few years, these benefits will likely be very useful.

5- Ease of sending and receiving money

Another reason to have a bank account in Canada is to easily send and receive money through both domestic and international transfers. Many banks also offer electronic transfer options and remittance services.

6- Access to online banking services and mobile apps

In Canada, most banks provide online banking and mobile apps, giving you the convenience of managing your finances from anywhere. You can pay bills, transfer money, check your balance, and complete other transactions without needing to go to a physical branch.

7- Access to tax and governmental benefits

Whether you’re a permanent resident or have a work permit in Canada, you may be eligible for government benefits like the Canada Child Benefit or the GST/HST Credit. These payments are typically deposited directly into your bank account, making it easy to access them.

8- Rental or home purchase requirements

When renting a home, you’ll find that many landlords or real estate agents will ask for proof of your financial stability. Having a local bank account shows that you’re financially stable. Plus, you’ll be able to pay rent through a bank transfer or money order, which is much more convenient than paying in cash.

9- Building your financial history in Canada

Another benefit of having a bank account in Canada is that you can start building your credit history, which will be helpful in the future when applying for a loan, credit card, or even buying a home. It will also help you establish yourself as a reliable resident within the Canadian financial community.

10- Access to financial products

Finally, having a bank account will give you access to other financial products, such as savings accounts, investment funds, insurance, and pension plans. These are especially useful for foreigners planning to stay in the country, helping them establish a solid financial foundation in their new home.

Opening a bank account in Canada is essential for simplifying daily life, managing your money securely, accessing financial services, and settling in the country.

What requirements must I meet to open a bank account in Canada?

You might be wondering about this next point. Opening a bank account in Canada as a foreigner is an essential step to becoming part of the country’s financial system and gaining access to various services. We’ll now go over the requirements you’ll need to meet to get started, and later, we’ll provide you with a simple guide on how to do it.

According to the Canadian government, any foreigner with a valid temporary resident visa or permit is allowed to open a bank account in the country, as long as they can provide certain documents. However, requirements may vary depending on the financial institution. Make sure to check in advance which documents you’ll need to open your account.

Generally speaking, these are the requirements that any foreigner wishing to open a bank account in Canada must meet:

- Be over 18 years of age. Most Canadian banks require you to be at least 18 years old to open a bank account. If you’re underage, some banks may allow you to open an account with the permission of a parent or legal guardian.

- Identification. The first thing the bank will ask for when opening an account is a valid, up-to-date passport or, if applicable, a permanent resident card.

- Work or study permit. If you’re not a Canadian citizen, you’ll need a valid work or study visa (or an acceptance letter from a university).

- Social Security Number (SIN). Although it’s not always a must, having a Social Insurance Number is really useful. Especially if you intend to work in Canada. It’s a unique number issued by the Canadian government for tax purposes, and you can apply for it once you’re in the country.

- Proof of address. Another requirement the bank may ask for is proof of your address in Canada, which you can provide with a utility bill or a lease agreement.

- Minimum deposit. Most Canadian banks will ask for a minimum deposit to open an account, and the amount varies depending on the account type. For instance, Royal Bank of Canada and Scotiabank offer checking accounts with no initial deposit required or a small deposit ranging from $25 to $100 if you select certain benefits. These banks also allow international students to open accounts without a deposit, as long as they can show proof of their student status.

What about people with a visitor or tourist visa? In these situations, they won’t be able to open a bank account in Canada. However, if you’re planning to change your status to a resident or student, you can ask a Canadian citizen friend or family member to add you to their account. Just keep in mind that both of you will need to go to the bank together to understand the process.

Steps to open a bank account in Canada

Now that you know what the requirements are, let us tell you the steps you have to follow to open a bank account.

- Choose a bank. The first thing you have to do. Research the available options and choose the one that best suits your needs.

- Gather the necessary documentation. Check the previous section and start gathering all the documentation you need to open an account. Make sure you have them ready before you start the process.

- Go to a branch office. If you choose a physical bank, head to the nearest branch and set up an appointment with a customer service representative. Alternatively, if you go with a digital bank like Tangerine, you can complete the entire process online, allowing you to open your account from your computer or phone.

- Complete the application. Once the bank representative gives you the application form, fill it out with your details and sign it. Be sure to double-check that all the information is correct and there are no mistakes that could delay the process.

- Provide your documents. Along with the application, provide the necessary documents, such as your passport, study or work visa, or any other required paperwork.

- Make the minimum deposit. If required, make the minimum deposit the bank asks for to open the account. The amount can vary, but it’s usually between 50 and 200 Canadian dollars.

- Activate your debit card. After completing the process, you’ll receive a debit card that you’ll need to activate in order to make transactions. You can then set up online banking to handle transactions, pay bills, transfer money, and check your account balance. Many Canadian banks also offer user-friendly mobile apps that let you manage your account from anywhere.

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Types of banks in Canada for foreigners

Local banks, international banks, or digital banks. Which is the best option for foreigners? This is probably another question you might have when opening a bank account. Below, we’ll explain in detail the different types of banks in Canada for foreigners, including the services each one offers.

1. Local Banks

The Canadian banking system is dominated by a few key players, often referred to as the “Big Six,” which are the six major financial institutions in the country. The Royal Bank of Canada, Toronto Dominion Bank, Bank of Montreal, Canadian Imperial Bank of Commerce, Bank of Nova Scotia, and National Bank of Canada. These banks are popular among both residents and foreigners due to their strong infrastructure and extensive branch network across the country. As a result, they are some of the best options when it comes to opening a bank account.

Some of the benefits include easy access to credit cards, payment services, personal loans, and mortgages. They also offer financial advisors who can assist you with investment decisions, insurance, and financial planning.

Each of the Big Six banks is a good option for foreigners for different reasons. For instance, the Royal Bank of Canada (RBC) offers special services for newcomers, such as advice on settling in the country. The Toronto-Dominion Bank (TD) provides low-cost bank accounts, remittance services, and support for international students. Meanwhile, Scotiabank has programs specifically designed for immigrants and new residents in Canada.

2. International banks

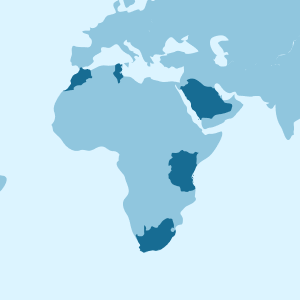

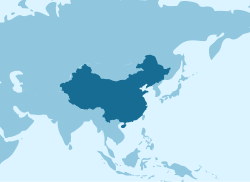

Foreigners can also choose to open an account with an international bank, especially those with business or interests in multiple countries. Some options in this group include HSBC Canada (part of the HSBC Group), Citibank Canada, and Barclays Bank. While Barclays doesn’t have a strong presence in the country, its financial products are popular among expats and customers who need to manage global operations.

One of the benefits of choosing an international bank is the ability to open accounts in multiple currencies and access solutions for businesses that operate globally.

3. Digital banks and neobanks

Digital banks or neobanks are becoming a popular option for foreigners who value the convenience of online banking. These banks don’t have physical branches and operate solely through mobile apps or websites. As a result, they often have lower fees since they don’t need to maintain physical locations. They also make it easy to open accounts quickly, which is ideal for people who frequently move between countries.

What options are available in this group? The main digital banks for foreigners in Canada are Simplii Financial, Tangerine (owned by Scotiabank), Koho, and Revolut (an international digital bank).

Top 5 banks in Canada for foreigners

Now that you’re familiar with some general aspects of the Canadian banking system, let’s take a look at the top 5 banks in Canada for foreigners. We’ll go over some key details about each one, the services they offer, and the specific benefits you’ll have as a non-permanent resident. We’ve included three local banks, one international, and one digital bank, so you can choose the one that best fits your needs.

1. Royal Bank of Canada (RBC)

The Royal Bank of Canada is the largest in the country, with over 150 years of history and operations in more than 30 countries. It provides a wide range of financial services for both residents and foreigners and is considered one of the most influential financial institutions globally, playing a key role in Canada’s economy. Although its fees can be on the higher side, its excellent customer service and broad selection of products make it a strong choice.

As a foreigner, you may open any of the following types of accounts with the RBA:

- RBC No-Frills Checking Account: No monthly fees if direct deposit is made, or low monthly fee of $4.

- RBC Personal Checking Account: Standard account with a monthly fee of $10 or no fee with certain balance requirements.

- RBC High Interest eSavings Account: Savings account with a competitive interest rate (up to 2.5% depending on the balance).

When it comes to fees, account maintenance can cost between $4 and $10, depending on the type of account. Withdrawals outside the RBC network range from $1.50 to $3, while fees for checks or transfers can vary from $0.75 to $5.

The Royal Bank of Canada has more than 1,000 branches in the country and an extensive ATM network, as well as access to the Exchange network.

| Advantages | Disadvantages |

| Extensive network of branches and ATMs | Monthly fees on standard accounts |

| Specialized services for newcomers | Non-RBC ATM withdrawal fees |

| Full online and mobile banking | Not all accounts have competitive interest rates |

2. Toronto-Dominion Bank (TD): One of the best banks in Canada for foreigners

The second-largest bank in Canada, it was established in 1955 after the merger of the Bank of Toronto and The Dominion Bank. With a strong presence across North America, it stands out for its outstanding customer service and innovative financial products.

TD offers a wide range of products and services, including personal and business banking, loans, mortgages, credit cards, investments, insurance, and wealth management. Its digital platform is one of the most advanced in the country, allowing users to make transactions and manage their finances quickly and efficiently.

As a foreigner, you can open one of the following types of accounts at TD:

- TD Simple Checking Account: Basic account for foreigners, with no monthly fees for the first 6 months.

- TD All-Inclusive Checking Account: All the benefits, such as unlimited transfers, but with a monthly fee of $29.95.

- TD Savings Account: Savings account with easy access and interest rate on savings.

With over 1,100 branches across the country, it is one of the most accessible banks for Canadians, along with a large network of ATMs and access to the PLUS network.

| Advantages | Disadvantages |

| Offers comprehensive services to foreigners | Monthly fees can be high |

| Access to a large network of ATMs | High fees for international transfers |

| Online banking accessible 24/7 | No monthly fee account options are not always available |

3. Scotiabank

Bank of Nova Scotia has been a key player in Canada’s financial sector since 1832. It is one of the country’s largest and most respected banks, offering a broad range of financial products and services, with a strong emphasis on international investments. This makes it a great choice for both Canadian residents and foreigners looking to establish themselves or do business in Canada.

As a foreigner, you can open any of the following Scotiabak accounts:

- Scotiabank Basic Checking Account: Perfect for newcomers with a monthly fee of $3.95 if you don’t meet the direct deposit requirements.

- Scotiabank Ultimate Package Account: Includes checks, unlimited ATM access and more, with a $30 monthly fee.

- Scotiabank Momentum Savings Account: Savings with increasing interest (up to 2% depending on the balance).

As you can see, account maintenance fees range from $3.95 to $30, depending on the account type. If you withdraw money outside the network, there’s a fee of $1.50, while international transfers cost between $15 and $30, depending on the method.

Scotiabank has more than 1,000 branches throughout the country, as well as a wide network of ATMs and access to the CIRRUS network.

| Advantages | Disadvantages |

| Ideal for foreigners who wish to open a low-fee account | Out-of-network withdrawal fees apply |

| Network of branches and ATMs nationwide | Some account types may have high fees |

| Easy-to-use online banking | Expensive international transfers |

4. HSBC Canada

HSBC is one of the leading international banks for foreigners in Canada. Established in 1981, it is a major player in the Canadian financial sector and is part of HSBC Holdings plc, a global group headquartered in London.

HSBC is a global bank operating in over 60 countries, offering a variety of financial services. It’s an excellent choice if you’re looking for an account that facilitates international transactions. It’s especially popular with multinational companies and clients who need to manage cross-border transactions smoothly.

As a foreigner, you can open one of the following types of accounts at HSBC Canada:

- HSBC No-Fee Current Account: No monthly fees, with access to a global network of ATMs.

- HSBC Premier Account: Monthly fee of $29.95, with benefits such as free international transfers.

- HSBC Savings Account: High interest rate account with no monthly fees.

Although the number of branches in the country is limited, this bank has been a pioneer in digital innovations. They offer customers access to a highly advanced online and mobile banking platform. This allows them to manage accounts, make international transfers, and access global financial products from anywhere.

| Advantages | Disadvantages |

| Ideal for international customers | Few branches in Canada |

| Free international transfers with Premier accounts | High fees for some services |

| Global ATM network | Only one basic account option with no fees |

5. Tangerine

Tangerine is a digital banking option ideal for those who prefer the ease of online transactions. It offers competitive financial products, no account maintenance fees, and high interest rates on savings. With no physical branches and a strong online presence, it provides an efficient and accessible banking experience for those looking for low-cost, convenient, and simple banking. Its excellent customer service and digital platform also make it a popular choice for foreigners in Canada.

The types of accounts you can open in this digital bank are:

- Tangerine Checking Account: No monthly fees and unlimited transfers.

- Tangerine Savings Account: Savings account with an appealing interest rate, with no monthly fees.

- High Return Savings Account: Competitive rates and no monthly fees.

One of the main benefits of Tangerine is that it offers accounts with no monthly fees and high interest rates on savings. This makes it a great option if you want to grow your money without paying extra costs. The only fees you’ll face are for domestic and international transfers ($1) or for withdrawing cash from ATMs outside the Tangerine network ($1.50).

| Advantages | Disadvantages |

| No monthly fees or transaction charges | No physical branches |

| High interest rate on savings accounts | Out-of-network cash withdrawals may incur fees |

| Perfect for people who prefer to manage everything online | Limited services compared to traditional banks |

Banks in Canada for foreigners: which one is the best?

After reviewing various banking options in Canada for foreigners, it’s time to pick the top choice. Of course, this selection is subjective, as it largely depends on each individual’s specific needs.

Before choosing a bank, the first step is to assess your needs and decide which type of account you require. Whether it’s a checking account, savings, or a combination of both. Then, compare the interest rates offered by each bank to find the best fit, and make sure to check their fees and charges. It’s also a good idea to select a bank with solid online and mobile banking options that suit your preferences. If you’re considering a traditional bank, check for branches and ATMs near you. Finally, it’s important to look into the bank’s customer service reputation.

Once you’ve considered all of this, you’ll be able to determine which bank is best for you. If you’re looking for advice, we recommend choosing either Royal Bank of Canada or Toronto-Dominion Bank. While both offer accounts with fees, there are also options with no monthly charges, as long as you meet certain requirements. Their 24/7 customer service and wide network of ATMs and branches make them highly accessible for those needing more traditional banking services.

If you prefer digital banking with no fees, Tangerine is definitely a great choice. The only thing to keep in mind is that it doesn’t have physical branches. This might be inconvenient if you prefer face-to-face interaction with a representative or if you need to make a lot of cash transactions.

Frequently asked questions about banks in Canada for foreigners

Yes, you can. While it’s not required, it’s definitely a good idea to make things easier. Many banks in Canada offer accounts to non-residents, particularly to those with work or study visas. The requirements can differ. Usually, you’ll need to show a valid passport, a work or study permit, and proof of your address in Canada.

Foreigners can open checking, savings, and no-fee accounts at many banks. Some offer special products for expats, like multi-currency accounts to manage different currencies, while others allow you to open accounts online without needing to visit a branch.

It’s not complicated, as many Canadian banks offer international transfers. You can do this through online banking services, international payment apps, or SWIFT transfers. Some banks also allow transfers through money transfer providers or their own international branch networks.

The process is quick and easy. It typically takes about 30 minutes to an hour at a branch. Depending on the requirements and how busy the bank is. If you’re opening an account online, it could be faster, but some banks might need additional verification if you’re a foreigner. To make things go smoothly, be sure to have all your documents in order.

In Canada, foreigners usually need a Canadian credit history to get a credit card. If you’re new to the country, you might consider a secured credit card, where you put down a deposit as security. Some banks also offer credit cards to newcomers without a credit history, but the limits may be lower.

Pay

Pay  Language

Language  Currency

Currency

No results found

No results found