Top banks in Andorra for foreigners: Choose the best option for you

A tax haven known for its low taxes. Do you want to know which are the top banks in Andorra for foreigners? Check out this post.

This small country in the Pyrenees, nestled between Spain and France, has become a popular choice for professionals due to its favorable tax advantages compared to other European nations. But do you know which are the top banks in Andorra for foreigners? Choosing the right bank to manage your income is key—it can help you maximize your earnings, avoid unnecessary fees, and enjoy other financial benefits.

In this article, we’ll walk you through the different types of banks in Andorra, why opening an account as a foreigner is a smart move, and what you’ll need to get started. Whether you’re already living in Andorra or planning to move soon, this information will help you manage your finances wisely. By the end of this post, you’ll know which bank we consider the best option for foreigners in Andorra. Let’s dive in!

Why open a bank account in Andorra?

If you’re earning income in Andorra—whether as a digital nomad with international clients, working for a local company, or simply living there for lifestyle reasons—opening a bank account in the country is a smart move. One of the biggest advantages is the financial benefits you can gain, but here are five key reasons why we recommend opening an account with one of the top banks in Andorra for foreigners.

- Security and economic stability: Andorra’s financial system is known for its strength, security, and efficient management. Your savings will be well-protected and held to international standards.

- Tax advantages: Taxes in Andorra are significantly lower than in most European countries. That’s why opening a bank account here is a great choice if you want to make the most of your personal or business deposits.

- Financial privacy: Bank accounts have a high degree of privacy and protection. You can be assured that they comply with current regulations.

- International management ease: Andorran banks enable international transactions in multiple currencies such as euros, francs, dollars or Swiss, among others.

- Exclusive financial services: For high net worth clients, banks in this country offer exclusive private banking and investment services.

Requirements to open a bank account in Andorra

If you’re looking to open an account with one of the best banks in Andorra as a foreigner, there are a few key requirements you’ll need to meet. These regulations ensure the financial system remains secure and compliant. Here’s what you should keep in mind:

- Personal documentation: You’ll need to provide a valid passport or a national ID card (for EU citizens), proof of your current residence in Andorra, and your tax identification number (NIF or its equivalent).

- Justification of the deposit: You’ll need to provide documentation to verify the legal source of your funds, such as an employment contract, invoices, business activity records, or similar financial statements.

- Purpose of the account: Depending on whether your account is personal, professional, or business-related, banks may require you to explain the purpose of opening it. They might also request additional information to comply with anti-money laundering and counter-terrorism financing regulations.

- Minimum initial deposit: Some banks require an initial deposit, and the amount can vary between 1,000 euros and 50,000 euros ($1,048 to $52,442), depending on your income and the reason for opening the account.

- On-site or remote verification: They ensure the identity of the client, this meeting can be in the offices or virtually.

- Compliance with local and international regulations: Due to tax transparency treaties, you will need to sign a number of regulations to comply with tax laws.

Types of banks with services for foreigners in Andorra

Choosing the top banks in Andorra for foreigners can take some time, as it requires finding the one that best suits your personal or business needs. To help, we’ve outlined the three main types of banks that cater to foreigners in the country, along with their key features and benefits.

Neobanks or digital banks

Neobanks, or digital banks, operate entirely online without physical branches. Although they’re not based in Andorra, many foreigners use services like Revolut, N26, or Wise. These platforms and apps allow you to handle everything, from opening an account to making transfers, all from the comfort of your device.

| Features | Advantages |

| Remote account opening. | Personal advisor available online. |

| International transactions. | Possibility to operate in different currencies. |

| Fast and efficient communication. | Online documentation avoiding physical copies. |

Local banks

Local banks are physical institutions in Andorra where you can open an account, but you’ll need to do so in person. These banks operate according to the country’s financial and banking regulations. Some of the most well-known ones are Andbank, Crèdit Andorrà, and Morabanc.

| Features | Advantages |

| Specialized in international clients. | Personal financial advice tailored to specific needs. |

| Multi-currency management. | Comprehensive investment and asset management. |

| Private banking services. | Strong banking system. |

International banks

Andorra doesn’t have physical international banks, but its local banks collaborate with financial institutions from other countries to make international transactions easier for their clients. Some of these partners include HSBC and Deutsche Bank, with whom they have agreements in place.

| Features | Advantages |

| Fast and secure international transfers. | Account opening in multiple currencies. |

| Cross-country alliances for global investments. | Operates from the global networks of local banks in Andorra. |

| Security and compliance with international regulations. | Borderless operations, perfect for entrepreneurs. |

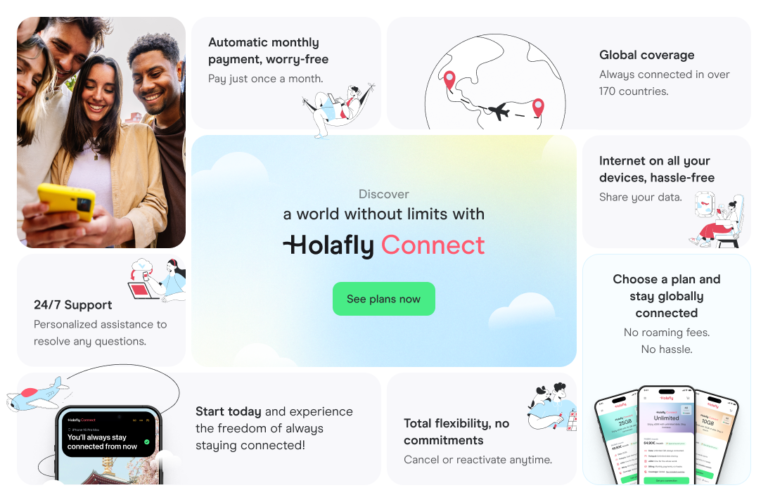

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

Top 5 banks in Andorra for foreigners

Choosing the best banks in Andorra for foreigners depends on several factors and each client’s financial goals. We’ve compiled a list of what we consider to be the top five banks in the country, based on the experiences of other foreigners and the reputation of the institutions.

Andbank, for wealth management and private banking

Andbank, founded in 1930, is one of the oldest banks in Andorra. It specializes in wealth management and tailored financial services. Headquartered in Andorra la Vella, the capital, it also has a global presence in more than ten countries, including Spain, Switzerland, Luxembourg, the United States, Brazil, and Mexico. Here are the main services it offers:

- Premium Account: Designed for private banking clients. It includes access to personal managers and investment services.

- International savings account: Helps you manage your funds in different currencies.

- Fees: Requires annual maintenance of your accounts from 300 euros ($315).

- ATMs and branches: Wide coverage throughout the country.

- Opening hours: Monday to Friday, from 9:00 am to 5:00 pm.

- Digital channels: Mobile app for transfers and account management.

| Advantages | Disadvantages |

| Personalized advice. | High fee costs for smaller balances. |

| International banking experience. | High initial deposit required. |

| Access to investment products. |

Crèdit Andorrà, suitable for foreign residents or business people

Crèdit Andorrà is another highly regarded bank in Andorra for foreigners, thanks to its long-standing history and strong reputation. Established in 1949, it has been repeatedly recognized for its excellence in private banking and commitment to sustainability. While its headquarters are in Andorra la Vella, it also has branches throughout the country and in major international locations such as Switzerland, Luxembourg, Spain, and the United States. Here’s a closer look at its accounts and services:

- Classic Account: Flexible account for managing personal finances.

- Business Account: Aimed at foreign entrepreneurs and companies.

- Fees: Personal accounts have fees starting at 60 euros per year ($63) and business accounts vary depending on the services purchased.

- ATMs and branches: Wide network in Andorra, with both face-to-face and digital branches.

- Opening hours: Monday to Friday, from 9:00 am to 5:30 pm.

- Digital channels: Modern platform for payments and monitoring of investments.

| Advantages | Disadvantages |

| Wide variety of services. | Some formalities must be carried out in person. |

| Benefits for foreign entrepreneurs. | |

| Good connectivity with international banks. |

Morabanc, suitable for foreigners interested in investments

Founded in 1952, this bank specializes in private banking and quickly established itself as one of the top banks in Andorra for both foreigners and residents. It has been recognized as the “Best Bank in Andorra” by the financial magazine The Banker. Here are some of its services and account types:

- Elite Account: Personalized account for the management of large assets.

- Investment management services: Advice on exclusive financial products.

- Fees: Depending on the volume of assets, starting at 500 euros per year ($525).

- ATMs and branches: Offices are available in several areas of the country.

- Opening hours: Monday to Friday, from 9:00 am to 5:00 pm.

- Digital channels: Secure website for investment management.

| Advantages | Disadvantages |

| Exclusivity in products and services. | High entry requirements. |

| International network of contacts. | Accounts are more focused on investment. |

| Several branches in Andorra. | High annual maintenance fee. |

Vall Banc, perfect for international banking and non-residents

Founded in 2015, this is one of the newer banks in Andorra, focusing on international clients and wealth management. It was created following the acquisition of assets and liabilities from the former BPA (Banca Privada d’Andorra) after its restructuring. Here’s an overview of the services it offers:

- Global Account: Allows transfers and transactions in multiple currencies.

- Premium Account: Focused on customers with high purchasing power.

- Fees: From 120 euros per year ($125).

- ATMs and branches: Suitable coverage for international customers.

- Opening hours: Monday to Friday, from 9:00 am to 4:00 pm.

- Digital channels: Intuitive mobile banking for global transactions.

| Advantages | Disadvantages |

| Experts in international operations. | Limited hours for face-to-face service. |

| Solutions for non-residents. | Average annual maintenance fee. |

| Mobile banking. | Recently created. |

Wise, the best digital option for foreigners in Andorra

For those who don’t need a physical bank and are comfortable navigating the digital world, Wise has become one of the best banking options for foreigners in Andorra. This is due to its low fees, free registration, and the ability to hold accounts in multiple currencies. Here are its main services:

- Multi-currency account: Allows you to maintain balances in more than 50 currencies and make fast international transfers at competitive rates.

- Wise debit card: For daily expenses in Andorra or any other country.

- Fees: Free registration, transfers (from 0.5%) and maintenance free of charge.

- ATMs and branches: No physical offices, operates with global ATMs.

- Customer service hours: Chat and email, from Monday to Friday.

- Digital channels: Mobile app and web for complete management of your account.

| Advantages | Disadvantages |

| No maintenance costs. | No physical offices. |

| Easy and fast registration. | Online communication only. |

| Multi-currency accounts. |

Which is the best bank for foreigners in Andorra?

Selecting the best bank from the ones we’ve covered depends on your individual needs as a foreigner in Andorra. Think about the kinds of transactions you’ll make regularly, your wealth level, whether you need a personal savings account or a business account, and more. Here’s a quick summary to help make your decision easier:

| Bank | Recommended for | Rates | Digital channels |

| Andbank | Wealth management | From 300 euros per year ($315) | Advanced |

| Crèdit Andorrà | Companies and individuals with local needs | From 60 euros per year ($63) | Complete |

| Morabanc | International investors | From 200 euros per year ($210) | Intuitive |

| Vall banc | Financial and estate planning | From 500 euros per year ($525) | Modern |

| Wise | Multi-currency transfers and accounts | From 0.5% per transfer | Fully digital |

To wrap up, if you’re looking for a traditional bank in Andorra, Crèdit Andorrà might be the ideal choice. They offer tailored services for foreigners and have a cost-effective account option for entrepreneurs. Alternatively, if you prefer managing everything digitally, Wise is a fantastic option that lets you handle everything from your computer or phone.

Steps to open a bank account in Andorra

Andorra has strict regulations when it comes to tax transparency, so if you’re looking to open an account with one of the best banks for foreigners, you’ll need to follow certain steps. While the process may vary slightly from bank to bank, here are the most common steps you’ll need to take:

- Choose the right bank: Choose the bank you think is the best for you.

- Gather the necessary documents: Passport, proof of residence and proof of income.

- Make an appointment: In person at a branch or register online if it is digital banking.

- Choose account type: Among all the options, choose the account that is most beneficial for you.

- Make a minimum deposit: Some banks may require a minimum initial amount.

- Sign the contract: Check the fine print, conditions and fees. Once the contract is signed, you should keep a copy.

- Access to the account: You can access the physical ATMs, activate your card and the digital apps.

Frequently asked questions about banks in Andorra for foreigners

Andbank, Crèdit Andorrà, and Morabanc offer options for non-residents, as long as they meet the required criteria for identification, source of funds, and the purpose of the account.

Opening an account with local banks may require an initial deposit starting at 1,000 euros ($1,048), while Wise, being digital, has no account opening fees.

Andorra offers strong financial stability, a secure tax environment, and personalized wealth management options. Additionally, its banks are well-known for their discretion and for providing services tailored to foreigners.

With physical banks, the process may take a few days, depending on the required documentation. On the other hand, with digital banking, the process is completed immediately when you register online.

No, being a resident is not required, but you will need to meet the bank’s criteria. This usually involves explaining the purpose of the account, whether it’s for investments, savings, or business activities.

Language

Language

No results found

No results found