Digital Nomad Taxes: Which Types of Taxes and How to Pay them?

Have you ever wondered what digital nomad taxes you have to pay? Discover all the types of taxes that exist in each country.

If you work remotely or would like to do so in order to be able to work from any corner of the planet, you should know what types of digital nomad taxes you must pay. Nomads work remotely for companies or clients around the world and enjoy the freedom to move between countries while continuing to work. However, one of the big questions that arise when adopting this lifestyle is: what taxes does a digital nomad have to pay?

In this article we will explore the tax implications for digital nomads. Taxation can vary depending on the country where you are physically located, your country of origin and other factors related to tax residency. While being a digital nomad sounds like a life with no strings attached, it’s important to be aware of the taxes that could apply to avoid future problems. Here we explain the key issues related to digital nomads and taxes so you can manage your finances properly while enjoying this way of life. If you are interested in the world of digital nomads, but need more information, it is interesting for you to read our post: Complete guide to being a digital nomad.

What is tax residency?

Tax residency is a key concept to understand how, where and what taxes you must pay as a digital nomad. In general terms, tax residency determines in which country you must comply with your tax obligations, depending on where you spend most of your time or where your center of economic interests is located.

Normally, tax residency is established in the country where a person resides more than 183 days a year. However, for digital nomads, who are constantly moving between countries, it may not be so simple. Some countries allow digital nomads to maintain their tax residency in their home country, while other countries may claim you as a tax resident if you spend enough time within their borders. In addition, there are countries that have implemented special visas for digital nomads, which could also affect your tax residency status. You have more information about the countries that offer this visa in our article: 42 countries that offer visa for digital nomads.

For digital nomads, it is crucial to have a clear understanding of where they are considered tax residents so that they do not face double taxation or legal issues. Many countries offer double taxation agreements to prevent people from paying taxes in two different jurisdictions, but each case must be evaluated individually. If you are a digital nomad, consulting with a tax advisor may be an excellent option to clarify your situation.

Types of taxes involving digital nomads

Although the taxes that digital nomads must pay may vary according to the legislation of each country, these teleworkers usually face several types of taxes. Here are the main taxes that digital nomads have to face.

1. Income tax

This is the most common tax that digital nomads must pay. It refers to the income you earn from your work, regardless of where you are physically located. The key to determining where you must pay this tax lies in your tax residence. Depending on the country, different income tax rates and rules may apply. In some cases, you may benefit from deductions or exemptions, depending on your personal and professional situation.

2. Value added tax (VAT)

If you offer digital services to clients abroad, you may be subject to VAT. In some countries, freelancers or self-employed individuals must charge and remit VAT for services rendered, even if they work as digital nomads. VAT regulations can be complicated, as some countries allow exemptions or the possibility of recovering VAT in certain cases, especially if you are working abroad.

3. Capital gains tax

If, as a digital nomad, you have invested in stocks, cryptocurrencies or other assets, capital gains tax may also apply to you. This tax is levied on gains made from selling assets that have increased in value since the time of purchase. Like income tax, this tax will depend on the country in which you are a tax resident.

4. Social security tax

In many countries, remote or self-employed workers are also required to pay social security. This tax covers aspects such as health, retirement and other social protections. Depending on the country, you may be exempt or even have to make voluntary contributions to maintain your social security rights while working as a digital nomad.

Double taxation as a digital nomad

One of the biggest problems a digital nomad may face is double taxation. This occurs when two countries consider you a tax resident and therefore require you to pay taxes on the same income. This problem is more common among digital nomads who divide their time between different countries, but generate income in another.

To avoid double taxation, many countries have established bilateral Double Taxation Agreements. These agreements allow income earned in one country not to be taxed again in another. In addition, some countries allow deductions for taxes already paid abroad. Either way, it is important to be informed about the tax treaties between the countries in which you plan to live or work as a digital nomad.

If you discover that you may be subject to double taxation, it is best to consult with a tax advisor specializing in international law to ensure you comply with all regulations without paying more tax than necessary.

Tax benefits

Despite the possible complications, there are also tax benefits that can alleviate the taxes that digital nomads have to pay. There are some tax benefits that you could take advantage of depending on the country where you reside and work. Such as exemptions, refunds and deductions. Let’s dig a little deeper into each of these concepts.

- Tax breaks. Some countries offer specific tax breaks to attract digital nomads. This may include a period of time during which you do not have to pay taxes or reduced tax rates for remote workers. For example, some countries with visas for digital nomads offer tax incentives such as elimination of income tax for a limited time.

- VAT refund. In certain cases, as a digital nomad you may be able to claim a VAT refund. If you have purchased products or services in a foreign country, you may be able to claim back VAT paid when you leave the country. This varies depending on local legislation, but it is something that can make a difference to your annual budget as a remote worker.

- Deductions for work-related expenses. If you are self-employed, you may be able to deduct a number of expenses related to your work. Such as coworking expenses, technology tools or equipment. Depending on the country where you have your tax residence, these deductions can significantly reduce your tax burden.

Countries with lower taxes for digital nomads

Some countries have created special tax conditions to lower the taxes that digital nomads must pay, aware of the economic and cultural value that these professionals can bring to their economies. These places have developed incentives such as reduced tax rates, temporary tax exemptions or specific visa programs. This makes it easier for digital nomads to stay without having to worry too much about their tax obligations. Here are some of the most attractive destinations for digital workers, which stand out for their favorable tax policies.

1. Georgia

Georgia has emerged as one of the most attractive destinations for digital nomads due to its Remotely from Georgia program. It allows remote workers to live and work in the country for a year without paying local taxes. As long as they do not earn income from Georgian sources. In addition to this tax advantage, Georgia does not require visas for citizens of more than 90 countries for periods of up to one year, which greatly simplifies the logistics of living there. Residents can pay an income tax of only 1% on income earned abroad.

The cost of living is another of its great attractions. Cities like Tbilisi, the capital, offer a much more affordable cost of living compared to other European cities. A monthly rent in the city center can be around 300-500 euros ($315-$525). While eating out or enjoying the local cafes costs just a fraction of what you might spend in other destinations.

2. Estonia

Estonia is a pioneer in government digitalization and is one of the most welcoming countries for digital nomads. With its e-Residency program, Estonia has enabled anyone in the world to create a digital company on its territory, manage taxes and operate a global business, all remotely. This program has been a total success and has attracted thousands of digital entrepreneurs.

For nomads who choose to live temporarily in Estonia, the country also launched the Digital Nomad Visa, which allows remote professionals to live there for a year while working for foreign companies or as freelancers. Although taxes apply if you stay more than 183 days a year, Estonia is known for its flat tax rates (20% overall), which simplifies tax obligations. Moreover, as Estonia is part of the EU, individuals residing within the European Union find additional facilities to manage their business or taxes.

3. Croatia

In 2021, Croatia joined the list of countries that have designed a specific visa for digital nomads. Croatia offers a special tax regime for these workers, with a foreign income tax exemption for up to one year for those who apply for the digital nomad visa.

The country offers a decent network of coworking facilities and an emerging community of nomads. Living costs are relatively low compared to other European cities, as people can find affordable rents and excellent value for money in food and services.

4. Portugal

Portugal, with its D7 Visa program, has gained a lot of popularity among digital nomads and remote workers. This visa allows those who can demonstrate passive or remote work income to live in Portugal, a country with an excellent quality of life. In addition, its NHR (Non-Habitual Resident) tax regime allows new residents to pay low tax rates on certain income for the first ten years of residence.

In terms of cost of living, Lisbon remains considerably more affordable than other top European destinations. You can find a comfortable apartment for around 800-1,200 euros ($835-$1250) per month and restaurants are relatively cheap.

5. Costa Rica

Costa Rica is a popular destination for digital nomads seeking a life in touch with nature and with a focus on sustainability. The country launched its digital nomad visa called Rentista, designed for freelancers who can demonstrate a fixed monthly income. This visa allows remote workers to live in Costa Rica for up to two years with the possibility of renewal. Costa Rica offers a tax exemption on foreign income for those applying for the digital nomad visa.

The cost of living in Costa Rica varies depending on whether you choose to live in the capital, San José, or in more touristy areas such as Tamarindo or Puerto Viejo. San José is relatively affordable, with apartment rents in the range of 600 to 1,000 euros ($625-$1045) per month.

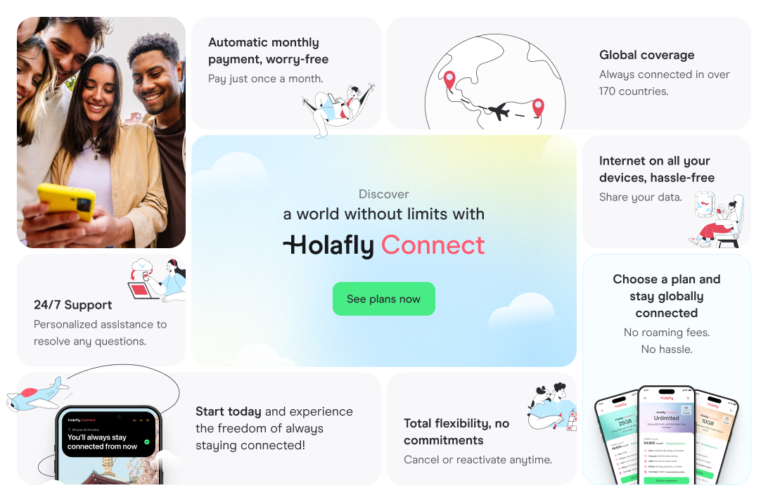

Important: If you are a frequent traveler and want to stay connected without worrying about expensive roaming or looking for a new SIM at every destination, Holafly’s subscription plans are for you. With a single eSIM, enjoy internet in more than 170 countries for a fixed price and no surprises on your bill. travel without limits and connect easily and securely! 🚀🌍

How to pay taxes as a digital nomad?

Paying taxes as a digital nomad can be a challenge due to legal differences between countries. There are several platforms and methods that can help you pay your taxes efficiently.

| Tax management platforms | Tools such as Xolo or Deel allow you to manage your taxes remotely. |

| International tax consulting | Consulting with tax advisors specialized in international taxation is an excellent idea to avoid problems and pay only what is necessary. |

| Online payments | Many countries allow tax payments to be made directly through their official online platforms, facilitating the process from anywhere in the world. |

Frequently asked questions about taxes to be paid by digital nomads

Hiring a tax advisor specialized in international taxes can be a good idea. An advisor can help you understand the tax regulations in each location, avoid double taxation issues and maximize any available tax benefits.

In countries that do not have a specific visa for digital nomads, tax regulations can be more complicated. You may need to register as self-employed or set up a local company if you work remotely for an extended period. In addition, you may be subject to the country’s standard tax regulations, such as income tax or value added tax (VAT).

Not complying with your tax obligations can lead to serious penalties, such as fines or legal problems. In addition, you could face problems if you try to enter or leave some countries, as the tax authorities could detect it.

Yes, some countries offer tax exemptions that only tax income generated within the country. For example Georgia or Costa Rica. If your source of income comes from outside these countries, you may be exempt from paying local taxes.

Passive income, such as income generated from investments, rentals or royalties, is also subject to taxation. Some countries impose lower taxes on passive income or even exempt it if individuals generate it outside their borders.

Working for a foreign company from a different country can complicate tax obligations. In some cases, you will have to pay taxes on your income in the country where you are temporarily residing.

Language

Language

No results found

No results found